Will Soft U.S. Jobs Data Finally Put the Brakes on Interest Rates and the Dollar?

Will Soft U.S. Jobs Data Finally Put the Brakes on Interest Rates and the Dollar?

By:Ilya Spivak

Investors are struggling to find direction after reading the minutes from the FOMC meeting

- Markets are finding little to inspire momentum in the December FOMC meeting minutes.

- All eyes are now turning to the U.S. employment data as interest rates remain in focus.

- Bonds may rise as the U.S. dollar declines on softer-than-expected outcomes.

Minutes from December’s Federal Reserve monetary policy meeting underwhelmed financial markets. Wall Street equity averages were mildly buoyed by the apparent absence of a more hawkish tone than was already anticipated, rebounding from session lows but keeping well within intraday ranges. The bellwether S&P 500 is on pace to finish flat.

The response from currencies and interest rates was still more dismissive. The U.S. dollar traded little changed against its major counterparts and Treasury yields marked time across the curve. Gold prices attempted to build a bit of upward momentum, but progress has been contained near last week’s high.

Markets seek direction after FOMC meeting minutes

“Almost all” members of the rate-setting Federal Open Market Committee (FOMC) judged that upside risks to the inflation outlook have increased as disinflation slowed in 2024. Nevertheless, a “vast majority” still saw risks to their employment and price stability objectives as roughly in balance.

“Most” participants in the conclave said that with rates now significantly less restrictive, they should take a careful approach to considering further adjustments. “All” of them saw elevated uncertainty about trade and immigration policy changes, but “many” also noted greater optimism linked to expectations of easing regulations and lower taxes.

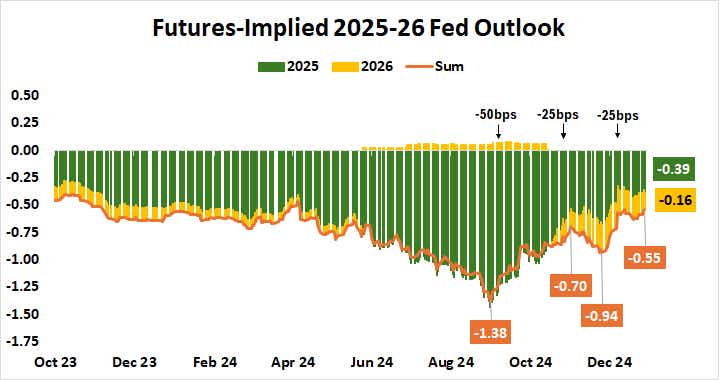

As it stands, benchmark Fed Funds futures are pricing in 39 basis points (bps) in rate cuts for 2025 and 16bps for 2026. That amounts to a narrow tilt toward two standard-sized reductions this year and one in next year. That is somewhat more hawkish than central bank officials’ median expectation of 50bps in cuts this year and next.

U.S. employment data is front and center

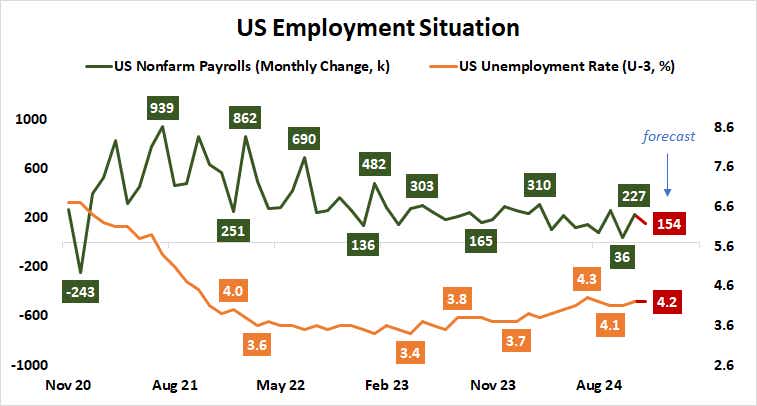

The spotlight now turns to the closely watched monthly labor market report from the Bureau of Labor Statistics (BLS). It is expected to show the U.S. economy added 154,000 jobs in December. The unemployment rate is expected to remain unchanged at 4.2%, matching the three-month high recorded in November.

Analytics from Citigroup suggest U.S. economic data outcomes have been cooling relative to baseline forecasts since mid-November, this week’s blistering ISM services report notwithstanding. In fact, the employment tracker in that survey and its manufacturing sector counterpart were notably cooler than headline results.

A leading report from Automatic Data Processing (ADP)—the HR management giant—was similarly underwhelming. It showed private payrolls added 122,000 jobs last month, missing estimates calling for 140,000. Treasury bonds may rise as yields and the U.S. dollar retreat if all this foreshadows soggier official labor market figures than expected.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.