S&P 500 Rebounds but Bonds Slip after Mixed August Jobs Report

S&P 500 Rebounds but Bonds Slip after Mixed August Jobs Report

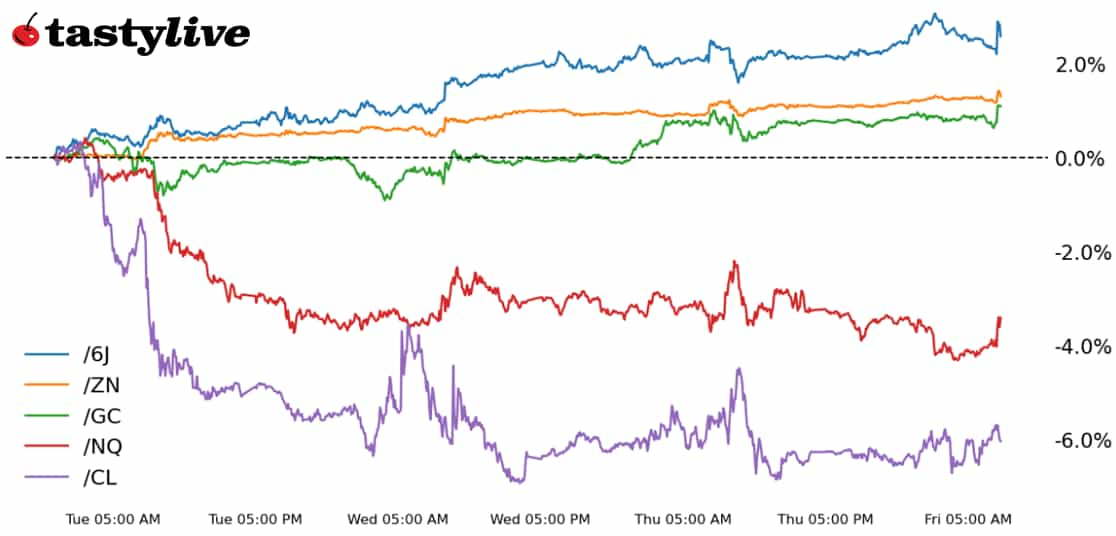

Also, 10-year T-note, gold, crude oil and Japanese yen futures

S&P 500 E-mini futures (/ES): +0.04%

10-year T-note futures (/ZN): +0.08%

Gold futures (/GC): +0.35%

Crude oil futures (/CL): +0.49%

Japanese yen futures (/6J): +0.31%

The U.S. labor market continues to moderate, but traders aren’t acting like it means a recession is imminent. The August U.S. jobs report was better than its predecessor but still missed expectations, with headline jobs growth coming in at a modest 142,000 vs. 160,000 expected. The unemployment rate (U3) eased to 4.2% from 4.3%, while wages surprised and came in stronger at 0.4% month over month (m/m) and 3.8% year over year (y/y) vs. 0.3% m/m and 3.7% y/y expected.

Continued albeit more moderate jobs growth, coupled with stability in the labor force participation rate at 62.7%, was enough to pull the unemployment rate (U3) lower to 4.2%. Nevertheless, it remains the case that the Sahm rule is triggered. The rule suggests a recession has started once the unemployment rate rises by more than 0.5% relative to the minimum of the three-month averages from the previous 12 months; the August jobs report puts the Sahm Rule indicator at 0.57% from 0.53% last report.

After a week of lesser U.S. labor market data showing continued moderation, the heftier August jobs report did little to offer any clarity on the path forward for the Federal Reserve. Ahead of the numbers, rates markets were discounting 47% chance of a 50-basis-point (bps) rate cut later this month; those odds have run as high as 60% this morning before dropping back to 47%.

Symbol: Equities | Daily Change |

/ESU4 | +0.04% |

/NQU4 | -0.19% |

/RTYU4 | -0.12% |

/YMU4 | +0.04% |

The S&P 500 futures (/ESU4) were mostly steady ahead of the New York open after traders digested the latest labor market data for the United States.

Broadcom (AVGO) was down over 7% ahead of the open after the chipmaker reported better-than-expected earnings but disappointed on fourth-quarter guidance. Stocks are on track to record losses for the week, with the S&P 500 looking at breaking a three-week winning streak.

Strategy: (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5200 p Short 5250 p Short 5900 c Long 5950 c | 61% | +410 | -2090 |

Short Strangle | Short 5250 p Short 5900 c | 66% | +2312.50 | x |

Short Put Vertical | Long 5200 p Short 5250 p | 83% | +262.50 | -2237.50 |

Symbol: Bonds | Daily Change |

/ZTZ4 | +0.09% |

/ZFZ4 | +0.08% |

/ZNZ4 | +0.08% |

/ZBZ4 | +0.15% |

/UBZ4 | +0.25% |

Bonds moved higher after the government unveiled downward revisions in jobs added for the last two months. That helped boost the case for rate cuts from the Fed. The underlying 10-year yield is on the verge of trading at the lowest levels seen since May 2023, underscoring the expectations for rate cuts.

Next week, auctions are back in focus with three-year notes (Tuesday), 10-year notes (Wednesday) and 30-year bonds (Thursday) on tap.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 112 p Short 113 p Short 117 c Long 118 c | 57% | +328.13 | -671.88 |

Short Strangle | Short 113 p Short 117 c | 65% | +765.63 | x |

Short Put Vertical | Long 112 p Short 113 p | 83% | +187.50 | -812.50 |

Symbol: Metals | Daily Change |

/GCZ4 | +0.35% |

/SIZ4 | +0.6% |

/HGZ4 | +0.4% |

Gold prices (/GCZ4) initially spiked on the jobs data this morning, but the gains were quickly trimmed ahead of the New York open. The metal is near its all-time highs and may require a shakeout before the next push higher, as profit-taking could come into play on any up moves. Meanwhile, weaker yields and a falling dollar should help to support gold’s structural backdrop over the mid- to long-term.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2375 p Short 2400 p Short 2675 c Long 2700 c | 66% | +660 | -1840 |

Short Strangle | Short 2400 p Short 2675 c | 72% | +2630 | x |

Short Put Vertical | Long 2375 p Short 2400 p | 86% | +310 | -2190 |

Symbol: Energy | Daily Change |

/CLZ4 | +0.49% |

/HOZ4 | +0.01% |

/NGZ4 | +0.75% |

/RBZ4 | +0.94% |

Demand concerns controlled the narrative for crude oil prices (/CLZ4) this week, but prices are getting a bump today after a surprisingly large inventory draw in crude oil, according to yesterday’s report from the Energy Information Administration (EIA). Meanwhile, there appears to be progress between factions in Libya that could lead to a deal that would unleash the country’s oil onto markets. Eyes are on OPEC in the coming weeks. Will the cartel move ahead with planned production increases?

Strategy (70DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 58 p Short 60 p Short 77 c Long 79 c | 61% | +580 | -1430 |

Short Strangle | Short 60 p Short 77 c | 69% | +2090 | x |

Short Put Vertical | Long 58 p Short 60 p | 81% | +300 | -1700 |

Symbol: FX | Daily Change |

/6AU4 | +0.24% |

/6BU4 | +0.29% |

/6CU4 | +0.06% |

/6EU4 | +0.16% |

/6JU4 | +0.31% |

Japanese yen futures (/6JU4) are off to a good start for September, with prices on track to rise about 2% this week. The Japanese currency saw a small pop on the jobs numbers but has surrendered those gains, although it remains higher on the day. Bank of Japan (BOJ) officials continued to vow that rates would rise if supported by economic conditions. The prevailing sentiment between the BOJ and the Fed lends support to further upside for the yen.

Strategy (63DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0066 p Short 0.0067 p Short 0.0073 c Long 0.0074 c | 58% | +362.50 | -887.50 |

Short Strangle | Short 0.0067 p Short 0.0073 c | 66% | +1150 | x |

Short Put Vertical | Long 0.0066 p Short 0.0067 p | 88% | +125 | -1125 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.