ARM Stock Outlook Strained as Prices Fall Below IPO Debut

ARM Stock Outlook Strained as Prices Fall Below IPO Debut

ARM Stock Slips Under IPO Price: Time to Buy?

- ARM Holdings is under pressure.

- The broader market is weighing ARM's down price after FOMC meeting.

- The fundamentals hardly support a bullish outlook.

ARM Holdings plc (ARM) hasn’t had the best first week of trading. Since its initial public offering (IPO) last Thursday, the stock is down nearly 10% to trade around $50.50 per share, which is below its IPO price of $51 per share.

While the stock enjoyed a strong first two days of trading, the enthusiasm quickly faded. Instacart (CART) is also having a rough go at it during its first week of trading. These selloffs have sapped enthusiasm created around these IPOs, which signaled a healthy capital-raising environment.

The consequences, assuming these losses are maintained, could dissuade more IPOs until market optimism recovers. That wouldn’t necessarily bode well for market confidence, which is already waning.

The Federal Reserve rains on the parade

While investors had their individual hesitations regarding ARM (what stock doesn’t?), we can confidently point our fingers at Jerome Powell and his central bank for ruining the good times. The broader market is down nearly 2%—gauged by e-mini S&P 500 futures, /ESZ3—since Wednesday’s announcement from the Federal Open Market Committee (FOMC).

It's likely that the higher-for-longer narrative dominating sentiment won’t bode well for stocks in the months ahead, especially for budding startups and companies like ARM that are looking to aggressively expand. However, the market has shown resiliency in the face of future rate hikes earlier this year—and that optimism may return.

ARM stock outlook

The outlook among analysts who give a rating on the stock isn’t looking the greatest. According to Bloomberg, one analyst has a buy rating on the stock, two have a hold rating, and one has a sell rating.

Unfortunately for ARM, its revenue from the smartphone market will be hard to grow, mostly from it already dominating the market. Inflation may make things worse as consumers opt to hold their current phones for longer instead of upgrading.

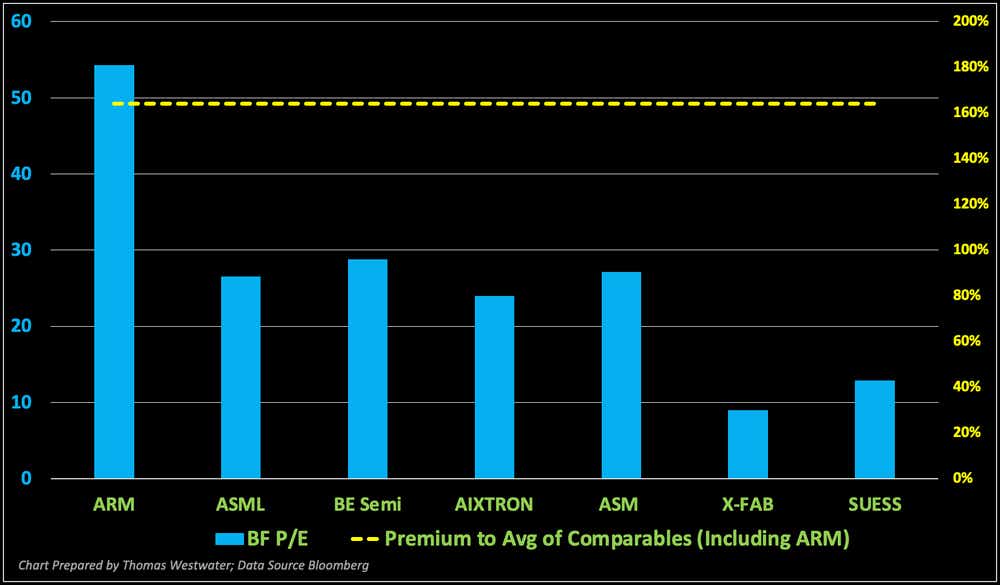

When comparing ARM to a basket of comparable stocks (using data from Bloomberg), ARM trades at a 164% premium against the average of those peers on a blended forward price-to-earnings basis (54.4x versus mean of peers: 20.6x).

That said, if you like the stock, it might be better to wait until the price drops a bit more before taking a directional position. The implied volatility, looking at the November 3 expiration (IVx), is 52.9%, indicating the market is pricing a move of 6.26 in either direction by that time. So, if you want to trade volatility in ARM, you can probably find it.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.