Cisco Systems Acquires Splunk in Deal Worth $28 Billion

Cisco Systems Acquires Splunk in Deal Worth $28 Billion

By:Mike Butler

The deal puts Cisco in a great spot

- Cisco Systems has agreed to buy software company Splunk in a cash deal worth $28 billion.

- This would bring the Splunk share purchase price to $15.

- This strategic move bolsters Cisco's ability to stay ahead of the AI curve and increase the power and efficiency of their workforce dramatically.

Cisco Systems (CSCO) agreed to acquire Splunk (SPLK) for a cool $28 billion in a cash deal, as reported Thursday.

The deal puts Cisco in a great spot, as both companies complement each other in the cloud-computing AI world that drives society today. With Cisco being a software company that allows users to reimagine technological infrastructure and application use, and Splunk being an infrastructure and application security company, the merger would allow companies of all sizes benefit from uncovering and analyzing data in a secure way, while staying ahead of the AI-transformation that's happening every day.

Cisco stock drops, Splunk stock rises

Cisco stock is taking a hit after the news, which isn't uncommon with mergers that are so costly. The deal is said to be a cashflow positive deal from the start, so the hiccup in the stock price may not be all that hefty over time. If Cisco can manage to harness the power of Splunk's systems to bolster security, stability and accessibility, that makes its product suite that much sweeter to companies of all sizes.

Splunk stock is seeing a big move to the upside as you might imagine, given the fact that the stock closed at $119.59 on Sept. 20. The stock shot up and opened at $144.48 on Sept. 21 as the news was released and has hovered around that same level ever since. What's interesting is that the deal is said to be for $28 billion with a stock price around $157, but we're still pretty far off that level currently.

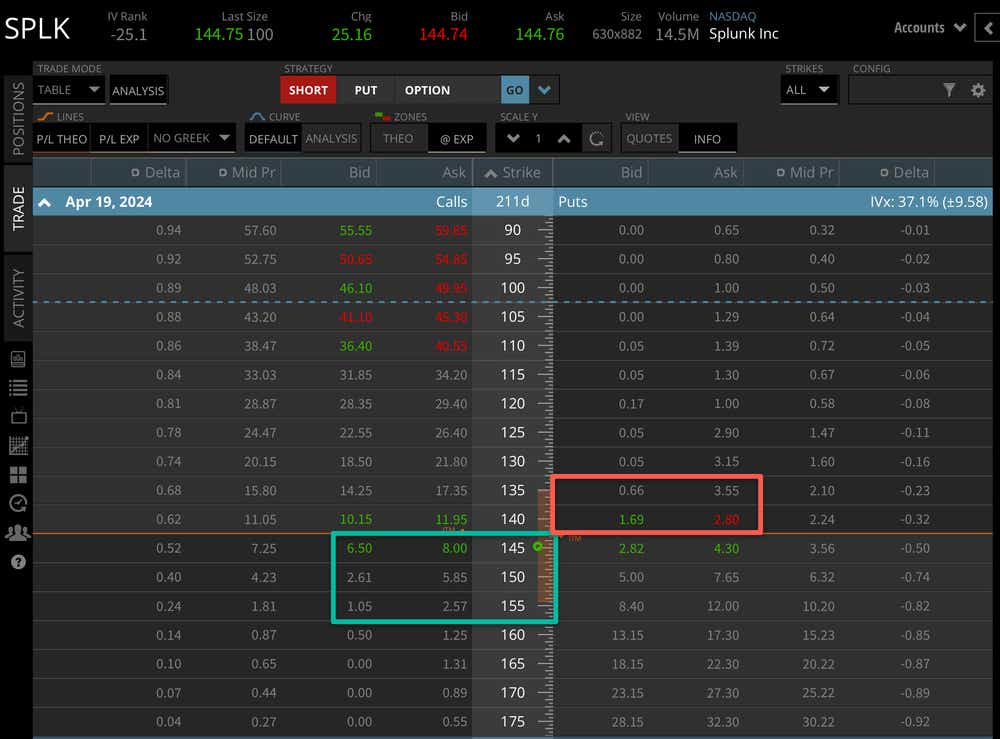

Looking deeper into the April 2024 options cycle, we can see that there is a strong amount of certainty that the deal will go through, given the lack of extrinsic value premium at prices below the $145 level, as highlighted by the salmon-colored rectangle.

Uncertainty remains

On the upside, we can see that there is still some uncertainty around the exact sales price, as there is still plenty of extrinsic value up to the $157 level where the deal is said to be projected at.

As we get more closure on the deal, it's always interesting to see how the options market prices it in —if the deal were set in stone, you wouldn't see any extrinsic value around the stock price in further-dated options cycles. The fact that we are seeing extrinsic value premium tells us that it's not a done deal just yet.

If the deal goes through, it will be interesting to hear what Cisco has to say on their next quarterly earnings call, which is projected to be mid-November 2023.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.