Coinbase Earnings Preview—8% Stock Price Move Expected

Coinbase Earnings Preview—8% Stock Price Move Expected

By:Mike Butler

Crypto is more popular than ever, and with that comes uncertainty around the COIN earnings report

- Coinbase will report quarterly earnings on Aug. 1 after the stock market closes.

- The crypto exchange has benefited from the recent rally in Bitcoin and Ethereum.

- Coinbase is expected to report an earnings-per-share (EPS) of $0.81 on $1.37 billion in revenue.

- Coinbase has exceeded EPS estimates by triple digit percentages the past two quarters, but EPS estimates are lower this quarter.

- Regulatory clarity and updates will likely be a focal point for this earnings call.

Coinbase earnings preview

Bitcoin (BTC)hovers around $70,000, Ethereum (ETH) is around $3,300 and Coinbase (COIN) is just of of all time highs. Crypto is more popular than ever, and with that comes a lot of uncertainty around the earnings announcement for Coinbase. With an expected stock price move of +/- 8% for this week based on current implied volatility, the market is telling us we should expect some big movement on Thursday. Coinbase has exceeded earnings per share (EPS) and revenue estimates four quarters in a row, with an EPS beat of a whopping 420% in February.

Coinbase is expected to report earnings per share (EPS) of $0.81 on $1.37 billion in revenue on Thursday after the market closes. The revenue estimate is similar to last quarter, where the EPS estimate is actually lower than last quarter.

COIN stock opened 2024 at $173.02, and reached a high of $283.48 just a few months later. The stock currently sits at $239, up over 38% on the year so far.

Coinbase offered insight into 2024 goals in the letter to shareholders for the last earnings result: "In 2024, Coinbase will focus on three main priorities. First, driving revenue through improving our core trading and USDC. Second, driving utility in crypto with experiments in payments using USDC and Base. Lastly, we will continue to drive regulatory clarity for the industry. All told, Coinbase is a fundamentally stronger company today than a year ago, and we are in a strong financial position to capitalize on the opportunities ahead."

Coinbase reaches over 100 countries, and employs over 3,400 people, and there was a lot of positive sentiment at the Bitcoin Conference in Nashville, Tennessee, recently with multiple proposals for the U.S. Government to hold bitcoin in reserves. It feels as though policy is beginning to shift, and Coinbase is front and center for all of the action.

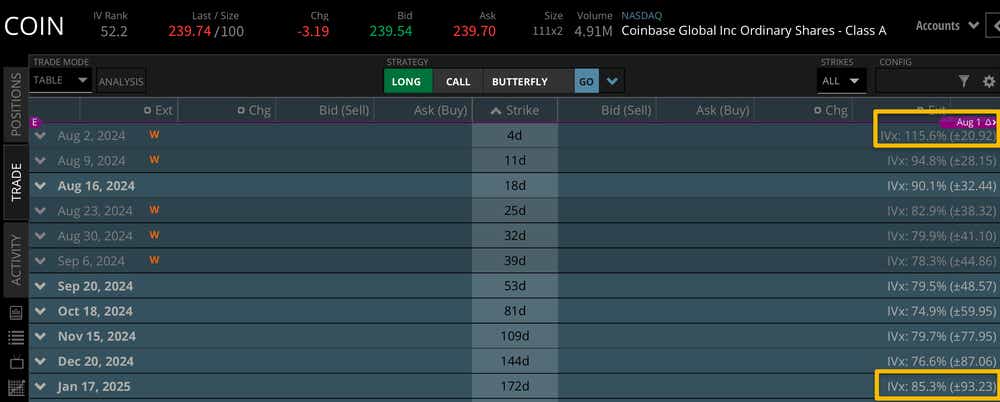

For quarterly earnings announcements we can look to the options market for context around expected moves for the week. Coinbase boasts a +/- $20.92 stock price expected range for this week that contains the earnings announcement. This is over 8% of the current stock price, which puts the expected move on the higher end of the 5%-10% range we typically see for other tech stocks yet to report.

Looking further to the January 2025 cycle, which has a +/- $93.23 expected move, we can deduce that while this earnings announcement implies a big move, there's still plenty of projected movement through the end of the year. This speaks to the uncertainty around Coinbase, but really the entire crypto space given the macro implications for the November presidential election and future interest rate cuts.

Bullish on Coinbase for earnings

Active investors bullish on Coinbase for earnings are certainly looking for another EPS and revenue beat in a big way. We've seen the stock rally behind strong earnings figures before, and it seems a double earnings beat would be required for a big rally after the announcement. Positive sentiment around sector growth and efficiencies would be icing on the cake if we're to expect a bullish move after the numbers are released. We know that BTC has become much more popular this year and trading activities have accelerated, but the market still needs to digest this in a positive way.

Bearish on Coinbase for earnings

Bearish traders and investors for Coinbase earnings are looking for an earnings miss, or a less-than-expected result, even if it is still an earnings beat. Neutral to negative sentiment for the rest of the year could also result in a sell off near highs in COIN stock. When there is so much momentum behind a company that seems to be thriving on the back of the Bitcoin rally, it wouldn't take much to send the stock lower if there is any sort of miss or weak guidance for the rest of 2024.

Tune in to Options Trading Concepts Live on Thursday at 11 a.m. CDT for an in-depth look at Coinbase earnings strategies ahead of the announcement!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.