Week Ahead - Top 5 Events: US Inflation Rate; FOMC Minutes; Australia Jobs Report; China CPI, Loans; US Retail Sales

Week Ahead - Top 5 Events: US Inflation Rate; FOMC Minutes; Australia Jobs Report; China CPI, Loans; US Retail Sales

FX WEEK AHEAD OVERVIEW:

- The turn through the middle of October sees a jam-packed calendar in the second half of the week, particularly for the United States.

- Chinese inflation data and lending figures for September may help alleviate concerns of a ‘hard landing’ after recent Evergrande default fears.

- Australian jobs data looks bleak, but even a modest improvement above expectations could help provoke a short covering rally in a crowded market.

For the full week ahead, please visit the DailyFX Economic Calendar.

10/13 WEDNESDAY | 12:30 GMT | USD INFLATION RATE (CPI) (SEP)

Price pressures remain elevated in the United States, so much so that Federal Reserve officials have acknowledged that the inflation mandate “has been met.” Forthcoming data suggests that US inflation rates might not be climbing any further, but instead leveling off – but leveling off at a level that will continue to suggest that the ‘inflation mandate has been met.’

According to a Bloomberg News survey, the headline September US inflation rate is due in unchanged at +0.3% (m/m) and unchanged at +5.3% (y/y), with the core inflation rate (ex-energy and food) due in at +0.3% from +0.1% (m/m) and unchanged at +4% (y/y). The data will likely help keep US rate expectations firm, which have been supportive of a stronger US Dollar.

10/13 WEDNESDAY | 18:00 GMT | USD SEPTEMBER FOMC MEETING MINUTES

While the September Fed meeting did not yield a taper announcement, it appears that the groundwork has been laid for a reduction in asset purchases imminently. While the dot plot revealed that policymakers were split on the timing of rate hikes – nine foresaw a 25-bps hike in 2022, while nine didn’t see a hike until 2023 -- the timing of tapering asset purchases seems more concrete. Several policymakers, including those with historically dovish tendencies like Evans and Kashkari, have suggested that it may be appropriate to reduce asset purchases starting this year.

10/14 THURSDAY | 00:30 GMT | AUD EMPLOYMENT CHANGE & UNEMPLOYMENT RATE (SEP)

Lockdowns through the middle part of 2021 plagued the Australian economy, which lost a dramatic -146.3K jobs in August, erasing the prior three months of gains. While the Australian vaccination has started to rise, suggesting that the economy will soon rebound, the lockdowns continued into September, suggesting that jobs data will remain weak. According to a Bloomberg News survey, the Australian economy lost -120K jobs in August, another significant drop. The unemployment rate is expected to jump from 4.5% to 4.7%.

But if the data come out even marginally better than expected, the largest net-short position in the futures market leaves the Australian Dollar well-positioned for a short covering rally that could help pairs like AUD/JPY and AUD/USD realize their bullish technical potential.

10/14 THURSDAY | 01:30; 08:00 GMT | CNY INFLATION RATE (CPI) (SEP); CNY NEW YUAN LOANS (SEP)

The Chinese economy has lost a step or two in recent months, plagued by concerns that problems with property developer Evergrande are emblematic of more serious issues infecting the economy at large. But the upcoming slate of economic data has a chance to soothe fears, insofar as a rebound in Chinese inflation figures and lending data could help investors believe that a ‘soft landing’ is more likely than a ‘hard landing’ – even if that landing is cushioned by more debt cycling through the world’s second largest economy.

10/15 THURSDAY | 12:30 GMT | USD RETAIL SALES ADVANCE (SEP)

Consumption is the most important part of the US economy, generating around 70% of the headline GDP figure. The best monthly insight we have into consumption trends in the US might arguably be the Advance Retail Sales report. US economic data in September was not great, with growth expectations shrinking to their lowest level of the quarter. According to a Bloomberg News survey, consumption slumped with the headline Advance Retail Sales due in at -0.2% from +0.7% (m/m) in August. Similarly, the Retail Sales Control Group, the input used to calculate GDP, is due in at +0.5% from +2.5% (m/m).

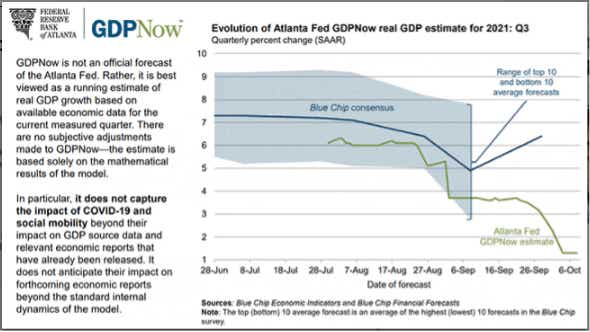

ATLANTA FED GDPNOW: 3Q’21 GROWTH ESTIMATE (CHART 1) (OCTOBER 8, 2021)

Based on the data received thus far about 3Q’21, the Atlanta Fed GDPNow growth forecast is now at its lowest expectation of the quarter at +1.3% annualized. This was due to “an increase in the nowcast of third-quarter real gross private domestic investment growth from +10.5% to +10.7% was offset by a decrease in the nowcast of third-quarter real personal consumption expenditures growth from +1.1% to +1.0%.” Another revision lower could be due if the September US retail sales report simply meets expectations – which may make for a weak end to the week for the US Dollar.

Written by Christopher Vecchio, CFA, Senior StrategistOptions involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.