CRAB Options Strategy 101: What You Need To Know

CRAB Options Strategy 101: What You Need To Know

By:Mike Butler

The CRAB options trading strategy is just a regular butterfly spread where the more expensive long option is pushed out in time. Learn how to use it.

- The CRAB options strategy is a calendarized ratio or butterfly spread.

- The long option has a further expiration date to give traders more time value as opposed to implied volatility value. Meanwhile, the short options have a near-term expiration date to emphasize implied volatility exposure.

- To put it simply, the CRAB strategy is just a regular butterfly spread where the more expensive long option is pushed out in time.

The CRAB trade, or calendarized ratio or butterfly spread, gives traders the ability to express directional assumptions on stocks in a defined-risk way.

With a CRAB trade, the most the trader can lose is the debit paid up front for the spread. The most the trader can make is more complicated. A trader can net the width of the debit-spread portion of the trade, plus any remaining extrinsic value in the further-dated long option at the expiration of the short options—less the debit paid up front for the trade.

The CRAB trade is a nice way to get exposure to more expensive stocks that we may not be able to afford trading outright. We can manipulate our expirations and spread width to fit our risk tolerance easily with a CRAB trade, and this is more apparent when there is a binary event like an earnings announcement.

This is because near-term expirations have heightened implied volatility due to extrinsic value being higher relative to time left to expiration. After the earnings announcement, this premium gets "crushed" and we could be left with options that are close to worthless, while the long option still can gain or maintain value.

A bullish CRAB trade example

Uber Technologies (UBER) reports earnings Nov. 7 before the market opens. In this example, we'll place a bullish CRAB trade to play for an upside move in UBER stock. But first, we need to understand how we're playing into the earnings announcement with our expiration selection.

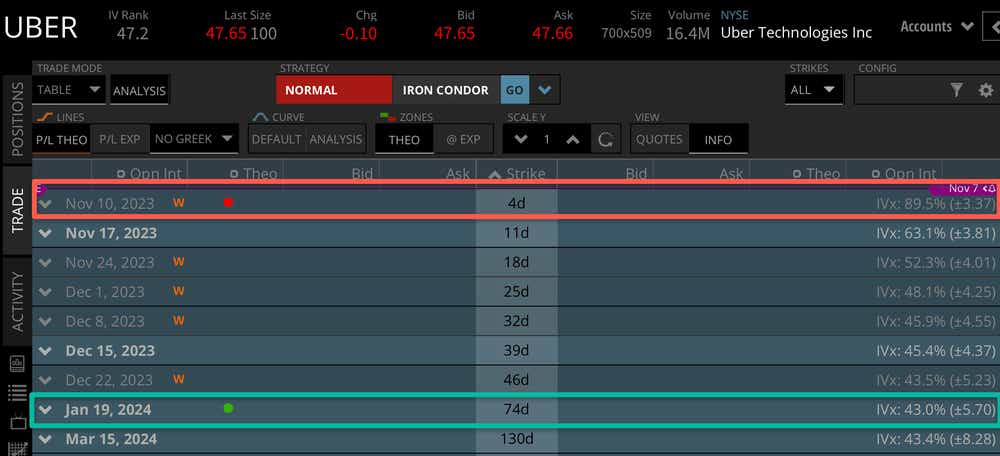

In the image above, you can see that in the red rectangle, we have the nearest contract-to-expiration date that also contains the earnings announcement. Because the stock is expected to move after the announcement, there is a lot of extrinsic value premium in this cycle. We want to emphasize this, so we place our short options in this cycle to reduce the cost basis of our January long option. You can see that the January cycle has a much lower implied volatility reading than the weekly cycle, which means our long option should hold onto some value even if the stock drops a bit.

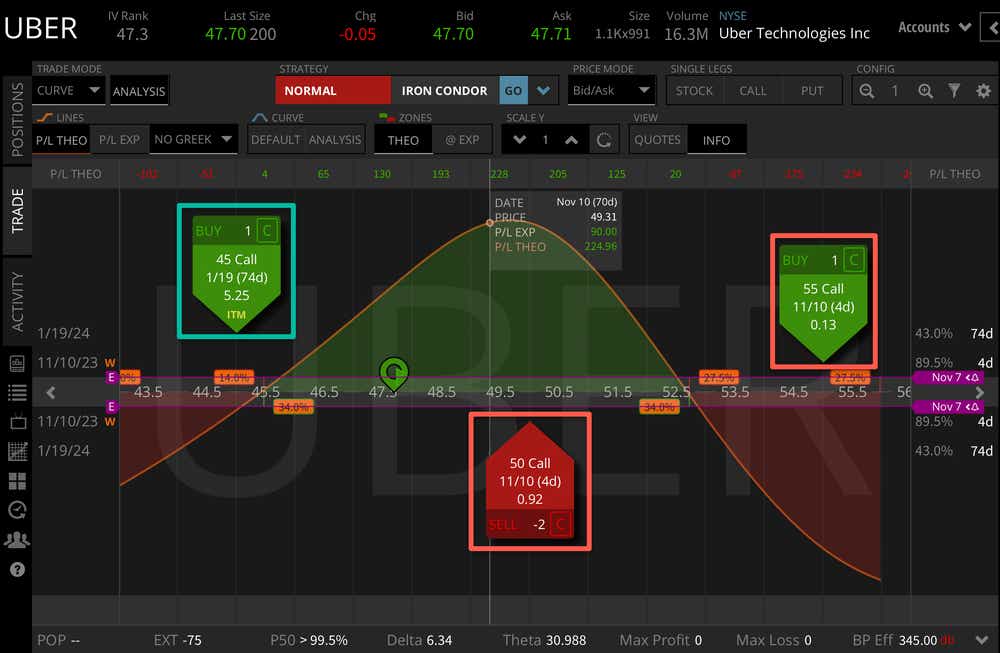

Looking at the structure of the trade, you can see that the long option is slightly in-the-money and all the way out in January. With so much time left until expiration, we could choose from a variety of defensive tactics if the stock drops after the earning announcement. The short options are in the weekly cycle, and you can see that the total value of the short options comes to $184 since there are two short options. This is a sizable cost basis reduction against the long option that has an opening cost of $525. The protective long option at the 55 strike is a cheap way to ensure the risk is defined in the case of a big rally.

The best-case scenario for this trade is if the stock is right around 50 at the expiration of the short options. In this case, the value is extracted from them, and the long option can increase in value on the stock price rally.

The worst-case scenario for this trade is if the stock drops well below 45 after earnings and never comes back to that range. In this case, the full loss of $345 could be realized, which is the debit cost for this trade.

Bearish CRAB trade example

The nice thing about CRAB trades is that they can be bullish or bearish. Let's assume I thought the Nasdaq ETF QQQ was going to come down a bit over the next month. I might explore a bearish put CRAB trade to express this assumption.

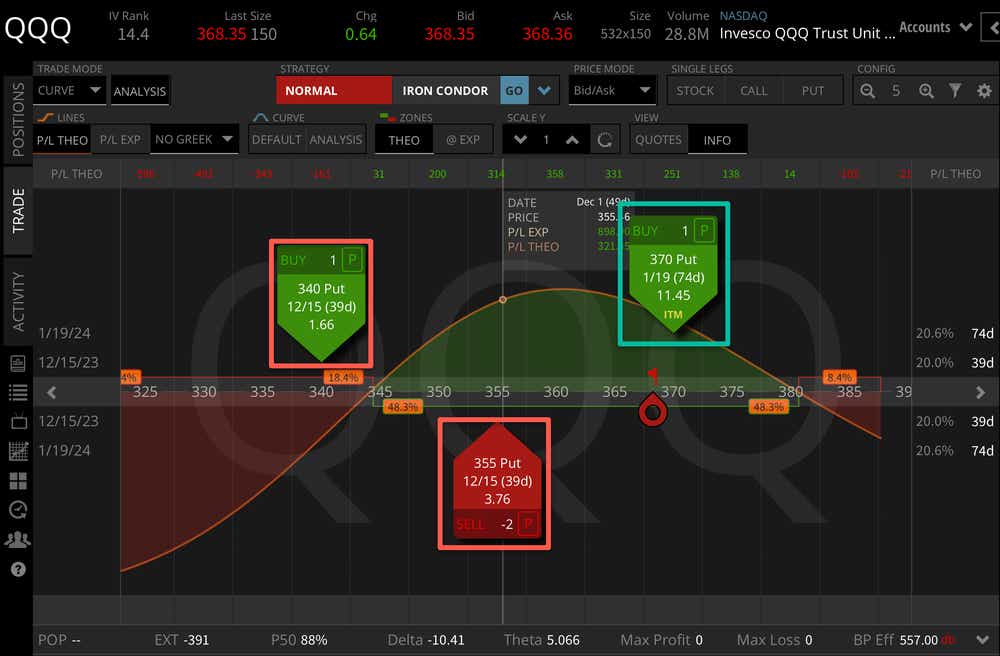

In this example, I'm purchasing the 370-strike put out in January to reflect my bearish assumption. I'm also selling two of the 355 strike puts in December to reduce the cost basis on the long option. The long option by itself trades for $1,145, so the cost basis is reduced aggressively with the sale of the two short options totaling $752. The long option is purchased at the 340 strike to create a symmetrical butterfly and define the risk.

The best-case scenario here is realized if QQQ trickles down towards the short strikes as time passes, so the short options can decay, and the long option can gain value. The theoretical risk graph in the image assumes we are at Dec. 1, reflecting about a month of time passing.

The worst-case scenario here is if QQQ rallies aggressively through the holidays and the market never comes down to the long strike. In this case, the max loss would be realized which is the entry cost of $557.

CRAB trades are dynamic strategies that help us emphasize implied volatility exposure around binary events, express our directional assumptions regardless of whether we're bullish or bearish, and keep risk in check with the defined risk nature of the trade.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.