Will FOMC Meeting Minutes, Nvidia Earnings Wake Up Stock Markets?

Will FOMC Meeting Minutes, Nvidia Earnings Wake Up Stock Markets?

By:Ilya Spivak

Stock markets and the dollar are treading water after U.S. CPI data. Will FOMC meeting minutes and Nvidia earnings revive momentum?

Wall Street cheers U.S. CPI inflation data, but follow-through conspicuously absent.

May FOMC meeting minutes eyed as markets weigh officials’ sticky prices worries.

First-quarter Nvidia (NVDA) earnings report in focus to guide speculative interest.

An eerie quiet has settled across financial markets since last week’s one-day burst of optimism in the wake of April’s U.S. consumer price index (CPI) data.

Stock markets roared with approval as disinflation resumed, with the core measure of price growth sliding to a three-year low of 3.6% as expected.

The outcome seemed to underpin the case for the Federal Reserve to cut interest rates this year, allaying concerns that sticky prices might force the central back to scrap stimulus plans or even push it to resume rate hikes. Bonds rose alongside equities, gold and silver raced higher, and the U.S. dollar slumped against its major counterparts.

Stocks market stalls after cheering U.S. CPI data

Progress has been conspicuously absent since then. The bellwether S&P 500 stock index has been trading effectively flat since last week’s post-CPI daily close (May 15, 2024). It is up a meager 0.03%. The tech-oriented Nasdaq has done only marginally better, up 0.4%. Treasury bond yields are telling up across maturities over the same period, as is the U.S. dollar.

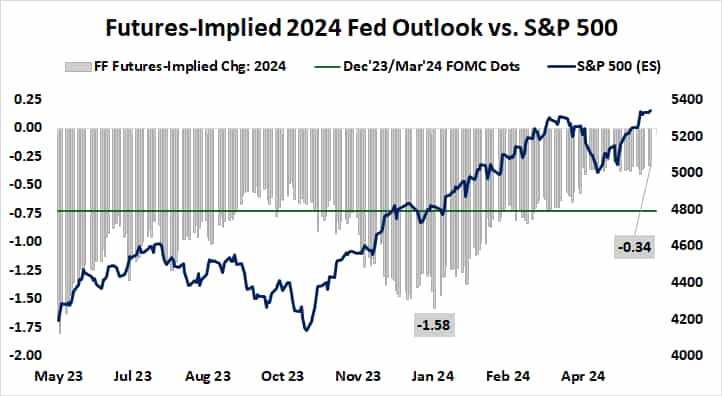

The standstill is echoed in the monetary policy outlook embedded into fed funds interest rate futures. The day before the CPI release, they settled on 36 basis points (bps) of easing priced in for 2024. That tally rose to 41 bps after inflation figures printed. It has now traded to 35bps, implying that next to nothing has changed.

From here, the spotlight turns to the incoming release of minutes from the May meeting of the Federal Reserve's policy-setting Federal Open Market Committee (FOMC). The statement unveiled after the conclave signaled officials’ frustration with stalling disinflation and a determination to withhold rate cuts until adequate progress is resumed.

Will FOMC meeting minutes, NVDA earnings wake up the markets?

Traders may be keen to weigh up the tone of the discussion around what to do about sticky prices, and whether the idea of resuming rate hikes has gained any traction. Speaking at the press conference following the meeting, Fed Chair Jerome Powell said current policy settings will become restrictive enough to cool prices if held over a longer period.

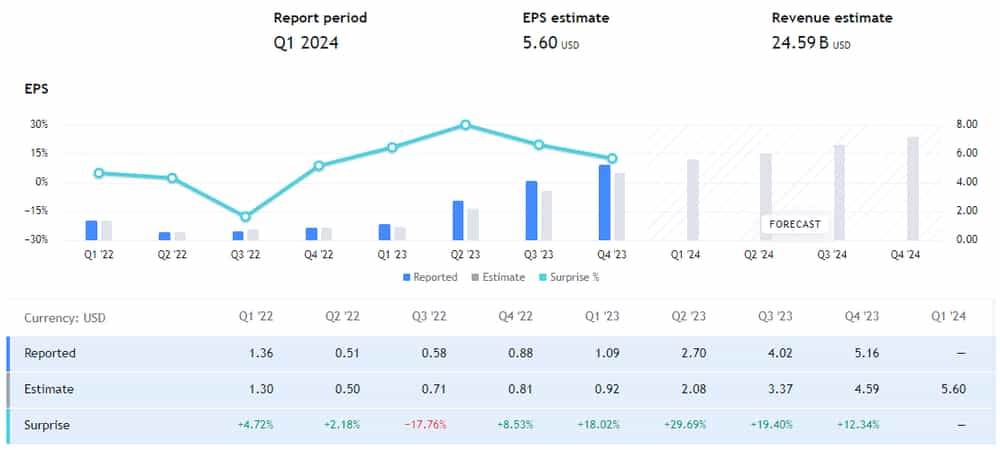

A closely watched earnings report from Nvidia (NVDA) – a darling of speculative enthusiasm centered on the burgeoning artificial intelligence (AI) space – is also on the menu. The company is expected to show EPS of $5.60 on revenue of $24.6 billion in the first quarter.

The magnitude of quarterly upside surprises that the chipmaker has reported on both measures has been nothing short of staggering. Last year, it beat quarterly EPS forecasts by an average of 26.5%. The pace has been slowing in the past two quarters, however. A risk-off response is feasible if momentum continues to cool.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.