Are Chinese Stocks Ready to Rebound?

Are Chinese Stocks Ready to Rebound?

By:Ilya Spivak

China’s economy probably slowed in the third quarter. Stocks, currencies and commodities linked to its performance might rebound anyway.

- Chinese stocks have suffered in 2023 as the economy has struggled to find its footing.

- The critical mass of “bad” Chinese economic news may have passed for now.

- China-linked ETFs, currencies and commodities may cheer “tolerable” GDP data.

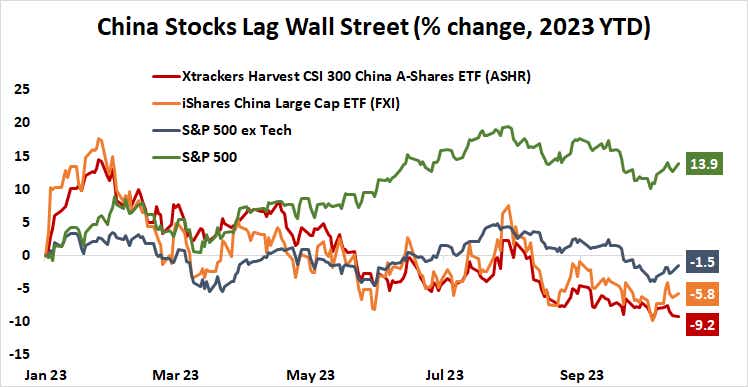

Chinese stock markets are struggling to keep pace with their U.S. counterparts this year.

The closely watched iShares China Large Cap ETF (FXI) tracking the biggest listings on the country’s exchanges is down nearly 6% so far in 2023. The broader-based Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) paints an even bleaker picture, down over 9%.

In contrast, the S&P 500 is up 13.9% over the same period. Even after stripping out the high-flying tech sector, U.S. names are down just 1.5% on average since the start of 2023. While much can be said about the pitfalls of such concentration, U.S. shares have clearly outperformed Chinese alternatives.

China’s economy is in a crisis after COVID-19 lockdowns

This lackluster showing echoes Beijing’s struggle to revive the world’s second-largest economy after scrapping COVID-19 lockdowns in December 2022. The belated reopening lagged China’s main export markets in the U.S. and Europe by nearly two years. They’d busied themselves diversifying supply chains while the East Asian languished in quarantine.

What’s more, ebbing support from fiscal stimulus and a campaign of rapid interest rate hikes from the Federal Reserve and the European Central Bank (ECB) meant that demand had significantly weakened by the time China reemerged. Spurts of rapid catch-up growth after the worst of the pandemic had already peaked by mid-2021.

Investors geared up for China’s big-splash return to form at the start of 2023 have been let down in spectacular fashion. Domestic demand has fizzled alongside the external sector, triggering turmoil in the mission-critical property market. That has driven capital flight, punishing the Chinese yuan.

Stimulus efforts have proven to be lackluster. A modest round of interest rate cuts and an assortment of measures meant to spur activity—like lowering barriers to property purchases and mandating lower bank reserve requirement ratios to free up capital—have made little difference. President Xi Jinping has played down scope for fiscal aid at scale.

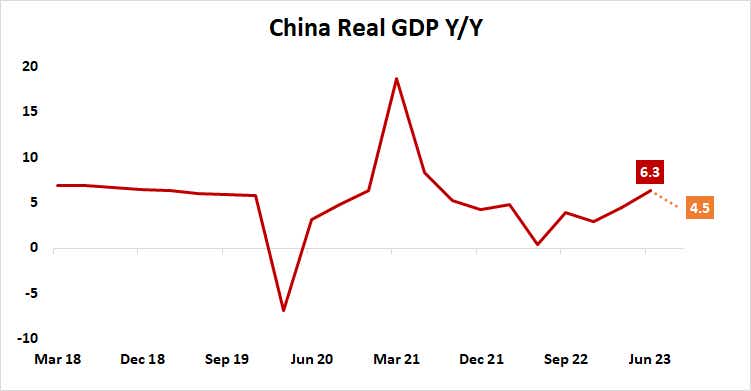

Against this backdrop, data due for release this week is expected to show that Chinese economic growth decelerated in the third quarter. A survey of economists polled by Bloomberg anticipates that gross domestic product (GDP) grew 4.5% year-on-year, down from the 6.3% recorded in the three months through June.

Do markets still fear weak Chinese economic data?

The key question now facing investors is whether another bit of downbeat economic news-flow offers anything that is yet to be priced into asset values after nearly a year of frustration since China’s reopening began.

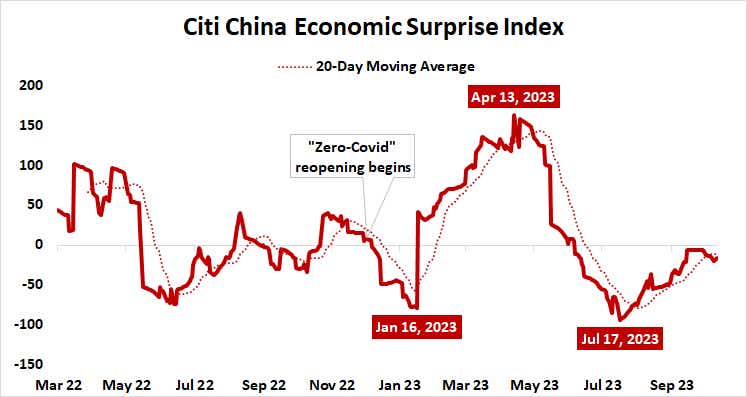

Analytics from Citigroup suggest that Chinese data outcomes still skew toward surprising on the downside relative to baseline forecasts. However, the margin for disappointment has narrowed as analysts have revised expectations lower. This means that the bar for a “bad” outcome might be asymmetrically higher than a “tolerable” one.

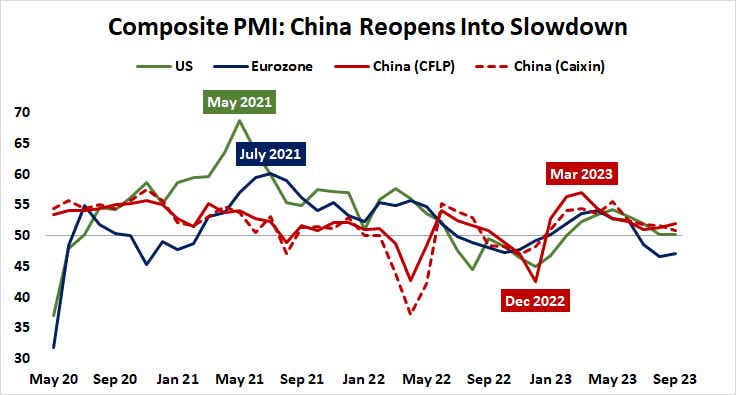

Leading surveys of purchasing managers have foreshadowed a slowdown from the second to the third quarter for some time. Meanwhile, some cautious green shoots have appeared.

Data released alongside GDP is expected to show retail sales growth picked up for a second month in September. Lending statistics published over the weekend showed aggregate financing increased by about 8 billion yuan in the three months to September compared with the prior period, implying a bit of a thaw. The yuan is stabilizing.

On balance, this means that growth figures hewing closely to expectations might translate as supportive for China-sensitive assets, with investors setting their signs on bargain-hunting amid speculation that the critical mass of “bad news” is already behind them.

Trackers of Chinese stocks like FXI and ASHR may rise alongside currencies and commodities sensitive to the country’s economic fortunes, like the Australian dollar and copper. The broader risky asset universe—global equities and other cycle-sensitive assets—may also get something of a lift.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.