Bitcoin is Crashing—Will it Rebound?

Bitcoin is Crashing—Will it Rebound?

The crypto tends to increase in volatility into upside moves and decrease in volatility into downside moves

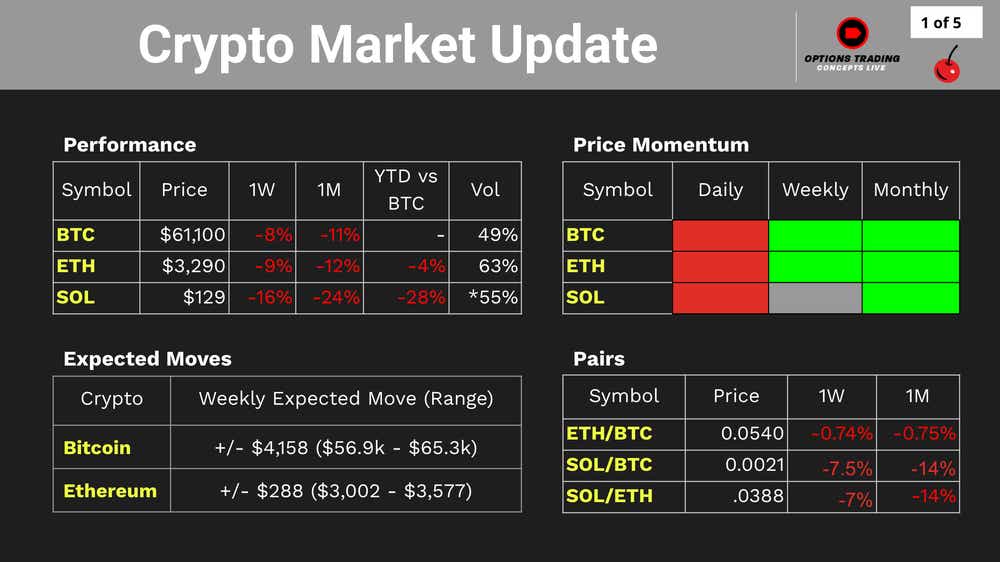

- Bitcoin has plunged in value this month.

- But is hasn’t declined as much as Ethereum and Solana.

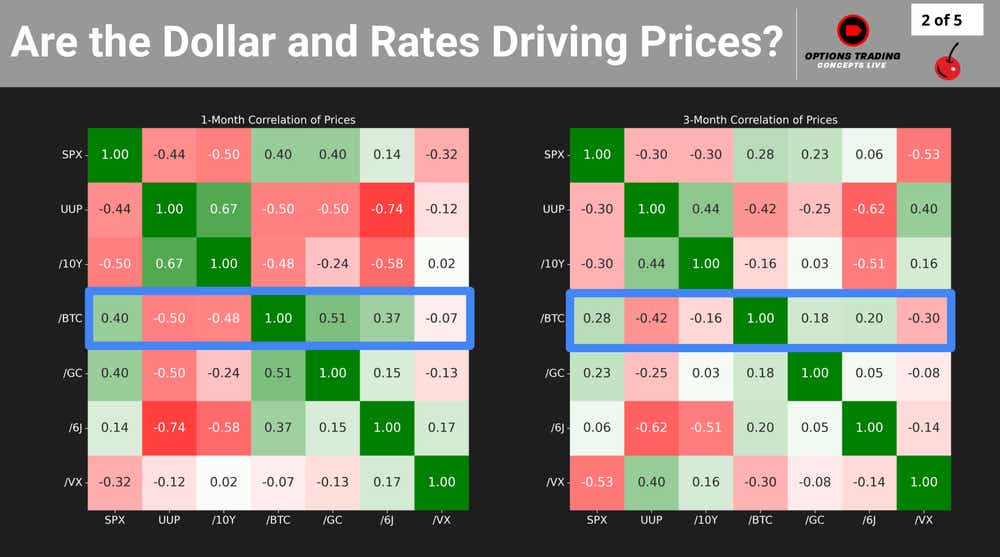

- Bitcoin is negatively correlated to rate changes and dollar strength.

Bitcoin (BTN) has seen significant downside over the month of June, hitting highs near $72,000 with lows trading in the $59,000 handle. Bitcoin tends to be the leader of the pack—as seen in comparison to Ethereum (ETH) and Solana (SOL), which have seen greater downside moves over the last month.

Bitcoin has an interesting volatility skew. It tends to increase in volatility into upside moves and decrease in volatility into downside moves. This is contrary to most asset classes. The S&P 500, for example, sees downside put skew. As prices go down, volatility in SPY tends to increase, meaning future price movements are expected to be greater. That’s why the expected move in Bitcoin seems relatively small—volatility is near historical lows. For context, 2021 saw highs in implied volatility north of 140%, contributing to this upside potential "asymmetric" returns associated with Bitcoin.

What's driving the Bitcoin weakness?

Risk on assets like stocks or crypto tend to be liquidity-driven and tend to move in a correlated fashion. Over the last month, we've seen expectations for future rate cuts decrease, and the strength in the dollar increase as a result. Without binary catalysts like earnings or business cycles, Bitcoin has remained much more negatively correlated to rate changes and dollar strength than the market as a whole.

Is it time to buy Bitcoin?

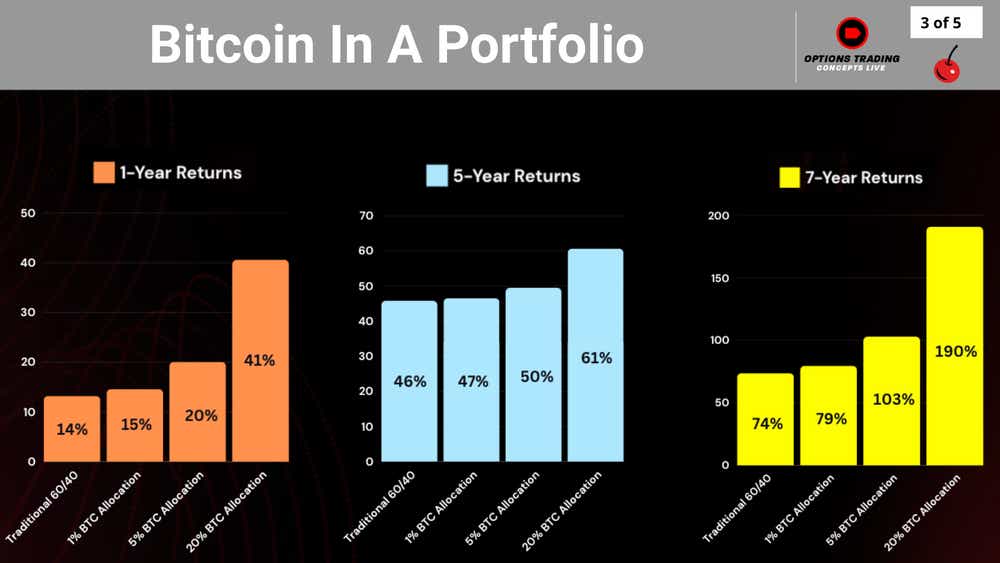

While it’s certainly hard to buy bottoms and sell tops, it should come as no surprise that incorporating volatile assets in a portfolio can accelerate potential returns. Even a small allocation might be appropriate, depending on your risk tolerance. Below is a breakdown of the returns of different portfolio allocations that shows even a 1% exposure to Bitcoin has outperformed a 60/40 portfolio.

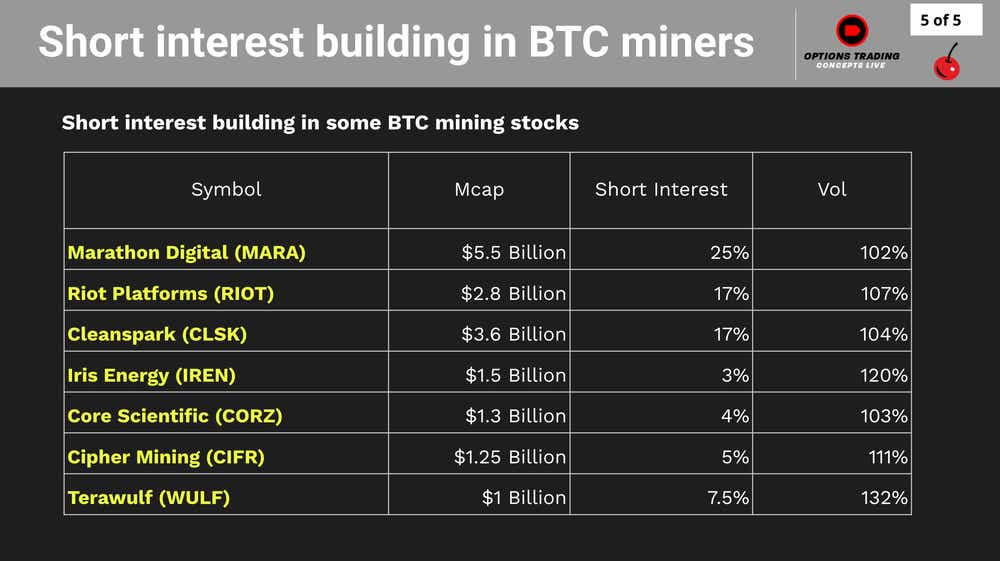

There are many ways to trade Bitcoin outside of the spot allocation, such as IBIT (IShares Bitcoin Trust), It’s among other highly correlated equities such as Coinbase (COIN) and the miners, such as Marathon Digital Holdings (MARA). The miners, in particular, while not 100% correlated to the price of Bitcoin, tend to have higher volatility than Coinbase or spot Bitcoin.

Check out our in depth review of what’s moving the crypto market here and join us every Monday at 11 a.m. CDT with Ryan Grace of tastycrypto.

Get all of the latest crypto news from the tastycrypto blog.

What do you think? Is Bitcoin a buy here? Let me know on twitter @TraderNickyBAT.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.