September to December: What to Watch in an Election Year

September to December: What to Watch in an Election Year

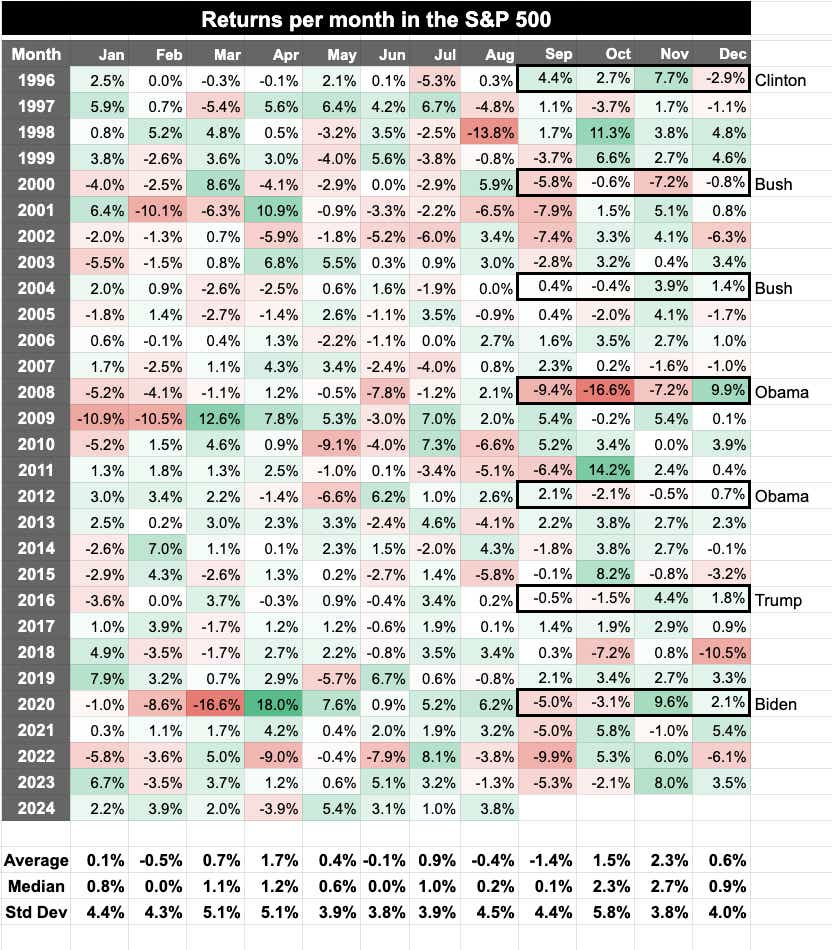

Historically, September has been the worst-performing month for the markets.

In September, stocks typically lose an average of 1.4%. October, on the other hand, tends to have the most volatility.

Looking at the years when we have elections, the standard deviation of monthly price returns is close to +/- 6%, whereas in non-election years, the standard deviation of monthly returns is less, at +/- 4%.

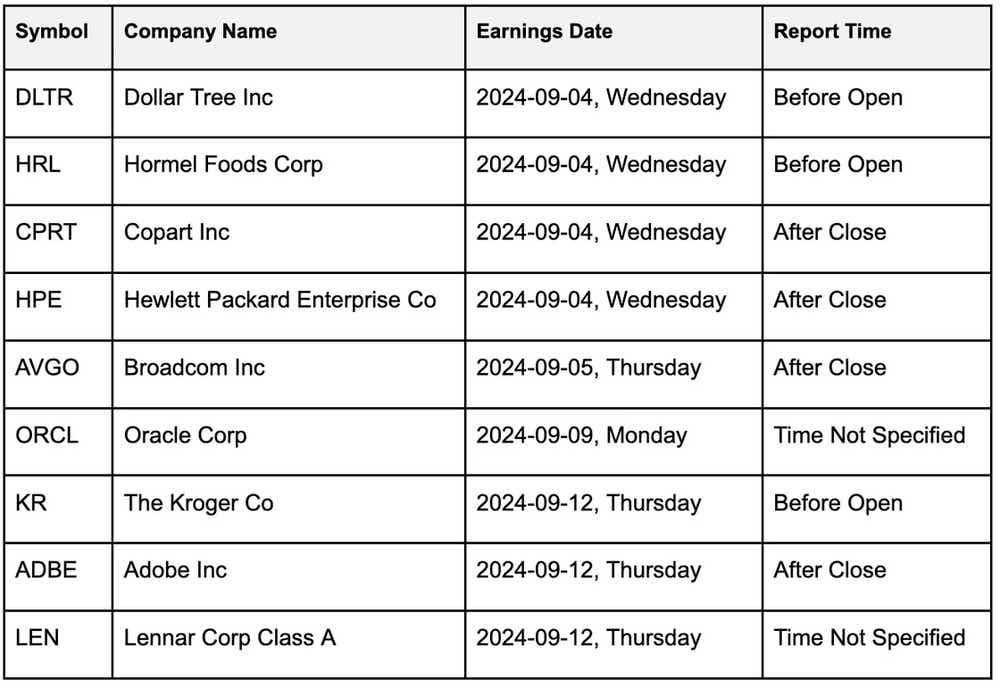

Slow Week in Earnings

Broadcom (AVGO) is the biggest name this week.

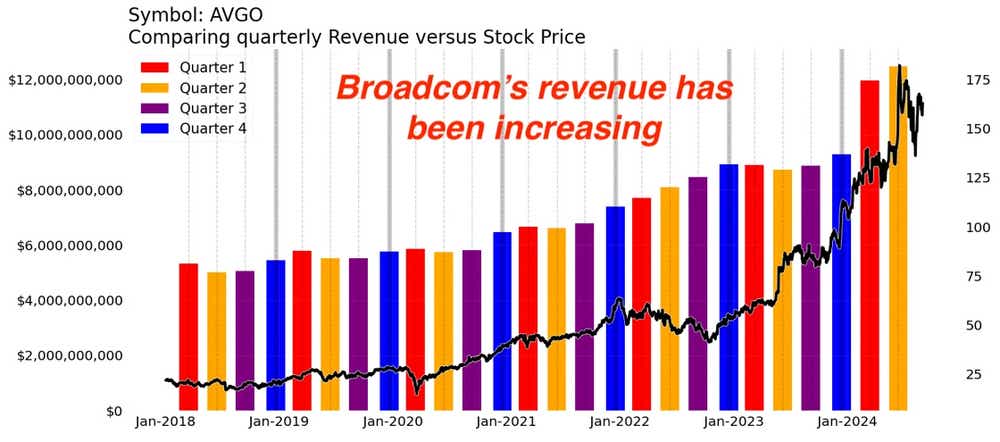

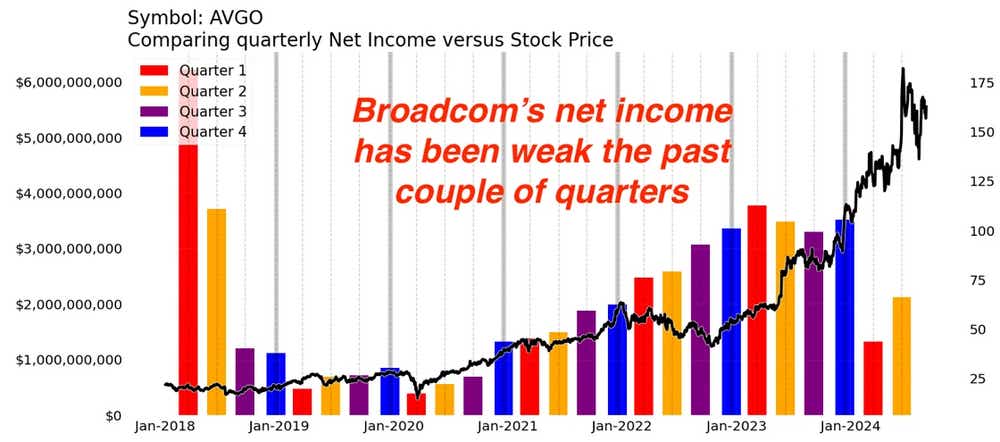

Broadcom Earnings this Week

Broadcom’s revenue has been increasing every year. But net income has been weak. Will this week's quarterly earnings results be any different? Options prices are rich, meaning they are priced with a large expected movement.

Two Trade Ideas

- SPY ($556) Iron Condor (OCT) $4.26 Credit

As of today, we are seeing a nearly 1.5% pullback in the markets for September and a significant 10% increase in volatility. If you think it might go lower but chop in the high/low range of the last couple weeks, an October iron condor would fit the assumption. Shorting the 535/520 put spread with the 575/590 call spread provides a breakeven point near 530 and 575, most of the range since May.

2. AVGO ($154) Short Strangle (OCT) $5.73 Credit

Nvidia (NVDA) traded well inside the expected move on earnings, and maybe the same is due for AVGO? It has a significant call skew, and the implied volatility rank (IVR) is above 60. If you want to avoid some of the event risk (earnings 9/6), the 130/175 strangle covers most of the trading range since the split announcement, with nearly $15 of potential theta decay.

5 Reasons Why September is The Worst Month For Markets

Sharing is caring. Forward this email to your friends so they cans, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He is best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.