S&P 500 Rises after December’s CPI Report: How to Trade the Move?

S&P 500 Rises after December’s CPI Report: How to Trade the Move?

US Consumer Prices and Market Reaction

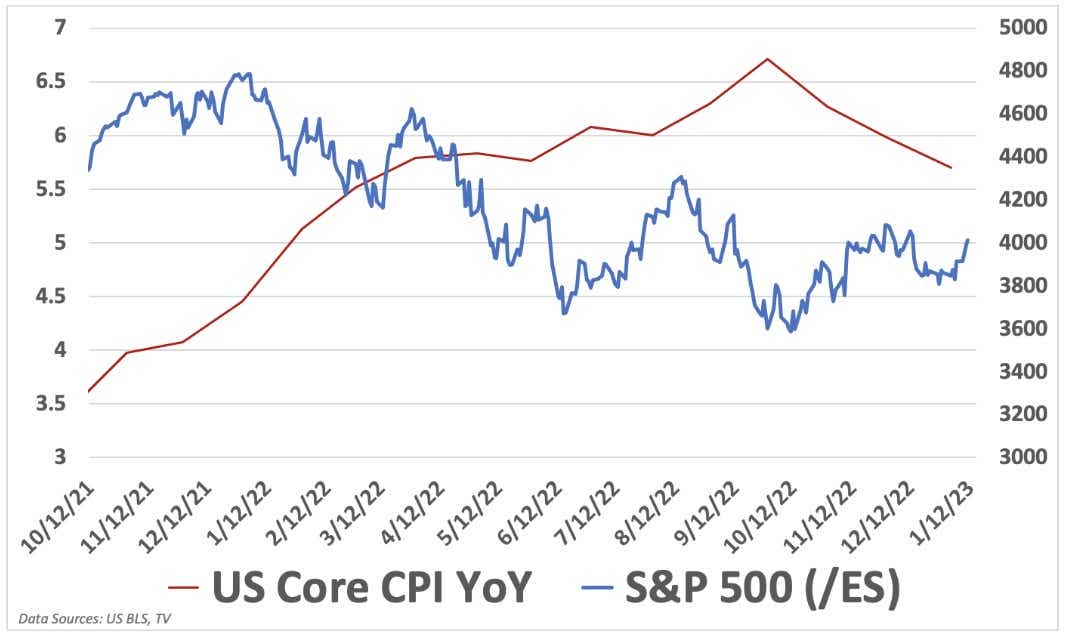

The S&P 500 (/ES) was about 0.4% higher through mid-day trading in New York after a U.S. inflation report showed that price pressures in the economy are cooling. U.S. consumer prices increased by 6.5% in December from a year before, according to the U.S. Bureau of Labor Statistics. That was the lowest rate of inflation since October 2021.

Analysts and markets anticipated the lower inflation reading, which has seen a risk-on tone in equities leading up to this morning’s report. For the week, the S&P 500 is up around 2.35%, which explains the subdued reaction to the data—traders already largely priced this in.

Although the report cooled market-based bets on further rate hikes from the Federal Reserve, we can likely expect Fed officials to push back on the market’s dovish interpretation. Fed funds futures show that rates topping at the 4.75% - 5.00% range is the most likely outcome this year, with chances for a cut increasing significantly later this year.

Trading S&P 500 Post-CPI Report

Today’s price increase and passing of the CPI report, which presented a risk event, has sapped volatility in the index. Opening a short-vol trade is probably not the best approach currently. But next week presents several opportunities that may influence Fed bets and induce some price swings in the market, thereby increasing volatility.

On Wednesday, US retail sales for December are due along with the producer price index for December. Both of those events can cause shifts in market pricing for rates. Retail sales are expected to fall 0.2% from the prior month, while PPI is seen increasing 0.2% for the same period. If these economic data points cross the wires above analysts’ expectations, it may cause increased volatility.

That said, if you’re confident that these measures may impress, a short butterfly presents a delta-neutral trade, which may be the safest way to play that thesis. While this trade may not offer the greatest profit potential, it does offer a high probability of profit (POP). The chart below demonstrates the trade dynamics of a short call butterfly on /ES futures.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.