China Inflation and Trade Data Warn of Global Recession Looming

China Inflation and Trade Data Warn of Global Recession Looming

By:Ilya Spivak

The world’s second-largest economy remains anemic nearly a year after reopening, stoking fear of global recession

- Chinese CPI inflation data to show the world’s No. 2 economy is still flatlining.

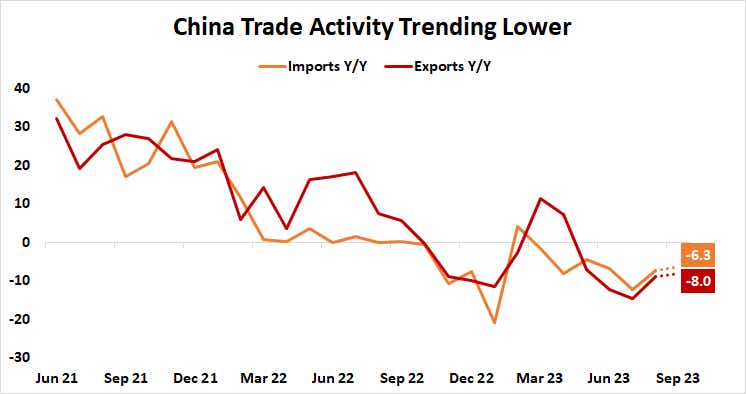

- Trade report to show imports and exports fell together for a fifth consecutive month.

- Surprise risk is tilted on the downside, threatening to feed fear of global recession.

China’s troubled economy continues to struggle nearly a year after it scrapped “zero-COVID” lockdowns in December, filling investors with optimism about a return to life in the world’s second-largest economy.

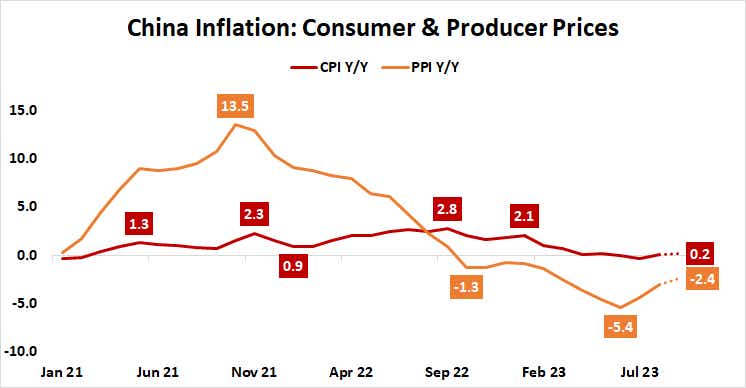

Rosy prognostications have been scattered. Upcoming consumer price index (CPI) data is expected to show that inflation languished a hair above a standstill in September. The headline price growth measure is seen rising 0.2% year on the year, a limp uptick from the paltry 0.1% rise in August.

China's economy: hope deflated

The absence of pricing power reflects absence of demand. Real gross domestic product (GDP) growth tellingly topped nominal expansion in the second quarter, implying a deflationary gap of 1.5%. The latest batch of trade statistics is expected to underscore the point.

Exports are expected to have fallen 8% while imports shed 6.3% year-on-year last month. That will mark the fifth consecutive month that both measures print in negative territory. Strikingly, this means that for nearly half a year, demand at home and abroad has been weaker than before the lockdowns ended.

Global recession: reasons to worry

China emerged from COVID restrictions over a year after its main customers in the U.S. and Europe. By then, those markets were briskly diversifying away from China-dependent supply chains. They’d also worked down the demand pop linked to their own emergence from lockdowns, and much of the stimulus money was still left in consumers’ pockets.

Growth was further cooled by combative central banks’ rush to raise interest rates to tamp down inflation, with the Federal Reserve at the forefront. The global tightening cycle seems to be ending, but the U.S. central bank has forcefully insisted it intends to hold rates “higher-for-longer,” delaying easing.

Analysis from Citigroup shows Chinese economic news-flow continues to underperform relative to economists’ forecasts. This implies the assumptions in their models are still too rosy. That’s despite downgraded expectations reflected in Bloomberg survey data. That may set the stage for a downside surprise, stoking fear of a global recession.

Such a scenario spells trouble for China-sensitive assets, from exchange-traded funds (ETFs) tracking local stock markets like FXI and ASHR to commodities like copper and currencies like the Australian dollar. Broader equities may also feel the string if the miss is particularly acute.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.