British Pound at Risk if the BOE Follows the ECB Playbook

British Pound at Risk if the BOE Follows the ECB Playbook

By:Ilya Spivak

The British pound may keep falling after hitting a four-month low if the Bank of England signals rate hikes are ending

- The Bank of England is in a familiar bind: inflation is too high as recession looms.

- Cool-off in August CPI data cuts into rate hike bets but bias is still hawkish.

- British pound may fall if the BOE signals rate hike cycle is close to ending.

The Bank of England (BOE) looks set to join the chorus of central banks signaling a downshift in the fight against inflation. That points to continued pressure on the British pound after it sank to a four-month low against the U.S. dollar.

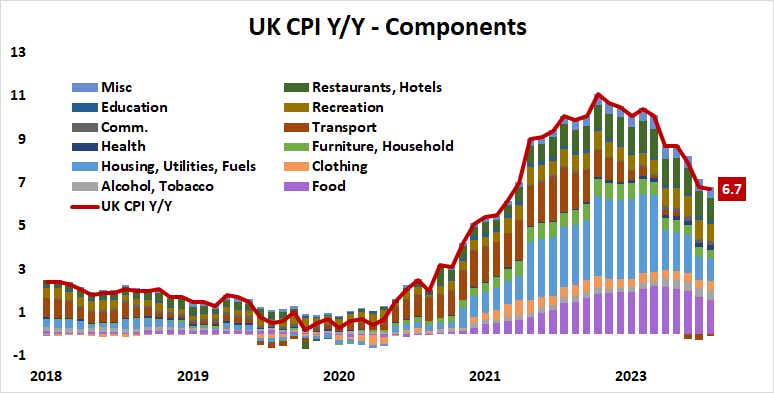

BOE Governor Andrew Bailey and company find themselves in much the same predicament as their Eurozone counterparts. Inflation is stubbornly above target, registering at 6.7% in August. That is a good deal lower than the 11.1% peak in October 2022 but still miles away from the central bank’s 2% objective.

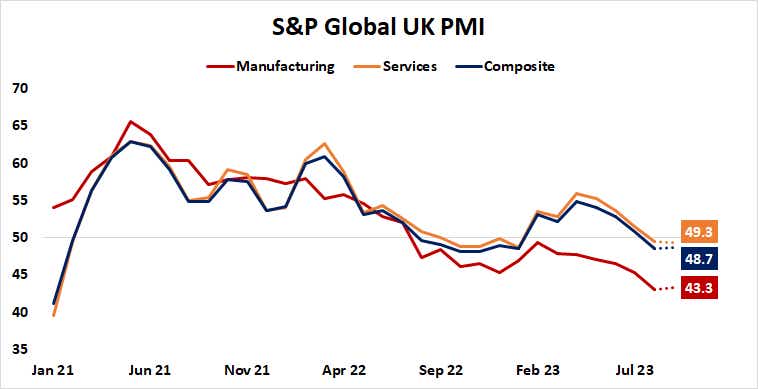

Meanwhile, leading economic data suggests the specter of recession is on the horizon. The latest set of Purchasing Managers Index (PMI) data due this week is expected to show that the economy shrank for a second consecutive month in September, with contraction recorded in both manufacturing and service sectors.

Inflation cool-off cuts into Bank of England rate hike bets

That puts policymakers in a bind. On one hand, keeping inflation moving lower seems to demand continued interest rate hikes. On the other hand, the dismal state of economic growth begs for monetary relief.

A softer-than-expected consumer price index (CPI) reading earlier in the week offered a bit of relief. As noted above, it put the headline inflation rate at 6.7%, undershooting analysts’ forecasts calling for a print at 7%. The markets promptly marked down the probability of a rate hike at this week’s BOE conclave from 80% to 46%.

The bias remains broadly hawkish, however. The probability of a rate hike before year-end is still hovering over 80% and easing doesn’t enter the conversation until August of next year. That leaves ample room for further adjustment toward the dovish side of the spectrum if the BOE follows the path that the ECB blazed last week.

British pound at risk if BOE hawks seem sated

The argument for the U.K. central bank to follow its continental cousin is compelling. As with the currency bloc, food inflation has emerged as the largest contributor to price growth. Higher borrowing costs have little scope to have an impact here, at least in the near term.

Meanwhile, a gauge of global food prices from the United Nations suggests they fell to a 28-month low in August after peaking last year. It tends to lead price growth trends by about seven months. So, some progress is already on display, and more is signaled ahead.

With that in mind, the BOE might have an opening to signal readiness for a move to the sidelines. August’s CPI report may even give the central bank some cover to hold fire at September’s meeting. If markets come away with a sense that the rate-setting MPC committee’s hawkish impulses have been tamed, the pound may be in for a beating.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.