Fed's Powell Speaks, U.S. Inflation & China PMI

Fed's Powell Speaks, U.S. Inflation & China PMI

By:Ilya Spivak

Macro events that may move the markets this week

- Fed Chair Powell to speak at ECB central bank forum.

- China’s PMI survey data may show continued malaise.

- U.S. and Canadian inflation data may prove impactful.

Another busy week awaits as financial markets try to reconcile signs of a deepening slowdown in global economic activity with a hawkish turn at most major central banks.

Last week’s roundup of June purchasing managers' index (PMI) data painted a sobering picture. Purchasing managers surveyed in the U.S. put economic activity growth at the slowest in three months. The U.K. matched that dismal outcome, as did Australia. Meanwhile, growth in the Eurozone is now at its most sluggish since January. It was at a four-month low in Japan.

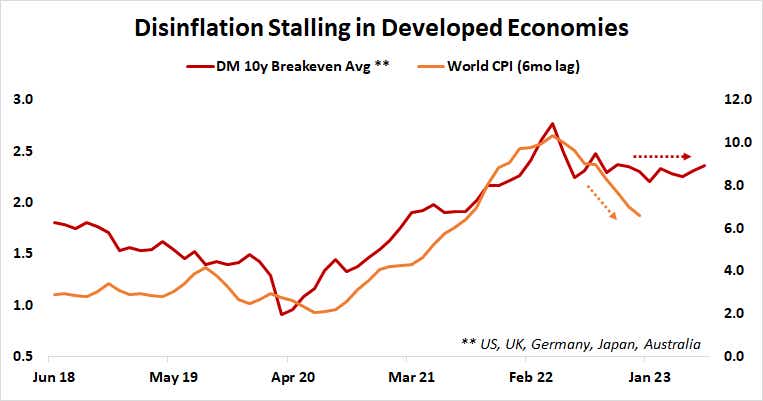

Meanwhile, central banks seem worried that the fight against inflation is struggling to progress. So far this month:

- The Reserve Bank of Australia (RBA) and the Bank of Canada (BOC) delivered unexpected interest rate hikes.

- The Bank of England (BOE) raised rates by 50 basis points (bps), whereas only half that (25bps) was priced in.

- The hike from the European Central Bank (ECB) landed in line with forecasts at 25bps but policymakers dialed up hawkish rhetoric, with the institution's President Christine Lagarde all-but preannouncing another move next month.

- The Federal Reserve loudly talked up its inflation-fighting appetite, even as it paused after 10 consecutive rate hikes.

If the policy screws continue to tighten even as growth slides, a global recession might begin to look increasingly inevitable. Price action in the wake of Friday’s PMI reporting seemed to offer a preview of what such a scenario might look like across the major asset classes: stocks and cyclical commodities like crude oil and copper fell, the U.S. 10- to two-year Treasury yield curve spread showed the deepest inversion since early March, and the U.S. Dollar rose.

Here are the key macro events that will shape this narrative in the week ahead.

ECB Forum on Central Banking

The annual gathering of monetary policy bigwigs in Sintra, Portugal, will feature speeches from Lagarde, Fed Chair Jerome Powell, Bank of Japan Governor Kazuo Ueda and Bank of England Governor Andrew Bailey. Markets will be all ears as officials try to parse how much to squeeze growth to put inflation on a path that officials find comfortable.

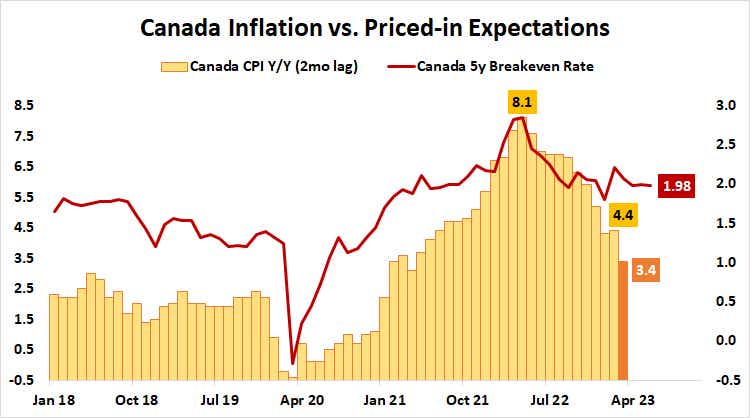

Canada CPI inflation

The BOC helped set the stage as central banks dialed up hawkish signaling this month. Its unexpected rate hike tellingly pushed up yields in the U.S., showing that markets view what happens in Canada as something of a window into what might be in store from the Federal Reserve. How markets react if the consumer price index (CPI) inflation drops to a two-year low of 3.4% on-year as expected, may prove impactful well beyond local markets.

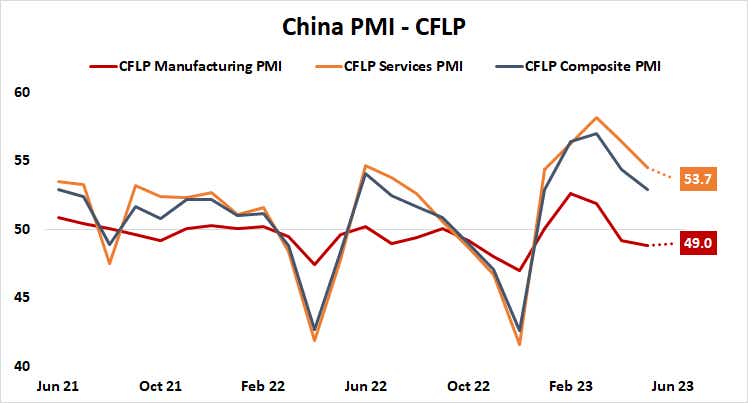

China PMI

The world’s second-largest economy continues to struggle as momentum following its reopening from zero-Covid lockdowns in December hits the skids. The slide toward global recession might appear truly inescapable if weakness continues to fester. Incoming PMI data is expected to show the manufacturing sector contracted for the third consecutive month while the services side grew at the slowest pace in six months.

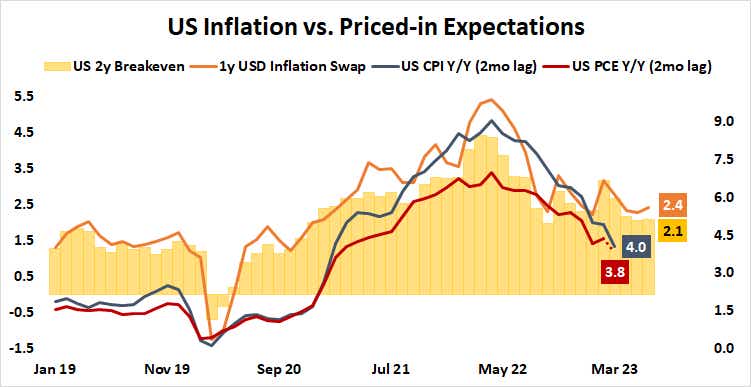

U.S. PCE inflation

The personal consumption expenditures price index (PCE), the Fed's preferred inflation gauge, is projected to show price growth slowed from 4.4% to 3.8% on-year in May. Worryingly, the core reading excluding volatile food and energy prices is seen holding unchanged at 4.7%. Market-wide risk appetite seems likely to suffer if traders see such an outcome as beckoning more hikes this year. As it stands, at least one more 25bps increase is priced in before the calendar turns to 2024.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, specializing in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.