Stocks Face More Macro Event Risk After FOMC Fireworks

Stocks Face More Macro Event Risk After FOMC Fireworks

By:Ilya Spivak

A busy calendar of macro event risk continues to pound financial markets after a fateful monetary policy announcement from the Federal Reserve

- The British pound may rise as the Bank of England resists rate-cut speculation.

- Relatively upbeat U.S. ISM manufacturing data may hurt stocks, boost dollar.

- Euro may suffer as CPI inflation data endorses traders’ dovish ECB outlook.

The monetary policy announcement from the Federal Reserve sparked fireworks across global financial markets, as expected. However, the deluge of macro event risk is far from over. Here are the waypoints that are likely to shape price action from here:

Bank of England (BOE) monetary policy meeting

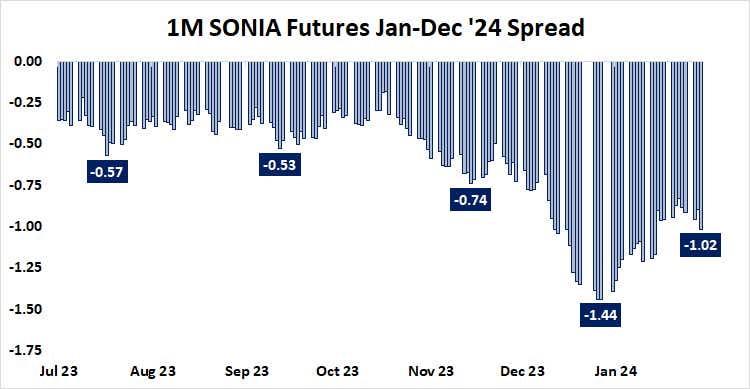

No outright policy changes are expected from the United Kingdom’s central bank this month, putting the spotlight on guidance from officials about the scope and timing of the interest rate cut cycle due later in the year. As it stands, the markets have priced in 1% or 100 basis points (bps) in easing over the course of 2024.

This is a climbdown from the 144 bps in late December, implying that investors have narrowed scope for BOE easing by nearly two full 25 bps rate cuts. This reflects a pickup in the U.K. economy. Leading purchasing managers index (PMI) data shows growing momentum in the past three months. January saw the fastest expansion in seven months.

With that in mind, the BOE Governor Andrew Bailey and company may signal that they are in no rush to begin scaling back borrowing costs. That may offer a lift to the British pound.

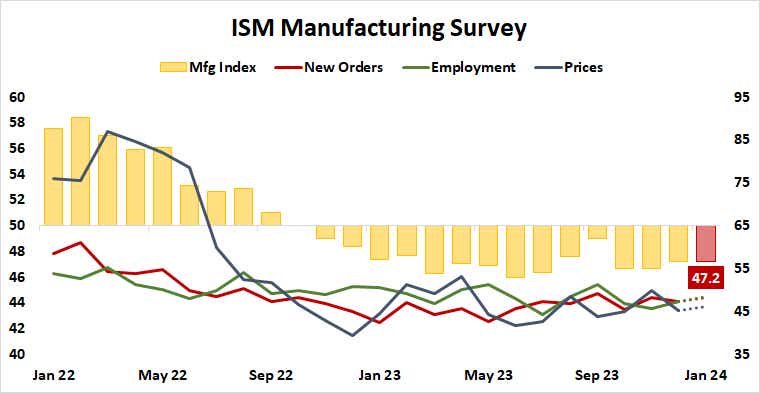

U.S. ISM manufacturing survey

The Institute of Supply Management (ISM) is expected to report that activity in the U.S. manufacturing sector shrank for the fifteenth consecutive month in January. Input measures of new orders, prices and employment are all projected to remain in contraction territory.

Analytics from Citigroup show that realized results on U.S. economic data have tended to outperform relative to baseline forecasts by a growing margin in past two weeks. This implies that surprise risk is tilted toward better-than-expected results. That may pressure stocks and boost the U.S. dollar as Fed rate cut bets are pared back further.

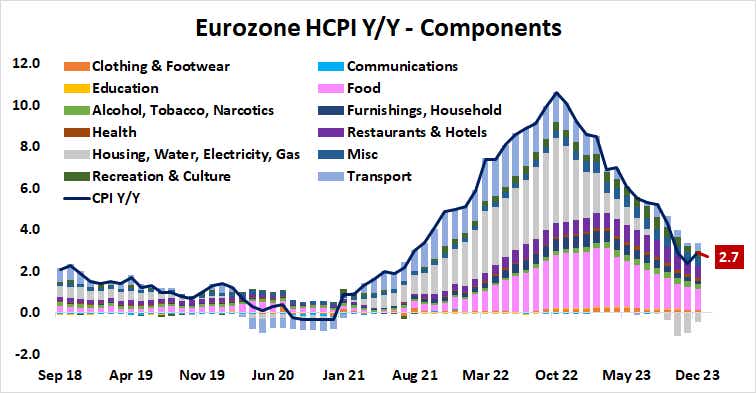

Eurozone CPI data

Inflation in the Euro Area is expected to have slowed a bit in January. Incoming consumer price index (CPI) data is due to show a rise of 2.7% year-on-year, marking a downtick from the 2.9% recorded in December. German CPI fell more than analysts anticipated earlier in the week, sliding to 2.9% year-on-year versus 3% expected.

More of the same in the region-wide report is likely to bolster the recent dovish shift in monetary policy expectations, pressuring the euro. Traders are pricing in 141 bps in rate cuts from the European Central Bank (ECB) this year. That’s up from 119 bps less than two weeks ago.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.