Are These the Best Stocks to Buy in September 2024?

Are These the Best Stocks to Buy in September 2024?

The market may be heading for another down move but also might rally to all-time highs

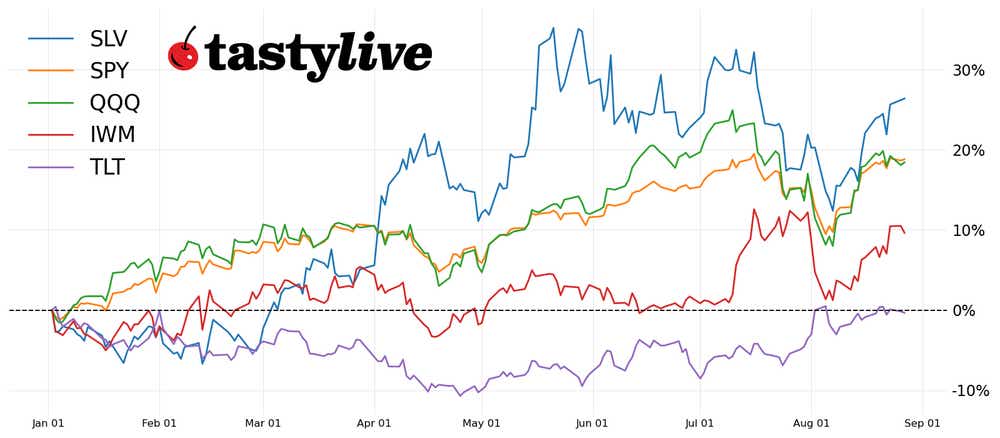

Market update: S&P 500 E-mini futures up 10.56% year-to-date

After last month's update, the market continued to sell off to $5,120.00 and then quickly bounced back to $5,242.00 on Aug. 6. The market remained volatile through the eighth, at which point it displayed a strong bullish bias.

From Aug. 8-26, the market rallied 487 points in the S&P 500. We have since pulled back slightly. From Aug. 20-28, the market found sellers and remained in a tight range of about 87 points.

As of writing, we sit 106 points off all-time highs. Although it appears the market is turning for another down move, I would not be surprised if we rally to all-time highs from here. The market remains bullish for the time being. August’s sharp selloff was met with an equally sharp rally, indicating strength in the face of weakness. We can observe similar price action throughout the market. We continue to wait for indications of weakness.

A note on earnings trades

To capture most of the volatility of earnings announcements, earnings trades are often executed either the day before or on the day of the earnings announcement. However, earnings trades can also be placed days or weeks before an earnings event, which could lead to early profit-taking.

Alternatively, placing a trade shortly after an earnings announcement can be a strategic choice to circumvent the binary nature of the event. Evaluate each trade in a way that enables you to execute the position that matches your strategy.

If you're considering a trade going into an earnings event, one approach is to initiate the position in the monthly options contract that follows the earnings event. This strategy offers flexibility. Should you need to defend your position—perhaps because of unexpected market movements—you have the choice to 'roll' it out to the subsequent monthly options. Rolling out the position in this way enables you to extend its duration and potentially collect more premium, providing a buffer against market volatility.

Top 10 stocks to watch in September 2024

- C3.ai (AI) – Sept. 4, After the close

- Broadcom (AVGO) – Sept. 5, After the close

- UiPath (PATH) – Sept. 5, After the close

- DocuSign (DOCU) – Sept. 5, After the close

- Oracle (ORCL) – Sept. 9, After the close

- Adobe (ADBE) – Sept. 12, After the close

- FedEx (FDX) – Sept. 19, After the close

- Micron Technology (MU) – Sept. 25, After the close

- Costco (COST) – Sept. 26, After the close

- Nike (NKE) – Sept. 26

1. C3.ai (AI)

C3.ai provides artificial-intelligence software for building enterprise-scale AI applications. It’s down 17.61% year-to-date. Its IVR is 52, with August IVx at 87.9 and September IVx at 71.7. Its liquidity is rated 3 out of 4 on the tastytrade platform.

AI is a lower-priced stock, so smaller accounts could consider undefined risk positions. A 22-delta short strangle sets up well. 25-delta short iron condors can also be considered. Five-dollar wide at-the-money directional spreads also set up decently if you have a directional assumption.

2. Broadcom (AVGO)

Broadcom designs, develops and supplies semiconductor and infrastructure software. AVGO is currently up 47.48% year-to-date. Its current IVR is 63.5, with August IVx at 55.8, September IVx at 49.1. Its liquidity is rated three out of four on the tastytrade platform.

AVGO is a higher-priced stock, so medium to larger accounts could consider undefined risk positions. 22-delta short strangles set up well. This can be converted into an iron condor for a decent ratio of credit received to buying power used. Directional spreads can be set up in either direction with your preference of risk.

3. UiPath (PATH)

UiPath offers a platform for robotic process automation that enables organizations to automate repetitive tasks. PATH is currently down 47.55% year-to-date. Its current IVR is 63.5, with August IVx at 106.1, September IVx at 72.3, and its liquidity is rated three out of four on the tastytrade platform.

PATH is a cheaper stock to trade, so smaller accounts could consider an undefined risk position. However, low-priced stocks can move dramatically in a short time, so if you do put an undefined risk position on, manage it early. Five-dollar wide at-the-money directional spreads also set up decently if you have a directional assumption.

4. DocuSign (DOCU)

DocuSign provides electronic signature solutions that facilitate agreements digitally. DOCU is down 0.73% year-to-date. Its current IVR is 62.4, with August IVx at 55.9, September IVx at 42.7, and its liquidity is rated two out of four on the tastytrade platform.

DOCU is a medium-priced stock, so medium-sized accounts could consider undefined risk positions. A 22-delta short iron condor sets up decently. 35-delta short directional spreads also set up with a decent ratio of credit received to buying power used.

5. Oracle (ORCL)

Oracle specializes in developing and marketing database software and technology, cloud-engineered systems and enterprise software products. ORCL is currently up 32.49% year-to-date. Its current IVR is 80.5, with August IVx at 44.6, September IVx at 34.9, and its liquidity is rated three out of four on the tastytrade platform.

ORCL is a high-priced stock, so medium-to-large-sized accounts could consider undefined risk positions. A 20-delta short strangle sets up well. This can be converted into a short iron condor for a decent ratio of credit received to buying power used. Directional spreads can be set up in either direction with your preference of risk.

6. Adobe (ADBE)

Adobe focuses on multimedia and creative software products, with a more recent foray into digital marketing software. ADBE is currently down 3.68% year-to-date. Its current IVR is 67.7, with August IVx at 46.2, September IVx at 38.8, and its liquidity is rated two out of four on the tastytrade platform.

ADBE is a very expensive stock to trade, so most accounts will want to trade defined-risk positions. That said, a 19-delta short strangle sets up OK. A 21-delta short iron condor also sets up well, but be cautious of wide bid-ask spreads. An earnings trade in ADBE will not work for everyone’s account. Directional spreads can be set up in either direction with your preference of risk.

7. FedEx (FDX)

FedEx offers e-commerce, business services, and courier delivery services and transportation. FDX is currently up 17.25% year-to-date. Its current IVR is 96.9, with August IVx at 42.4, September IVx at 32.5, and its liquidity is rated two out of four on the tastytrade platform.

FDX is a very expensive stock to trade, so most accounts will want to trade defined-risk positions. That said, a 21-delta short strangle sets up well. A 21-delta short iron condor also sets up well, but be cautious of wide bid-ask spreads. An earnings trade in ADBE will not work for everyone’s account. Directional spreads can be set up in either direction with your preference of risk. Manage your position early.

8. Micron Technology (MU)

Micron Technology manufactures semiconductor devices, primarily DRAM and NAND memory and storage products. MU is currently up 16.5% year-to-date. Its current IVR is 72.4, with August IVx at 54.1, September IVx at 58.6, and its liquidity is rated four out of four on the tastytrade platform.

MU is a medium-priced stock, so a medium-sized account could consider undefined risk positions. A 16-delta short strangle sets up well. A 19-delta five-dollar wide short iron condor also sets up well. Directional spreads can be set up in either direction with your preference of risk.

9. Costco (COST)

Costco Wholesale operates membership warehouses offering a variety of products at discount prices. COST is currently up 38.64% year-to-date. Its current IVR is 47, with August IVx at 20.7, September IVx at 26.5, and its liquidity is rated two out of four on the tastytrade platform.

COST is a very expensive stock to trade, so most accounts will want to trade defined-risk positions. A 21-delta short iron condor also sets up well, but be cautious of wide bid-ask spreads. An earnings trade in COST will not work for everyone’s account. Directional spreads can be set up in either direction with your preference of risk. Manage your position early.

10. Nike (NKE)

Nike designs, develops, markets and sells athletic footwear, apparel, equipment and accessories. NKE is currently down 20.74% year-to-date. Its current IVR is 63.5, with August IVx at 24.8, September IVx at 35.3, and its liquidity is rated four out of 4 four on the tastytrade platform.

NKE is a medium-priced stock, so medium-sized accounts could consider undefined risk positions. A 21-delta short strangle sets up well. Directional spreads can be set up in either direction with your preference of risk.

Ryan Sullivan is an active options and forex trader and programming producer for the tastylive network.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.