Markets Scramble and Crude Oil Prices Surge as More Pain is Seen Ahead

Markets Scramble and Crude Oil Prices Surge as More Pain is Seen Ahead

By:Ilya Spivak

Bank of Canada rate decision, U.S. service-sector ISM survey and China’s trade data may stoke global recession fears

- Saudi Arabia and Russia send crude oil prices higher and spook financial markets.

- Traders fear costlier energy will keep interest rates higher, boosting recession risk.

- Bank of Canada's rate decision, a U.S. services ISM survey and Chinese trade data now come into in focus.

Investors were in a downbeat mood as liquidity poured back into financial markets after closures for the U.S. Labor Day holiday.

Stocks slid across global exchanges while the U.S. dollar traded broadly higher against major currencies and gold declined as bond yields shot higher. Borrowing costs pushed up in tandem across Asia Pacific, European and North American markets.

Surging crude oil prices might be the culprit. The bellwether West Texas Intermediate (WTI) contract is on track to score a fifth-consecutive day of gains, advancing to the highest level in nearly 10 months. Traders may be thinking that higher energy costs will filter into inflation and complicate Fed-led global central banks’ exit from an aggressive interest rate hike cycle and transition to a much-hoped-for reversal in the opposite direction.

Oil prices are up after Saudi Arabia said it will extend through December the production cutback program of 1 million barrels per day (bpd) unveiled in July. The move exceeded analysts’ expectations. Last week, a survey by Bloomberg showed most respondents expected an extension for just one additional month. In a parallel statement, Russia said it would prolong an export reduction of 300,000 bpd through the end of the year.

The bad news might continue. Wednesday’s economic calendar brings three releases that threaten to show the global economy can ill afford an oil price shock as broad-based recession worries deepen. That might keep stocks under pressure as the greenback extends gains.

Bank of Canada (BOC) interest rate decision

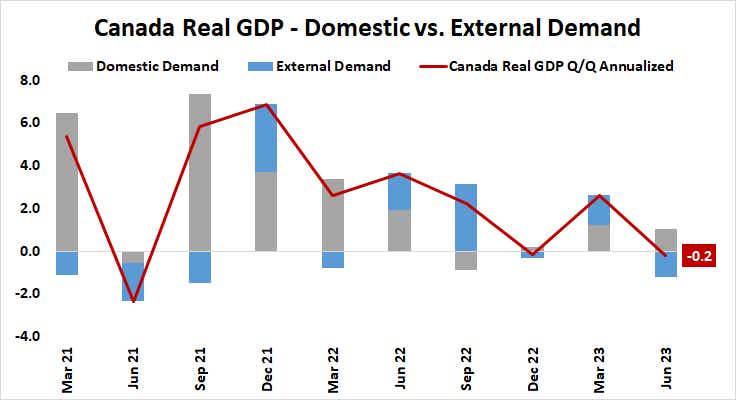

First up is a monetary policy announcement from Canada’s central bank. It is widely expected to keep the target overnight rate unchanged at 5%, but markets will be keen to hear what officials have to say about the path forward. Gross domestic product (GDP) data published last week showed the economy unexpectedly shrank in the second quarter, with weak external demand and swelling inventories mostly at fault. Nearly 80% of Canada’s exports are heading for the U.S., implying the weakness in these numbers speaks to increasingly difficult conditions in the world’s largest economy.

U.S. service-sector ISM survey

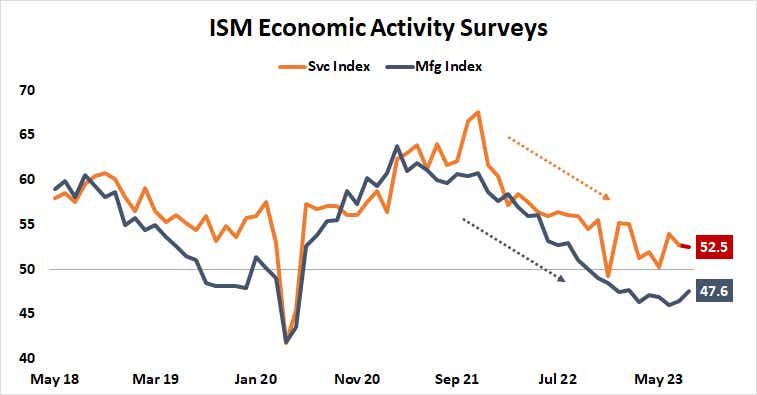

Next, the monthly purchasing managers’ survey from the Institute of Supply Management (ISM) is expected to show that activity growth the U.S. service sector slowed for a second consecutive month in August, registering at the weakest level since May. This has been a critical area of resilience for the global economy at a time when the Eurozone is all but confirmed to be in recession and China struggles to revive its economy after scrapping COVID-era lockdowns in December. It is also the pocket of sticky inflation most acutely targeted by the Fed. Signs of weakness here may signal that worldwide recession is becoming increasingly unavoidable.

China trade statistics

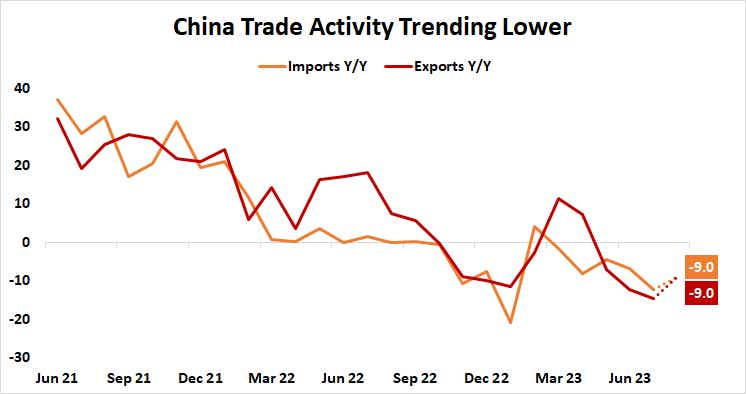

Finally, China is due to report August trade figures. Analysts expect both imports and exports to have fallen 9% year over year, extending a protracted slide in cross-border demand in both directions. Data from Citigroup shows China’s economic data outcomes still tend to underperform relative to baseline forecasts despite a dramatic lowering of growth expectations since mid-July. That opens the door for more downside surprises.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.