Dollar Rally Stalls and QQQ Can Break Either Way Into Thursday Trade

Dollar Rally Stalls and QQQ Can Break Either Way Into Thursday Trade

QQQ Nasdaq 100 ETF, Dollar, Gold, Earnings and USDTRY Talking Points

- The Trade Perspective: Bullish Nasdaq 100 above 15,400 or Bearish Below 200 SMA; Bearish Gold on Test of 1840

- US rate forecasts remain lofty, but fading week’s liquidity will act to balance speculative reach…unless the market’s spiral into risk aversion

- Top market-moving event risk ahead includes: the PBOC and Turkish central bank policy decisions; US earnings including Netflix and CSX

The Whispers of a Possible Bear Market Grow

What would it take to push the US equity market into a progressive tumble before a highly anticipated FOMC rate decision next week? That is the question that is on most traders’ minds at the moment – or at least it should be. Anticipation is a powerful influence for the markets, having killed many trends both bullish and bearish over the years. However, the technical slips from the benchmark indices are threatening to override the market’s comfort with complacency. We are due to open Thursday’s New York trading session with the SPY S&P 500 ETF having closed below its 100-day moving average in the previous session. More ominous though is the QQQ Nasdaq 100 ETF which followed its trend channel break from the previous week with a slide into a technical correction – defined as a -10 percent retreat from all-time highs. I am a natural skeptic and think establishing a trend before Wednesday’s FOMC is improbable. A rebound that takes out a trailing resistance like 375 can be a cue for a move back into range. Alternatively, clearing the 200-day SMA at 365 would add more bearish conviction.

Chart of QQQ Nasdaq 100 ETF with 100 and 200-Day SMA and Volume (Daily)

.png?format=pjpg&auto=webp&quality=50&width=652&disable=upscale)

Chart Created on Tradingview Platform

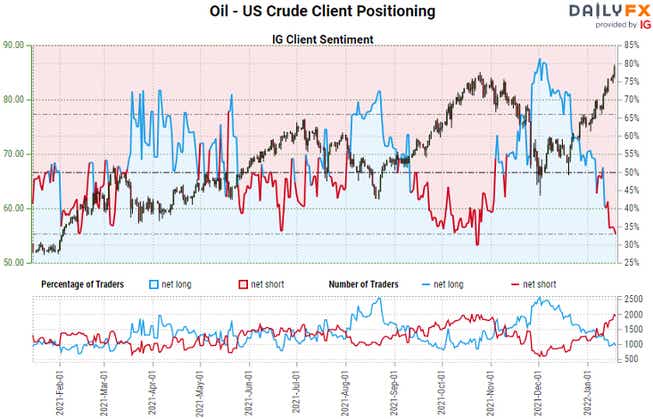

As is often a concern of mine while evaluating the abstract conviction of a nebulous market that has the tendency to support the ‘buy the dip’ mentality while facing an increasingly ominous fundamental environment, I like to refer to a comparison of assets that have a risk-sensitivity. While US indices are leaning hard to starboard, global counterparts like the FTSE 100 (UK) and ASX 200 (Australia) are holding up very well. Yield forecast sensitive emerging market and high yield bond ETFs are generally leaning lower, but there is hardly a productive bear trend. The most prominent contrast comes from the commodity market’s principal speculative favorites. US crude oil in particular is proving unflappable as it climbs to a 7-year high. This is more likely a reflection of supply constraints rather than an ideal target for unwedded capital, but the trend stands out nonetheless – and adds to inflation worries. Meanwhile, retail traders (CFD at IG) are shorting the advance heavily with net positioning the atone of its most bearish points in recent history.

Chart of US Crude Oil Futures Price Overlaid with IG CFD Client Positioning (Daily)

Chart Created on DailyFX.com

The Problem – and Opportunities – In Anticipation

While I am generally of the mind that the markets have indulged risk appetite trends for far too long and a deep reversal is overdue, timing is important in all trading. It is the anticipation of a major event like the FOMC rate decision (and IMF growth update, US 4Q GDP, etc) that can materially change the mood in the broader market. That said, I think it would be difficult for the collective forecast to grow even more bullish on risk assets and hawkish monetary policy. In this kind of environment, I believe a range strategy is more suited to conditions. That doesn’t necessarily mean looking for cleanly established, horizontal channels; but looking for tactical moves retreating from technical extremes is more appealing to me. That said, the Dollar has shown that both bullish and bearish, traction is fleeting. The DXY’s rebound has stalled out despite the unrelenting outlook for rates in Treasury yields and Fed Fund futures. GBPUSD’s bounce from 1.3600 or EURUSD’s turn before returning to 1.1300 support is fitting.

Chart of DXY Dollar Index with 100-Day SMA and 2-Year Yield with 20 and 60 Day Correl (Daily)

.png?format=pjpg&auto=webp&quality=50&width=652&disable=upscale)

Chart Created on Tradingview Platform

When the range threshold is held and the markets start to turn in the opposite direction, a congestion call may seem ‘obvious’. But, what happens when we need to abide by the market conditions while a market is still under the power of a strong move? Consider gold, which this past session rallied 1.7 percent on heavy volume of just over 300,000 futures contract. The recent bullish momentum is still in place, but there is both a 61.8 percent Fib of the post-pandemic range at 1845 and trendline resistance from September 2020 on at 1855 overhead. Fundamentally, interest rates are aiming higher which undermines this asset (though inflation is outpacing yield), the dollar is holding up as a pricing instrument and this commodity has significantly deviated from the course of a safe haven. There just doesn’t seem to be a strong fundamental thread to follow to fuel the trend.

Chart of Gold Futures with 100 and 200-Day SMAs and Volume (Daily)

.png?format=pjpg&auto=webp&quality=50&width=648&disable=upscale)

Chart Created on Tradingview Platform

Discreet Event Risk Over Thursday’s Trading Session

Putting aside the ebb and flow of speculative interest and the anticipation of next week’s over-loaded economic docket for a moment, there is meaningful scheduled event risk to keep tabs on for the session immediately ahead of us. Earnings will once again be something to watch for more than just the target tickers. Both Bank of America and Morgan Stanley beat this past session, but BAC and MS followed the XLF financial SPDR trust. The highlight was Procter & Gamble which warned prices would continue to rise – passing on the inflation that has pushed the Fed to its hawkish monetary policy position. Ahead, CSX and Union Pacific will speak to economic activity that is influenced by shipping; but its perspective on supply chain constraints will be most meaningful for the bigger picture. If you want speculative potential, that is Netflix’s report after the bell. NFLX is a fallen FAANG member, but it is still a key tech player for a sector under serious pressure.

Chart of CSX with 100-Day SMA and Volume (Daily)

.png?format=pjpg&auto=webp&quality=50&width=652&disable=upscale)

Chart Created on Tradingview Platform

From corporate earnings to emerging markets. While most people are keeping their speculative powder for monetary policy views dry until next week’s FOMC, there are a few other central bank insights that we have gotten in these past 24 hours and further updates in the next 24. Behind us, both Canadian and UK consumer inflation figures advanced to multi-decade highs. That said, both the Canadian Dollar and Pound were relatively stoic in the face of the data – not surprising given the Greenback’s own detachment not long ago. In this morning’s Asian session, China’s central bank (the PBOC) lowered its 1-year and 5-year main lending rates as an accommodative step; but an unmoved USDCNH surprises no one. In the European session, we will register the Turkish central bank decision. This group has run through rounds of aggressive rate cuts despite exceptionally high inflation. USDTRY is prone to volatility, but expectations are for no change at this meeting. This is a pair to watch.

Chart of USDTRY with 100-Day SMA Overlaid with US-Turkey 10-Year Yield Spread (Daily)

.png?format=pjpg&auto=webp&quality=50&width=650&disable=upscale)

Chart Created on Tradingview Platform

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.