U.S. Jobs Data Preview: Strong Data May Spook Stocks, Boost the Dollar

U.S. Jobs Data Preview: Strong Data May Spook Stocks, Boost the Dollar

By:Ilya Spivak

Would markets cheer stronger growth in U.S. employment? Not so fast.

- Until September, markets thought the Fed waited too long to cut interest rates.

- Meanwhile, the U.S. economy has outperformed, stoking reflation expectations.

- Stocks may decline if strong labor market data trims scope for interest rate cuts in 2025.

When the Federal Reserve began to signal in early July that the time had come to lower interest rates, the markets feared the central bank was compelled to act because it spied something worrying about economic trends. By then, they’d seen three months of deteriorating U.S. economic data while officials seemingly dithered, waiting for inflation to cool further.

That has stoked dovish speculation. The policy path implied in Fed Funds futures moved to add some 40 basis points (bps) more in easing by the end of 2025 from the time when Fed Chair Jerome Powell told Congress that upside risks to unemployment and inflation have come into balance—implying cuts are imminent—to the first decrease 10 weeks later.

The U.S. economy looks better than the markets feared

The U.S. economy seems to have bucked such pessimism. Leading purchasing managers’ index (PMI) data from S&P Global showed the pace of growth in economic activity had sustained momentum for a fifth consecutive month in September after jumping to a one-year high in May.

Analog PMI data from the Institute of Supply Management (ISM) seems to be tilting in a similarly benign direction. Meanwhile, a closely watched economic growth tracker from the Atlanta Federal Reserve expects the economy will grow at a healthy annualized clip of 2.5% in the third quarter, after expanding at a rate of 3% in the second.

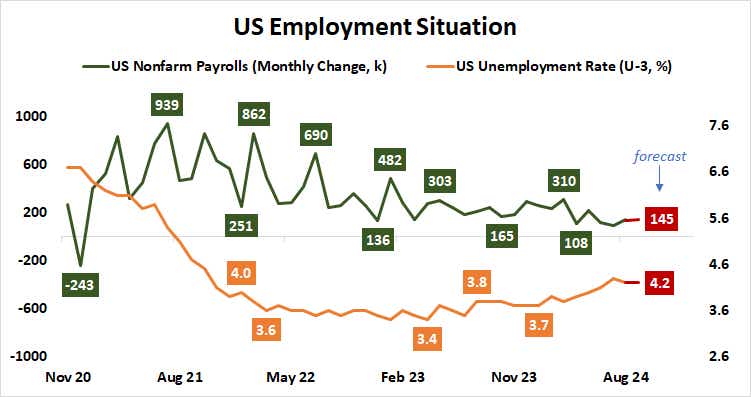

That makes for a curious backdrop as all eyes turn to September’s edition of official employment statistics. The economy is seen adding 145,000 jobs to nonfarm payrolls, a barely noticeable uptick from August’s 142,000. The unemployment rate is expected to remain unchanged for a third month at 4.2% straight.

Stocks may not like U.S. jobs data that beats expectations

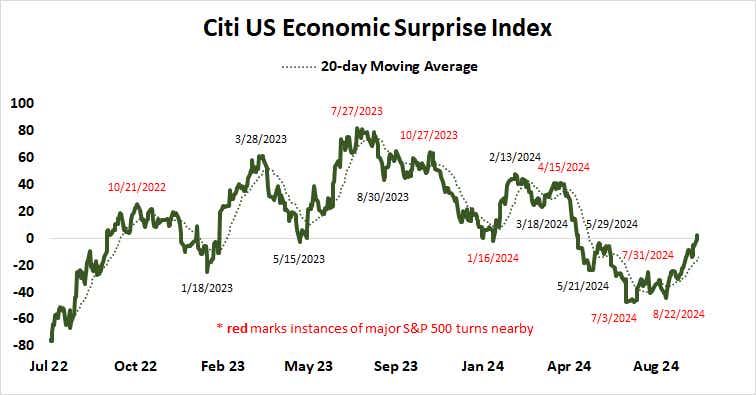

Analytics from Citigroup show that for the first time in five months, U.S. economic data outcomes are narrowly tending to outperform relative to median forecasts. Government figures tracking job openings and a private sector estimate of hiring from HR management giant Automatic Data Processing(ADP) already topped projections this week.

If the Bureau of Labor Statistics (BLS) unveils labor market data that similarly surprises to the upside, traders may lean into expectations that Fed rate cuts atop a decently growing economy will bring reflation and reduce scope for rate cuts next year. That may not sit well with stocks as a corporate refinancing wave looms. The U.S. dollar stands to gain.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.