Amazon Earnings Preview—7% Stock Price Move Expected

Amazon Earnings Preview—7% Stock Price Move Expected

By:Mike Butler

The company has exceeded earnings estimates for four straight quarters

- Amazon is scheduled to report earnings after the stock market closes Aug. 1.

- Earnings-per-share (EPS) and revenue estimates are both higher than last quarter's figures.

- In fact, the company has exceeded earnings estimates for four straight quarters.

- Amazon recently announced its plan to launch a low-cost lifestyle and fashion web-store that ships directly from China to compete with companies like Temu and Shein.

Amazon Earnings Preview

Amazon (AMZN) is set to report earnings at 3 p.m. CDT after the stock market closes on Aug 1. The company is expected to announce earnings per share (EPS) of $1.01 on $148.54 billion in revenue after exceeding last quarter's estimates.

AMZN stock has had a strong start to 2024, opening the year at $151.54 and currently sitting at $182 after reaching an annual high of $201.20 a few weeks ago. Compared to the other Magnificent Seven stocks, Amazon's gains sit exactly in the middle of the pack, with Nvidia (NVDA) leading the way by a lot.

Andy Jassy, Amazon president and CEO, offered words of encouragement for growth on the last earnings call: “The combination of companies renewing their infrastructure modernization efforts and the appeal of AWS’s AI capabilities is reaccelerating AWS’s growth rate (now at a $100 billion annual revenue run rate); our Stores business continues to expand selection, provide everyday low prices, and accelerate delivery speed (setting another record on speed for Prime customers in Q1) while lowering our cost to serve; and, our Advertising efforts continue to benefit from the growth of our Stores and Prime Video businesses. It’s very early days in all of our businesses and we remain excited by how much more we can make customers’ lives better and easier moving forward."

Amazon also had a few updates related to AI initiatives, as noted in its last earnings release, when it noted “the extension of AWS and NVIDIA’s strategic collaboration to make AWS the best place to run NVIDIA GPUs [is] helping customers unlock new generative AI capabilities."

The company went on to say it “delivered a number of innovations in Amazon Bedrock. That’s AWS’s generative AI service that enables customers to leverage an existing large language model, customize it with their own data, and have the easiest and best features available to deploy secure, high quality, low-latency, cost-effective production generative AI apps. Tens of thousands of organizations worldwide are using Amazon Bedrock."

Amazon claims to "obsess over the customer experience" and that seems apparent in its use of AI for customer-facing developments.

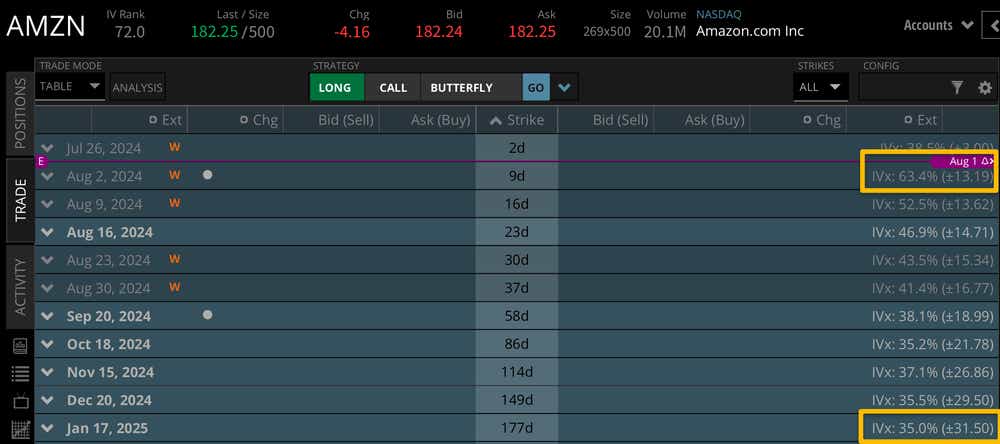

Amazon has a relatively high expected stock price move for the earnings announcement based on current implied volatility. The market is expecting a +/- $13.19 stock price move for next week, which is about 7% of the stock price.

Compared to the January 2025 options cycle, which sits at +/- $31.50, we can see the expected move next week accounts for almost half of the implied movement through the rest of the year. That's a big differential relative to the time associated with each of those expiration cycles, and we should expect to see some fireworks after the earnings announcement next week.

Bullish on Amazon Stock for earnings

Amazon bulls are likely looking for an earnings beat on both EPS and revenue, strong AI initiative performance and efficiency, and a positive update on the plan to launch a low-cost lifestyle and fashion site to compete with Temu and Shein. A successful grab of market-share in this space could result in a big boost to revenue because it would bring Amazon into the fold of a booming sub-culture in heavily discounted shopping.

Bearish on Amazon Stock for earnings

After two of the Magnificent Seven stocks, Google (GOOGL) and Tesla (TSLA), reported earnings July 23, the stock market sold off aggressively. Google exceeded earnings estimates, but the stock still fell over 5%. Tesla delivered mixed results, and the stock sold off over 10%. Amazon bears may be looking for the same—an earnings miss paired with a continued sell-off in the market. Even if Amazon exceeds estimates, there's always the possibility that the market digests the news poorly and the stock sells off.

Tune in to Options Trading Concepts Live every day next week at 11 a.m. CDT for a full breakdown of earnings strategies in Amazon (AMZN), Apple (AAPL), Meta (META) and Microsoft (MSFT), all reporting July 31 or Aug. 1.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.