US Jobs, German Inflation, Chinese PMI: Macro Week Ahead

US Jobs, German Inflation, Chinese PMI: Macro Week Ahead

By:Ilya Spivak

U.S. labor market data headlines a busy calendar warning of “higher for longer” U.S. interest rates amid growing global recession risk

- Price action across financial markets warns of higher rates, global recession risk.

- U.S. labor market data in the spotlight as the odds for another Fed rate hike grow.

- Chinese PMI and German CPI reports likely to show a worrying growth trajectory.

A worrying narrative seems to be taking hold of the financial markets. Traders are coming around to the conclusion that the global economy is sliding toward recession and the Federal Reserve has little appetite to do anything about it, at least in the near term.

Price action across benchmark assets last week appears telling.

Two-year Treasury note futures fell for a third week straight, touching a 23-year low. Meanwhile, 30-year bonds posted a modest rise. Appropriately enough, three-month to two-year yield spread at the front of the yield curve steepened while the “belly”–the two- to five-year spread—and the long end—the five- to ten-year spread—traded into deeper inversion.

At the same time, gold prices posted the largest rise in nearly two months while the U.S. dollar traded higher against its major counterparts, marking the sixth consecutive week of gains. Stocks managed a modest rise but shed most of their intra-week rise as optimism after another rosy earnings report from Nvidia (NVDA) quickly fizzled.

Taken together, this implies the markets are positioning for higher interest rates in the near term as the U.S. central bank remains focused on quashing inflation. That threatens to knock down the last line of defense against recession, underpinning assets benefiting from liquidation and reflecting bets on stimulus further into the future.

Here are the key macro waypoints shaping the story in the week ahead:

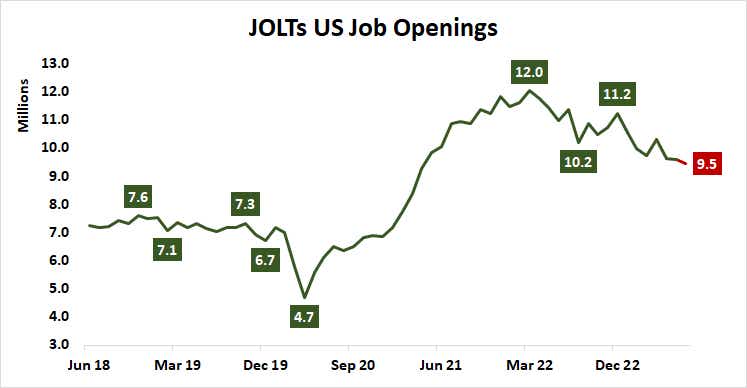

JOLTs U.S. job openings

US job openings are expected to decline for a third month straight. At 9.5 million, they are penciled in at the lowest level since April 2021 but still well above the pre-pandemic average of about 7 million. An outcome pointing to persisting imbalance between labor supply and demand may reinforce bets on a “higher for longer” Fed interest rate path. The odds of another rate hike in 2023 have increased to 65% from just 38% at the start of August.

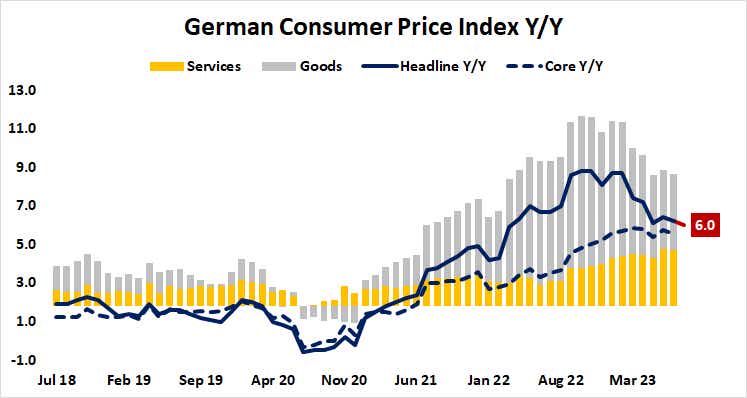

German consumer price index (CPI) inflation

The largest economy in the Euro area is expected to see headline inflation slow to 6% in August, the lowest since March 2022. A soft result may continue to work against the odds of another interest rate hike from the European Central Bank (ECB). The priced-in probability of a 25-basis-point increase before year-end has fallen to 74% from 85% a week ago. More of the same may amplify pressure on the euro, which now trades near a ten-week low.

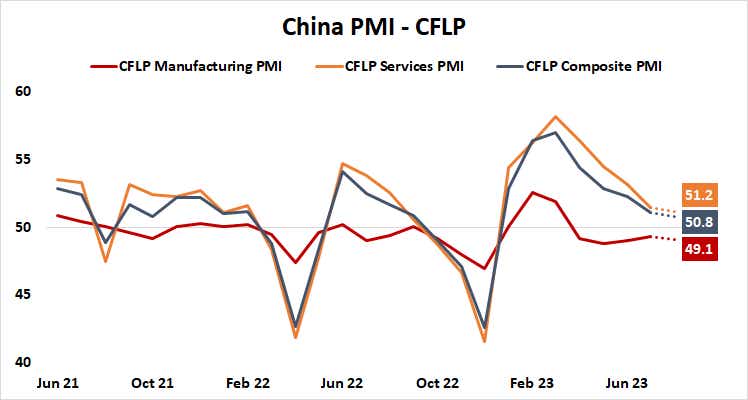

Chinese purchasing manager index (PMI) surveys

Of the main drivers of global growth, the Eurozone seems to be in contraction mode already and China has failed to get back on its feet since emerging from “zero COVID” lockdowns in December. A woeful set of PMI figures made the case for the former last week. Now, Beijing’s version of analog numbers for the latter threatens to darken the outlook further. The manufacturing sector is expected to contract for a fifth consecutive month while service-sector activity growth slows to the weakest in eight months.

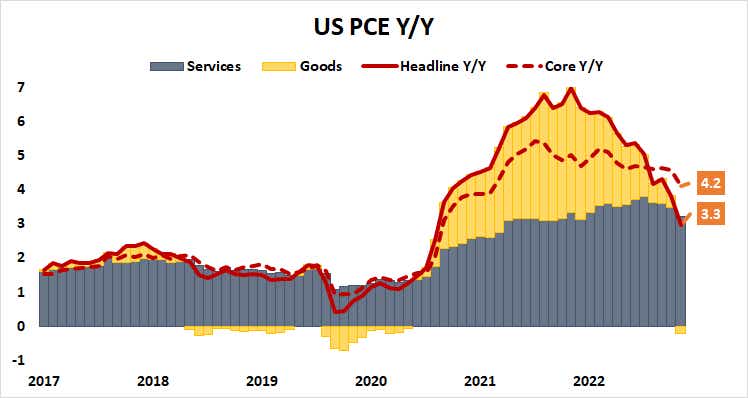

U.S. PCE inflation

The July edition of the Fed’s favored inflation gauge is seen echoing consumer price index (CPI) numbers published earlier this month. They showed disinflation stalling, and PCE is expected to follow suit. The service sector continues to be the culprit. Housing remains the largest contributor to price growth, where Chair Powell and company have relatively little agency to create change. This is likely to keep the spotlight on the labor market, meaning Fed hawks are likely to remain in control until resilience there gives way.

U.S. employment report

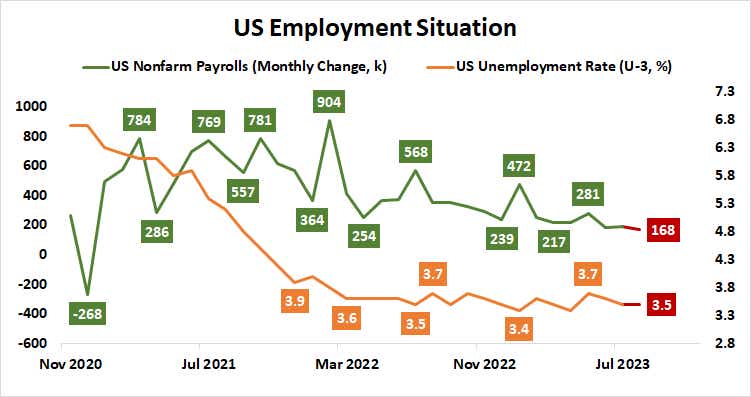

Following on from the PCE report and its implications, August’s employment report is expected to bring the slowest job creation since December 2020. Nevertheless, the unemployment rate is seen holding just a hair above historical low at 3.5%. Absent an improbably sharp downside deviation from consensus forecasts, the numbers seem unlikely to shake the Fed’s resolve and keep officials’ focus on fighting inflation.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.