Are These the 10 Best Tech Stocks to Watch in 2022?

Are These the 10 Best Tech Stocks to Watch in 2022?

Technology is a bedrock of the modern world. With a continuous evolution of innovation, there are always several key players that stand out. Discover some of the best tech stocks to watch in 2022.

WHAT’S ON THIS PAGE?

- Tech stocks: What You Need to Know

- 10 Best Tech Stocks to Watch

- How to Trade and Invest in Tech Stocks

TECH STOCKS: WHAT YOU NEED TO KNOW

All industries rely on technological developments to run processes faster, smoother and more reliably. But tech isn’t only integral to how companies are run, it also extends into everyday living in general. Be it in the household, on the go, or while enjoying recreational activities – automation is usually involved.

It’s no wonder that the tech sector has significant contributions to economies around the world. North America and Asia have been leading the way for the past few years in the devices, software, infrastructure and other information technology (IT) categories. The two regions have, respectively, maintained an industry share of over 30%.

Investors’ interest in tech stocks is often driven by factors such as the company’s financial statements, stock performance, long-term growth prospects and volatility. Considering such factors in decision-making, traders typically use a variety of information – e.g. technical, fundamental, or market metrics such as implied volatility, or IV for short – to speculate and participate in a tech stock.

10 BEST TECH STOCKS TO WATCH

- Apple (AAPL)

- Alphabet (GOOGL)

- Amazon (AMZN)

- Microsoft (MSFT)

- Alibaba (BABA)

- Tesla (TSLA)

- NVIDIA (NVDA)

- Meta (FB)

- Adobe (ADBE)

- Intel (INTC)

You can trade these stocks on the award-winning tastytrade platform.1 To get started, create an account. The companies featured on this page aren’t necessarily the best stocks per se. Rather, they were chosen based on a variety of factors, e.g. investors’ interest, market cap, liquidity and volatility.

![]()

APPLE (AAPL)

Apple is known for its hardware (iPhone, iPad, Macs, etc.), but it also provides software products like its operating systems and a range of online services. From Apple Music and Apple TV to Apple Fitness and Apple Arcade, Apple always finds itself in the headlines in one way or another.

The company was founded in 1976 by Steve Jobs, Steve Wozniak and Ronald Wayne – it was initially called the Apple Computer Company. Today, Apple is worth trillions and employs over 150,000 people worldwide.

On 3 January 2022, it became the first company in the world to reach the $3 trillion valuation mark. This milestone is attributable to its largely bullish stock price action over the past few years, investors’ interest in its ability to grow and its earnings performance. Apple reported a revenue increase of 29% year-over-year for Q4 2021.

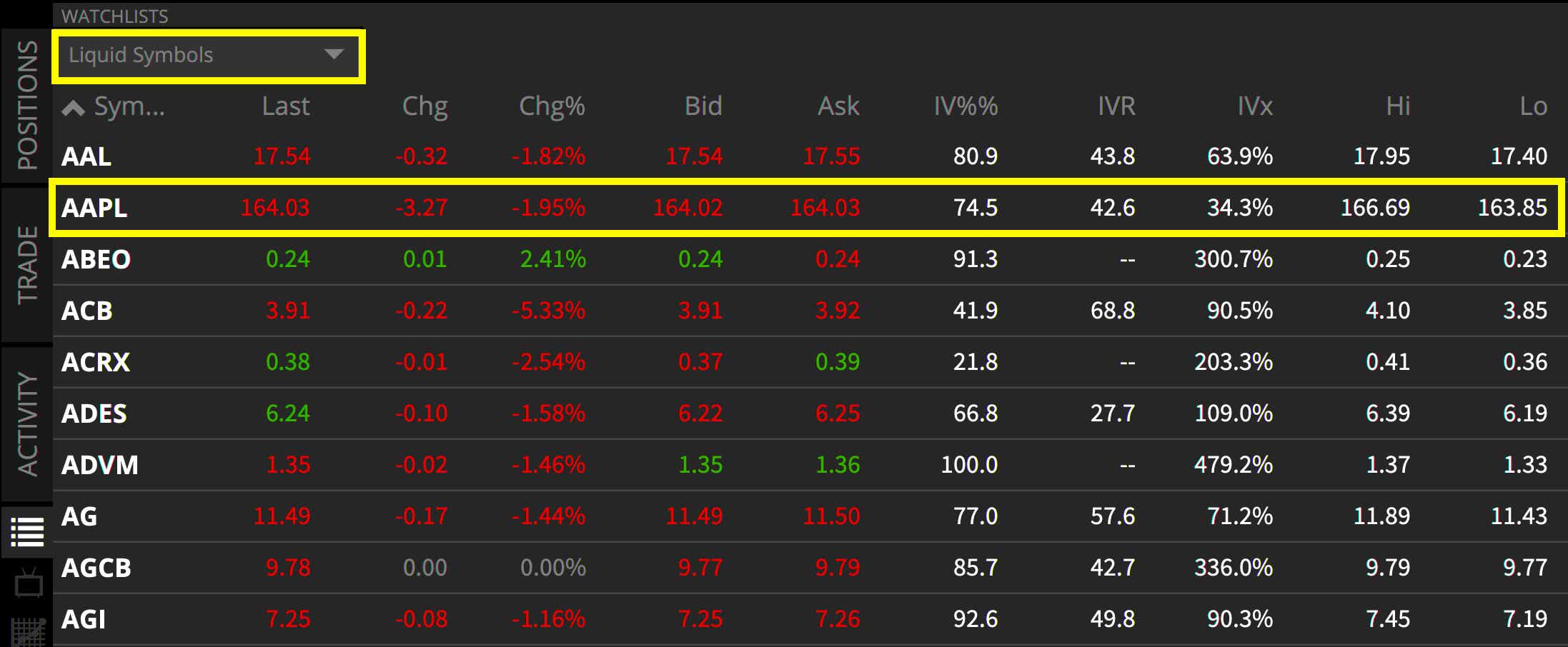

Looking further under the hood, Apple stock ($AAPL) is considered one of the most liquid stocks to trade options. With narrow bid-ask spreads, and liquidity in both weekly and monthly options expirations, traders can often enter and exit options positions with relatively little slippage involved.

![]()

ALPHABET (GOOGL)

Alphabet is the parent company of the world’s most used search engine, Google. While Google was established in 1998, Alphabet came into being in 2015, through a restructuring of the former.

Like many online products and services providers, Alphabet thrived during the pandemic, as millions shifted to working from home. At the beginning of 2022, the company’s share price had almost tripled to around $2,900.00 in value against early March 2020, when the world went into lockdown.

Given its expensive stock price, many retail traders may look to trade defined risk options spreads instead of trading shares themselves, to take part in a directional or neutral assumption without the high capital requirement.

In early February 2022, Alphabet’s market cap was $1.9 trillion. Besides being part of the trillion-dollar club and home to what many consider as synonymous with the internet itself, the company is also making other waves. While its businesses that are internet-related fall under Google, the search engine market leader has several sister companies, which include Calico, DeepMind, Waymo and Verily.

![]()

AMAZON (AMZN)

Now the global leader in the product distribution space, Amazon was founded by Jeff Bezos in 1994. With many moving parts, this tech giant’s logistics include company-branded services such as Amazon Air, Amazon Flex and Amazon Prime.

Amazon’s share price has soared since the onset of the Covid-19 crisis, often reaching highs that are over double what it was when the initial worldwide lockdown was enforced. For example, a share of Amazon stock traded at around $3,400.00 at the beginning of January 2022, compared to prices around $1,700.00 in mid-March 2020.

With various factors contributing to the stock’s positive results, its performance is partly attributable to its offerings, customer base and the widespread move to online shopping. In the early days of February 2022, the company’s valuation was at $1.4 trillion.

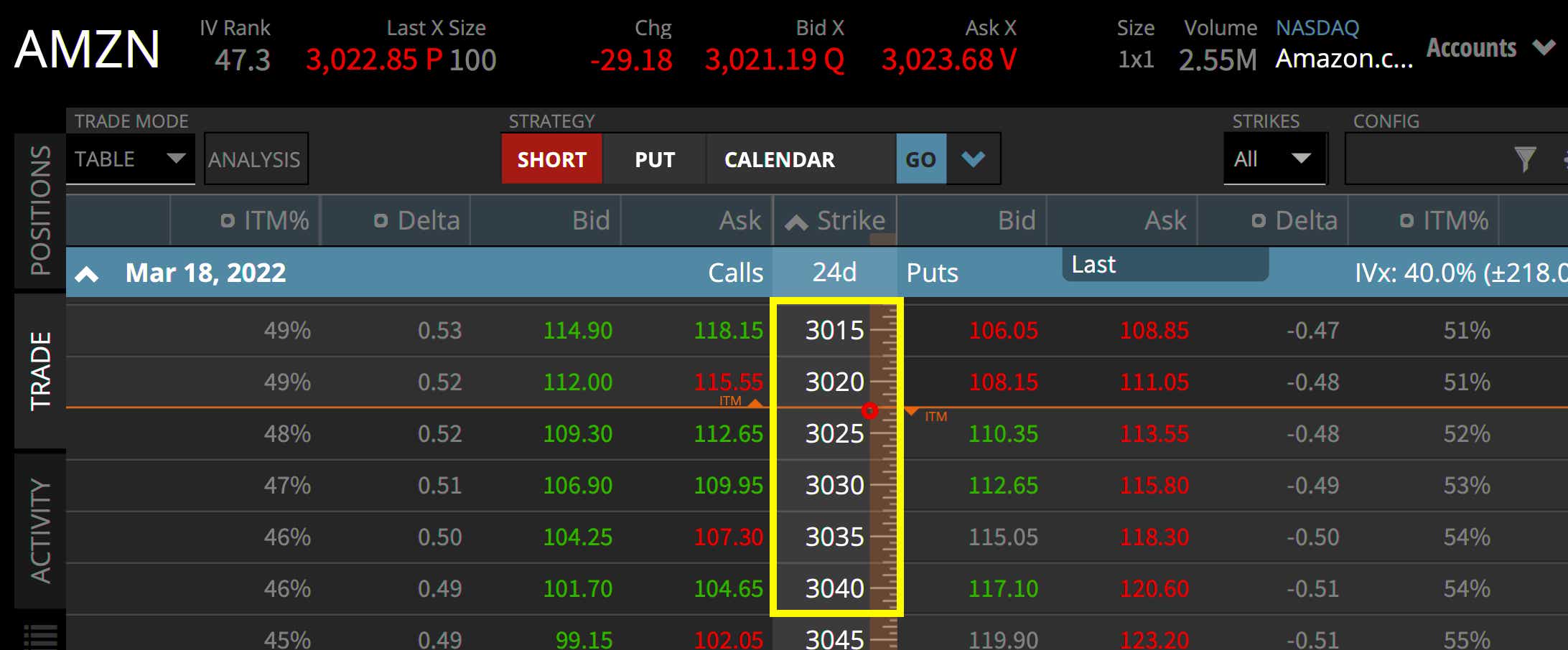

Much like Alphabet, the cost of outright shares in Amazon may be too expensive for some retail traders. However, options strikes as narrow as 5 points wide give traders the ability to be more flexible with their speculation and risk when looking to participate in trading this tech stock.

Amazon cloud-computing platform, Amazon Web Services (AWS), is the largest of its kind worldwide. AWS provides its services to millions of customers, including large enterprises, startups, government agencies and individuals. Amazon has several other subsidiaries, such as Whole Foods Market, Twitch and Kindle Direct Publishing. \

![]()

MICROSOFT (MSFT)

Microsoft came into being in 1975 – it’s the brainchild of Bill Gates and Paul Allen. With countless innovations throughout its various products and services, the company has become a household name. Microsoft, like Apple, is worth trillions – having been founded around the same time, the companies have been one another’s top competitors since early days.

With several acquisitions of over a billion dollars, Microsoft announced in January 2022 its plans to acquire game developer Activision Blizzard in a $68.7 billion deal. This would be the company’s biggest acquisition, since forking out $26.2 billion for LinkedIn.

Windows, Word, Excel, Skype and LinkedIn are just some of Microsoft creations that have become long-standing systems used in workplaces across many industries. The company itself employs around 190,000 people.

Microsoft’s performance on the markets has been marked by frequent bull runs, which have, despite retracements, seen the price per share generally increase significantly over the years. One of the reasons for this is increased demand due to the digital transformation brought on by the Covid-19 pandemic.

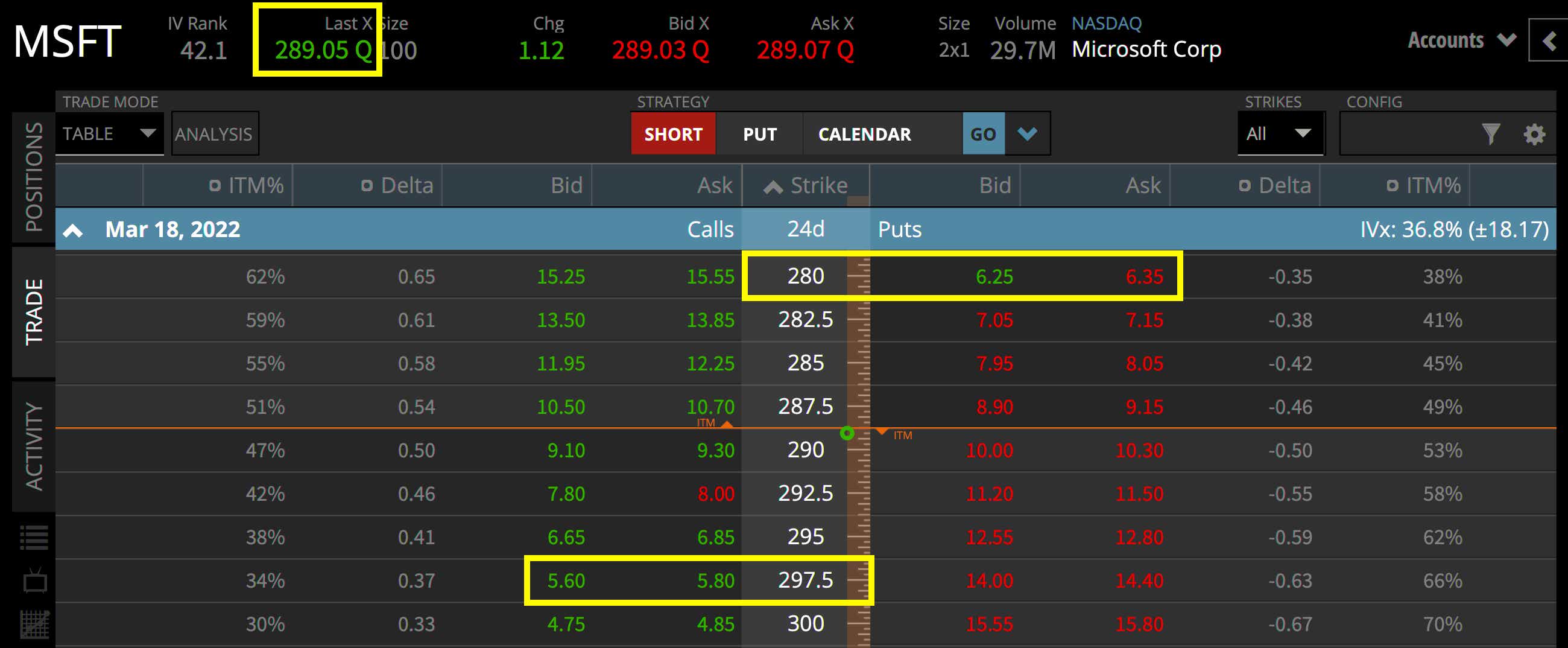

In February 2022, a share of the stock traded at around $300.00. During the same time, Microsoft had middling IV. However, options prices in the tech stock displayed put skew, meaning that equidistant OTM calls are trading cheaper than their equidistant OTM puts. With this in mind, options traders may look to capitalize on that skew with strategies that play into the downside fear.

![]()

ALIBABA (BABA)

Alibaba, a Chinese e-commerce company was founded by Jack Ma, with the help of a number of friends, in 1999. With tremendous strides of growth over the years, the company now provides millions of products across dozens of categories to customers globally.

In December 2021, Alibaba shared its target of $100 billion in gross merchandise volume (GMV) for Lazada, its southeast Asian online marketplace, with investors. Before this, the company had reported that its year-over-year revenue increased by 29% to $31.1 million in the quarter ending September 2021.

This multinational, like its U.S. peer Amazon, also offers cloud-computing solutions. Among the company’s subsidiaries are AliExpress, Trendyol, ZTEsoft Technology and Ali Telecom. Alibaba has over 250,000 employees worldwide.

As this is a China-based stock, traders should be mindful that there may be different price and volatility drivers that impact performance compared to a US-based tech company.

.png?format=pjpg&auto=webp&quality=50&width=30&disable=upscale)

TESLA (TSLA)

Tesla was established in 2003 by Martin Eberhard and Marc Tarpenning. Now, the company has over 70,000 employees and its subsidiaries include Tesla Energy, DeepScale and Tesla Grohmann Automation. Tesla specializes in autonomous vehicle manufacturing, driving the case for sustainable energy solutions. It also creates renewable energy solutions for households, such as solar panels.

The Tesla share price has made big leaps in the past couple of years, reaching its all-time high closing price of $1,229.91 in November 2021. This came days after the company released strong Q3 2021 financial results, which included revenue of $13.8 million, a significant jump from $8.8 million for the same quarter of the previous year. Two days later, Tesla’s valuation reached the $1 trillion mark for the first time.

The CEO of Tesla, Elon Musk is one of the most influential business figures in the world, with just one tweet by him sometimes affecting related stock market prices. Due, in part, to Musk’s social media presence and subsequent impact on TSLA’s stock price, this underlying typically demonstrates higher IV, which influences its expected move over multiple timeframes.

![]()

NVIDIA (NVDA)

NVIDIA is a computer chip manufacturer – specifically, graphics processing units (GPUs). The company was formed in 1993 to create graphics cards. The typical use of these chips was originally to facilitate computer gaming in personal computers.

NVIDIA exceeded revenue expectations with its Q3 2021 fiscal results, when data center sales were up by 55% compared to the same quarter of the previous year. It had a record figure of $7.,1 billion, up 50% from the previous year. For the same quarter, the company paid $100 million in cash dividends. During the same period, the stock’s share price rose by around 10% – it went from just over $200.00 to around $224.00.

With around three decades in business, 18,000 employees, and several subsidiaries, including DeepMap, Mellanox Technologies and Parabricks LLC , the company has expanded its horizons. It also produces chips for phones, game consoles, machine learning and cryptocurrency mining.

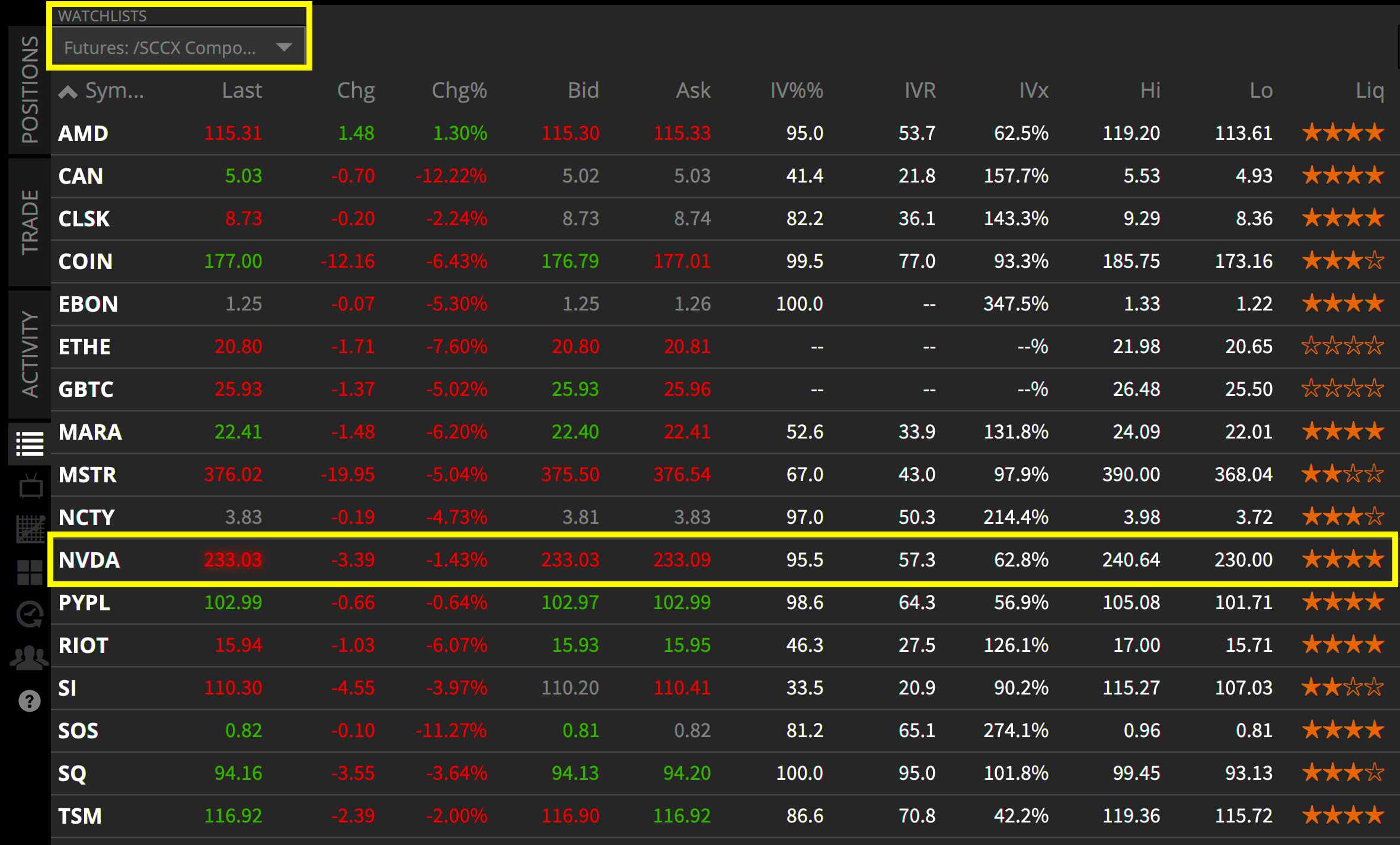

With the recent surge in cryptocurrency interest, NVIDIA has seen larger realized volatility.

![]()

META (FB)

Meta was founded in 2004 by Mark Zuckerberg and fellow Harvard University students (at the time). This came after the university shut down a previous version of the social network, Facemash, that was primarily developed by Zuckerberg.

In 2021, with the company’s active users almost at 3 billion, the company name was changed from Facebook to Meta. The reason for this change is said to be aligning to the company’s vision of building and shifting towards the metaverse, a three-dimensional virtual world. Meta has over 60,000 employees and several subsidiaries, including Instagram, WhatsApp and Giphy.

The company reported year-over-year increases in full year results for 2021. Revenue jumped 37% from close to $86 billion to $117.9 billion, of which $39.4 billion was 2021 net profit. This figure was 35% lower the previous year, at $29.1 billion. Like many companies that provide online services, Meta has seen continued financial performance growth during the Covid-19 pandemic.

Given Meta’s February 2022 pullback from $323.00 to $202.00, its IV rank of 58 is still on the higher end of its range. At the time of writing, Meta had an expected move of +/- $54.00 through January of 2023.

![]()

ADOBE (ADBE)

Adobe is a computer software company that specializes in products and services that empower business and individuals to create a variety of digital experiences. The company’s products fall under different categories, including graphic design, web design, video software, and eLearning.

Founded in 1982 by Charles Geschke and John Warnock, Adobe became a publicly listed company in 1986. Adobe now has over 25,000 employees globally. Workfront, Fotolia, Mixamo, Marketo and Allegorithmic are just some of the company’s subsidiaries.

To investors’ delight, Adobe’s finances are also on the upside, having achieved a record revenue of $4.1 billion in Q4 2021, representing year-over-year growth of 20%. This contributed to, and was echoed, by another record – $15.8 billion in annual revenue for the fiscal year.

At 23%, the year-over-year growth figure was very close to the Q4 number. The company made 92% of its total revenue from subscriptions in 2021 – a figure that has increased by 6% compared to 2019.

Although these figures appear positive, the stock has dropped over 200 points from its high of $699.54 in late November 2021.

![]()

INTEL (INTC)

Intel started out in 1968 as a semiconductor manufacturer. Its founders, Robert Noyce and Gordon Moore previously worked together at a semiconductor company. With the start of their own company, they’re said to have wanted to focus on practicality and affordability.

In its over fifty years in business and global reach, the company now has over 110,000 employees and has expanded its offerings substantially. With categories such as systems and devices, processors, memory and storage, chipsets and server products, customers and prospects get to have their pick. Some of the businesses that fall under the Intel brand are Mobileye, Movidius, Barefoot Networks and Saffron Technologies.

Intel’s stock price has been fairly volatile over the years. Like with any other stock, there are opportunities for traders whichever way the price swings. In early February 2022, Intel had a market cap of $195.5 billion, which put it at number 63 on the list of the world’s most valuable companies.

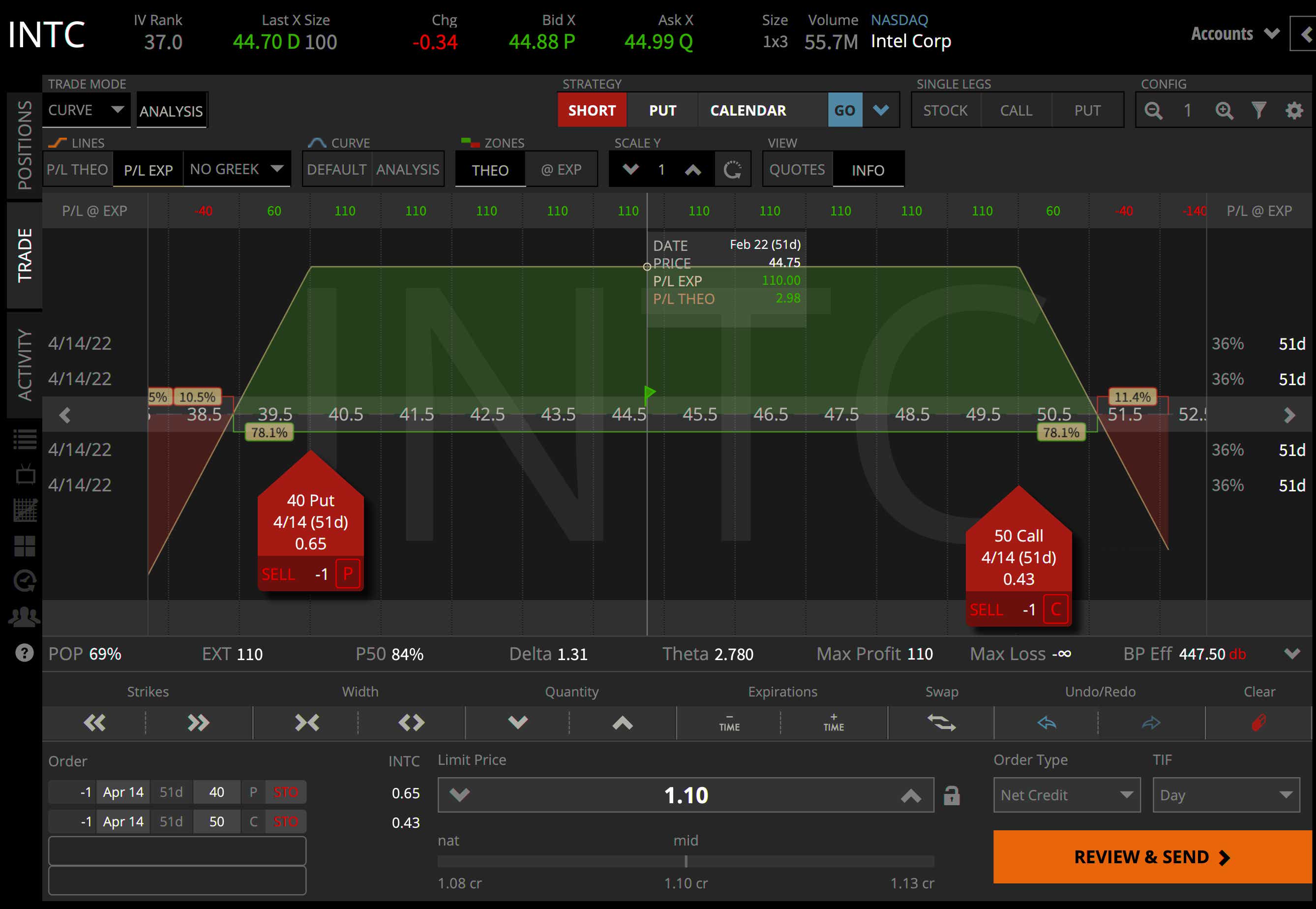

As the price of Intel’s stock is cheaper than some on this list, it may open up opportunities for outright stocks position, or undefined risk options strategies like strangles, ratio spreads, and naked options.

HOW TO TRADE AND INVEST IN TECH STOCKS

You can start trading and investing in tech stocks with these steps:

- Learn about tech stocks and how to buy and trade them

- Create a tastytrade account or log in

- Create a trading plan and a risk management strategy

- Choose a tech stock and open your position

- Monitor and close your position

When trading stocks outright with tastytrade, you pay no commission on an unlimited number of shares.

An alternative to trading stocks outright is trading options on stocks, which offers more flexibility in terms of risk, capital requirement, and breakeven prices. With options, you get exposure to 100 shares of a stock per contract – you also get to manage your trade in ways that wouldn’t be possible compared to outright stock trading.

Learn more about options trading

Now let’s look at some key differences between options trading and investing (holding company shares).

Options on stock trading | Investing (owning) physical shares of a stock |

Buying or selling contracts to go long or short on the market price of a stock | Taking direct ownership of a stock’s shares |

Ability to choose a timeframe for a trade/assumption | No expiration on shares, can be held in perpetuity |

Potential profits and losses are dependent on the strategy in use, and can profit from upward, downward and neutral price moves | Can only profit when selling the owned shares at a higher price, and potentially through dividends received (if the company pays them) |

Risk can be managed and manipulated through strategies, and risk can be defined up-front | The full share amount is at risk (excluding any additional fees) |

TECH STOCKS SUMMED UP

- Tech companies provide products and services to all industries as technology plays an essential role in modern living, including workplaces

- The tech sector contributes significantly to economies globally

- Companies that are considered the best tech stocks to watch all have unique backgrounds, offerings, and tradeable opportunities depending on all sorts of market conditions

- There are a number of differences between speculating on tech stocks outright, trading options on stock and taking direct ownership of a stock’s shares, but the most prevalent is the flexibility that options trading can offer

1 Named the Best Online Broker by Investor’s Business Daily (IBD) in its ninth annual survey.

tastytrade, Inc. and tastylive, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.