Boeing Earnings—More Turbulence Ahead?

Boeing Earnings—More Turbulence Ahead?

By:Mike Butler

Sentiment is usually positive on earnings calls. So, let’s see what company execs say this time

- Boeing is set to report quarterly earnings on July 31 before the stock market opens.

- The company is expected to report an earnings-per-share (EPS) loss of ($1.79) on $17.38 billion in revenue.

- This EPS estimate is worse than last quarter, when Boeing had an increase in expected revenue.

- The aviation company has had mixed earnings results recently, so it will look to turn the tide this quarter.

Boeing earnings preview

Boeing is on deck for a quarterly earnings report next week, and the financials don't look so hot. The aviation company has pleaded guilty to a felony charge of defrauding the U.S. government, according to the United States Department of Justice. Boeing will pay over $243 million in a plea agreement. Obviously this is not a great way to start the summer, but the company will look to rebound in the next few months.

BA stock started 2024 at $257.28 and has slumped to the current price of $186, fresh off a recent low of $159.70. The stock is down over 27% so far this year, while the rest of the stock market is fresh off all time highs. The stock has been in a $30 point channel for a few months, and it feels like it's only a matter of time before the stock breaks out of that range.

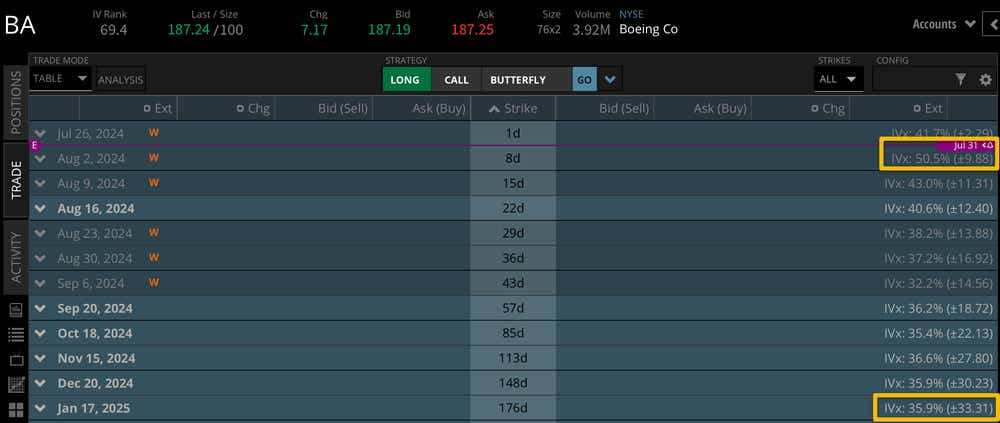

With so much uncertainty surrounding Boeing, I expected to see a much bigger earnings expected stock price move for next week. Based on current implied volatility, we're looking at a +/- $9.88 stock price move through next week which is just over 5% of the stock price.

Looking further through time, we can see the January 2025 options expiration cycle boasts a +/- $33.31 expected stock price move, so this earnings announcement doesn't account for that big a chunk of the expected movement through the year. Still, it feels a little low to me, considering the possibility of posting a big surprise number in a few days.

Boeing President & CEO Dave Calhoun offered defensive remarks on the last earnings call: “Our first quarter results reflect the immediate actions we’ve taken to slow down 737 production to drive improvements in quality ... We will take the time necessary to strengthen our quality and safety management systems and this work will position us for a stronger and more stable future.”

In rare cases, executives have to take action to stop the bleeding on earnings calls—sentiment is typically positive on an earnings call, so it's going to be interesting to hear what Boeing execs have to say this time around.

Bullish on Boeing for earnings

Traders bullish on Boeing may believe the recent troubles will be swept into history and the aviation company will rebound in short order. With any sort of EPS figure that's better than expected, we could see a bounce in the stock price, even if it's still a net loss. The lack of implied volatility around this earnings announcement could mean a surprise isn't too high a possibility, which is probably good for a struggling company like Boeing.

Bearish on Boeing for earnings

Earnings bears for Boeing are likely banking on a worse-than-expected result from an EPS perspective, revenue perspective or both. The company is hemorrhaging cash, which is problematic for many reasons. If the increased loss projection for this earnings quarter ends up being exceeded in a bad way, we could see BA stock tumble back to lows.

Tune in to Options Trading Concepts Live on Tuesday July 30 at 11 a.m. CDT for a look at strategies for Boeing earnings ahead of the announcement!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.