Boeing Q3 Earnings Preview

Boeing Q3 Earnings Preview

Boeing to report Q3 fiscal results as its stock struggles. The aerospace giant's stock is trading at its lowest level since December 2022

- Boeing to report earnings on Oct. 25.

- The stock sinks as the earnings announcement approaches.

- Will Q3 earnings arrest the recent descent?

Several hard hitters are scheduled to report earnings next week. Boeing (BA) is among them, set to report third-quarter fiscal earnings before the opening bell on Wednesday, Oct. 25.

Investors will want to see some impressive numbers after the recent decline in the stock price. But the outlook is grim, and a not-so-bad report may arrest the recent decline.

Over the past 10 weeks, Boeing hasn’t posted a single gain, falling nearly 25% during that time. The selloff comes at a particularly tough time for airline stocks, which have declined on higher fuel prices and more recently, the conflict in the Middle East.

The airplane maker also faces supply chain issues stemming from inflationary pressures, which have crimped the finances of some of its key suppliers, Spirit AeroSystems being one of them. In a recent deal, Boeing will pay higher prices for deliveries of fuselages for its 737s and 787s. In the meantime, oil continues to rise as Middle East tensions flare, which could further pressure airliners and affect Boeing.

What numbers are investors looking for?

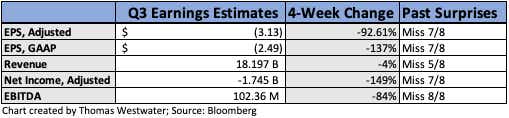

According to Bloomberg consensus estimates, investors expect to see earnings per share come in at -$3.13 on an adjusted basis and -$2.49 on a GAAP basis from $18.20 billion in revenue. Adjusted net income is seen crossing the wires at -$1.75 billion and earnings before interest, taxes, depreciation and amortization (EBITDA) is seen at $102.36 million.

Boeing has missed earning-per-share (EPS) estimates in seven out of the past eight quarterly reports, and revenue has missed five out of eight times. Analysts also have grown more bearish on the stock’s performance over the last several weeks, with the consensus EPS estimate has fallen about 100% from four weeks ago, according to Bloomberg data.

Boeing technical outlook

The Oct. 27 expirations, which include the earnings, show an implied move of $9.19 in either direction. Currently, the stock is trading at the lowest level since December 2022. Currently, prices are at a point of prior resistance seen back in August 2022. The chart is ugly, no way around that, but a break below 170 would make it hard to look at and could induce further weakness.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.