GBP/USD: British Pound May Fall as the Bank of England Takes a Dovish Turn

GBP/USD: British Pound May Fall as the Bank of England Takes a Dovish Turn

By:Ilya Spivak

The British pound may fall against the U.S. dollar as the Bank of England sets the stage for interest rate cuts

- As Fed rate cut bets unwound, the outlook for other central banks followed.

- Inflation and rates calculus for the Bank of England is different than the Fed.

- Dovish tone at this week’s BOE meeting might weigh on the British pound.

The markets have recalibrated Federal Reserve monetary policy expectations since the beginning of the year.

Having priced in as many as six interest rate cuts for 2024 in January, they adjusted to envision just one 25-basis-point (bps) reduction and a 44% probability of a second one.

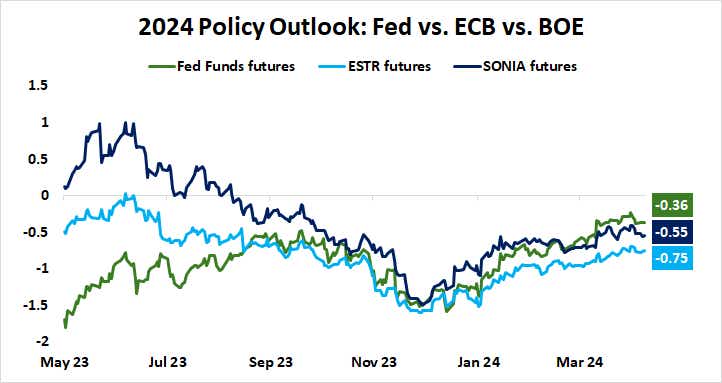

That change has echoed across credit instruments globally because of the ubiquity of the U.S. dollar in worldwide commerce.

As markets rethink Fed expectations, global credit markets move

The Bank of International Settlements reckons that close to 88% of global monetary transactions are being settled in terms of the greenback. This means the price of credit rises globally when the cost of borrowing dollars goes up because the Fed hikes rates.

The same dynamic works in the opposite direction. When markets began to speculate on Fed rate cuts in the fourth quarter of 2023, bond yields tracked Treasury rates lower worldwide.

So, as the tally of rate cuts expected of the U.S. central bank began to drop, interest rate futures tracking the priced-in policy outlook for other central banks got caught up in a global repricing of the cost of credit. In the U.K., this meant that 148 bps in cuts priced in at the start of the year fell to 55 bps now.

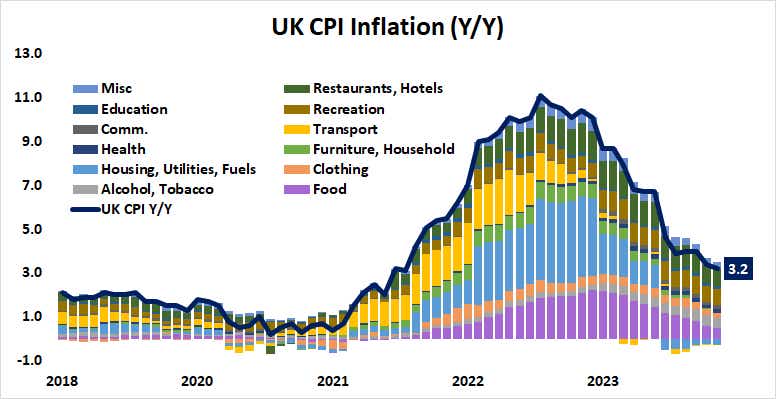

However, the policy calculus at the Bank of England (BOE) is different than that of the Fed. While U.S. inflation has conspicuously stopped falling in recent months, a steady and broadening disinflation continues in the U.K. The headline consumer price index (CPI) grew 3.2% year-on-year in March, the slowest since September 2021.

British pound at risk if Bank of England is dovish

Upward price pressure from energy and food–the strongest inflationary forces in 2022 and 2023, respectively–has mostly dissipated. Stickiness in discretionary spending categories like recreation and hospitality seem likely to succumb to economic weakness.

The economy sank into recession in the second half of last year, with the gross domestic product (GDP) shrinking for two consecutive quarters. The first quarter of 2022 was the last time that the economy managed to increase output by more than 0.2%. Output is seen rising in the first quarter of this year, but only very slowly.

On balance, this means that the BOE may sound much readier to cut rates than its U.S. counterpart when Governor Andrew Bailey and company deliver a policy update this week. If that moves at least one more official on the rate-setting MPC committee to favor a cut when the votes are tallied, the British pound may fall.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.