Off the Charts: 0DTE Options Volume, Penny Stocks, Panic Stock Buying, Jobs Data Divergence and GME’s Wild Week

Off the Charts: 0DTE Options Volume, Penny Stocks, Panic Stock Buying, Jobs Data Divergence and GME’s Wild Week

The S&P 500 up 1.30% for the month so far

Each week, buy-side and sell-side analysts produce reams of charts and data visualizations to help contextualize price action across asset classes.

These data can help shape one’s thinking, offering evidence for increased conviction or criticism about currently held beliefs. Likewise, they may offer insight into relative risk/reward opportunities in various markets.

These are the five charts that had an impact on my views on markets this week.

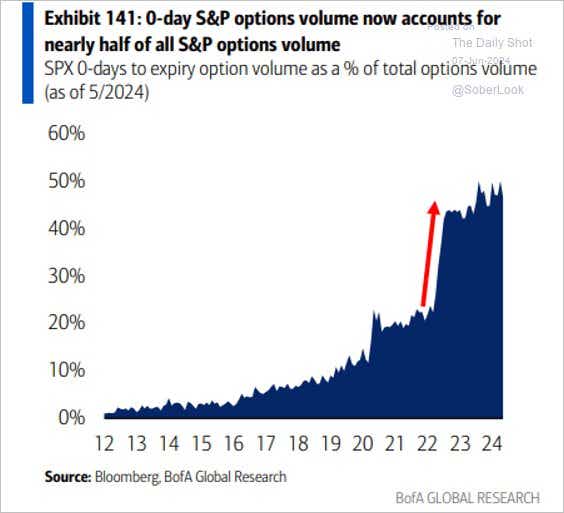

1) 0DTE options volume continues to surge

Takeaways: Investors typically use the options market for hedging purposes, which is why longer-dated SPX volumes are heavier for puts than for calls. Such is not the case for 0DTE options: volumes are split evenly between calls and puts, suggesting that hedging is not the objective–chasing intraday market direction is instead.

Trade implications: In recent months, an increasing frequency of late day moves seemingly came out of nowhere. It’s possible that the heavy trading volumes in 0DTE options late in the day could be causing a "tail wags the dog" type of situation, whereby the underlying SPX is moving because of option dealers being forced to adjust their books rapidly ahead of the close. Either way, 0DTEs can’t be ignored–see what Tom Sosnoff has to say.

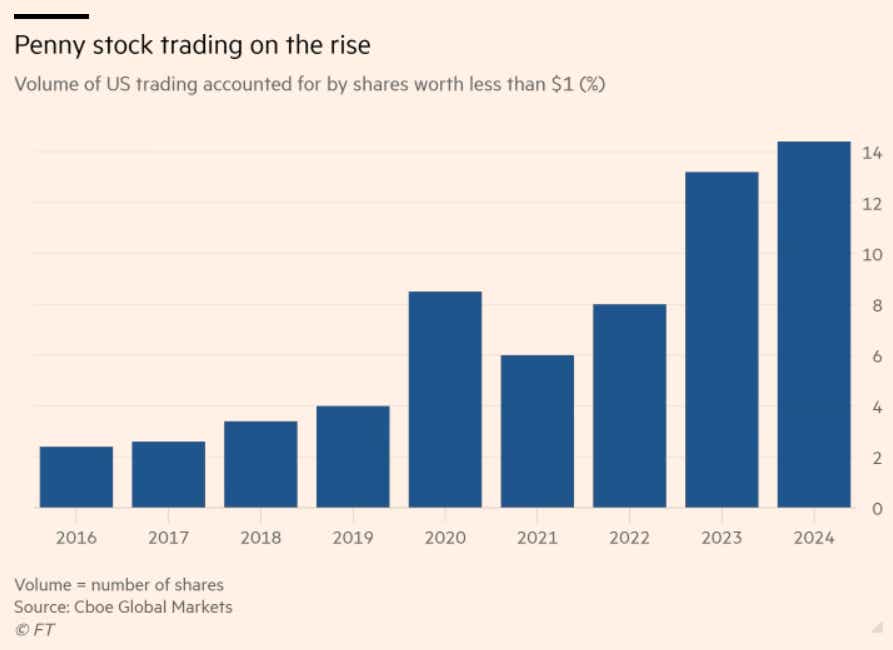

2) Retail trading is truly back

Takeaways: From the Financial Times: “Seven of the top 10 most traded US equities in May, as measured by the number of shares bought and sold, are penny stocks worth less than $1, according to CBOE Global Markets data supplied to the Financial Times. None of the companies are profitable. The huge volumes in so many little-known stocks suggest a renewed appetite among retail investors for cheap names in which they believe they can quickly make a lot of money.”

Trade implications: Cynics of the equity market rally in recent months have pointed to concentration among tech stocks and valuations that are starting to resemble the late 90s. But perhaps the biggest sign of the times, more so than the rally in cryptocurrencies or the reemergence of Roaring Kitty—is that penny stock trading is hitting record volumes. When speculative excesses pile up in financial markets, retail traders tend to take extreme risks hoping to strike it rich quickly. It also means that sentiment is at an extreme; equity market bulls beware.

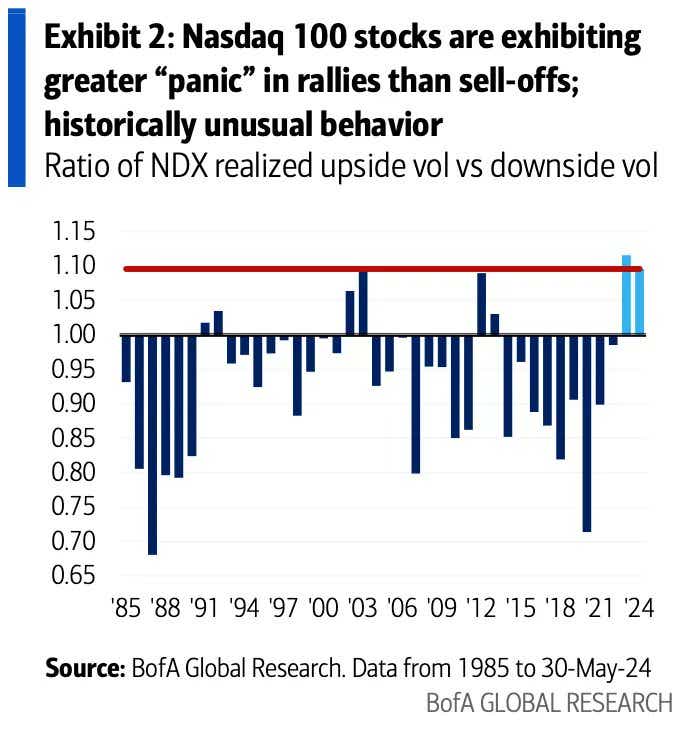

3) Panic buying in stocks?

Takeaways: The asymmetric volatility phenomenon stipulates that equity market volatility tends to be higher in falling markets than in rising markets. In normal times, this would be illustrated by the ratio of upside volume to realized downside volume coming in at 1.00 or below. That hasn’t been the case for each of the past two years.

Trade implications: Market participants bought stocks in a panic in 2023 and 2024. Why? Because they’re underinvested. There’s too much cash on the sidelines. A still-solid U.S. economy with the prospect of a Fed rate cut cycle beginning in a few months remains a tantalizing scenario for equity bulls in the short term. All of this explains why the downside has been muted in 2023 and 2024 while upside moves have tended to be explosive. There’s no reason for this to change.

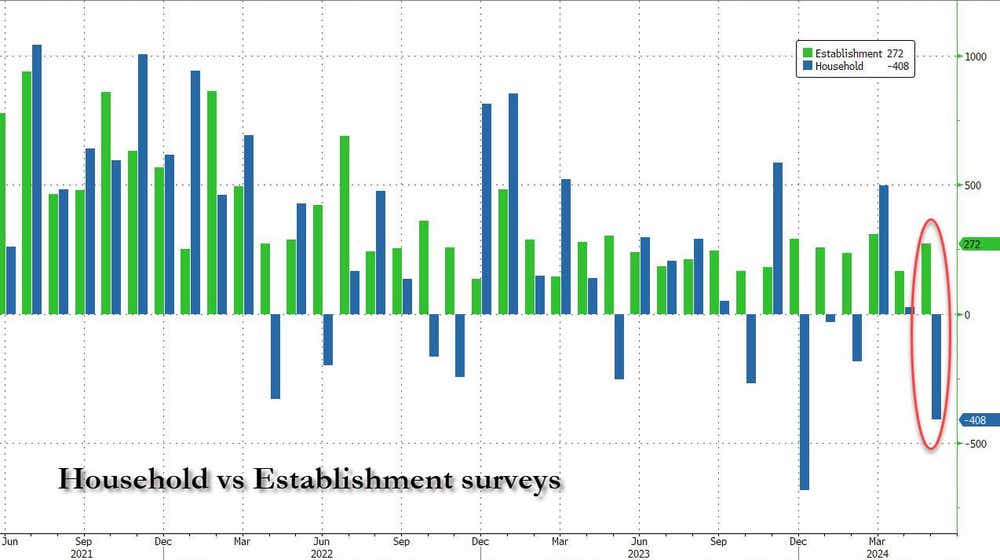

4) U.S. jobs data divergence

Takeaways: “The unemployment rate ticked up to 4%. That occurred as the participation rate slipped back to 62.5% (tied for the lowest level since February of last year). That is because the household survey showed a job loss of 408k. A difference of almost 700,000 between the two versions of this report," writes Peter Tchir, head of macro strategy at Academy Securities.

Trade implications: The May U.S. jobs report offered no clear signal, and there were plenty of reasons to be concerned. The wages component pushed off a near-term expectation for Fed rate cuts, but the bump higher in the unemployment rate saw a third full rate cut for 2025 get discounted. As for goldilocks, this report was not, as it has undercurrents of stagflationary pressures. While everyone in the market is waiting to put on a bull steepener, the fact of the matter is that a bull flattener may be more appropriate.

5) GameStop’s wild week

Takeaways: Keith Gill’s Reddit posts over the weekend outlined a near $300 million position, which surged as high as $900 million notionally overnight. GameStop (GME) management announced a share sale plan for up to 75 million shares, diluting prices. A livestream event from Keith Gill on Friday, June 7 cleared up any speculation about outside financial support, but it was not enough to bolster GME, which was down over -40% at a point on Friday.

Trade implications: Stay away! This is an irrational, illiquid market.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.