Macro Week Ahead: Markets Face a Flood of Economic News Before U.S. Election

Macro Week Ahead: Markets Face a Flood of Economic News Before U.S. Election

By:Ilya Spivak

Reports are due regarding U.S. Jobs, gross domestic product and and the consumer price index

- U.S. jobs, growth and inflation data will dominate a busy economic calendar.

- Australian dollar weakness may continue, based on the local CPI and Chinese PMI data.

- Euro selling may follow if GDP and CPI data drive dovish ECB speculation.

Wall Street was in defensive mode last week, thanks to a familiar story. Bond yields pushed higher across the curve, two- and 10-year rates up close to 4% each. That kept the U.S. dollar marching higher. Against this backdrop, the bellwether S&P 500 shed 1%. The tech-minded Nasdaq 100 traded flat with help from strong Tesla (TSLA) earnings.

Against this backdrop, these are the macro waypoints likely to shape what comes next.

Stocks, bonds and the dollar are in play on U.S. jobs, growth and inflation data

The U.S. economic calendar is bursting at the seams this week. Three big releases are likely to take top billing amid a sea of numbers. If they extend the string of upside surprises on key data since late August, a push lower in bonds may see yields and the U.S. dollar higher while stocks wobble as Federal Reserve rate cut expectations cool.

First, the Fed’s favored inflation gauge, the personal consumption expenditure (PCE) price index, is seen falling to 2.1% year-on-year. That would be the lowest since February 2021. Next, third-quarter gross domestic product (GDP) is expected to see the economy growing at a brisk annualized rate of 3%, unchanged from the previous period.

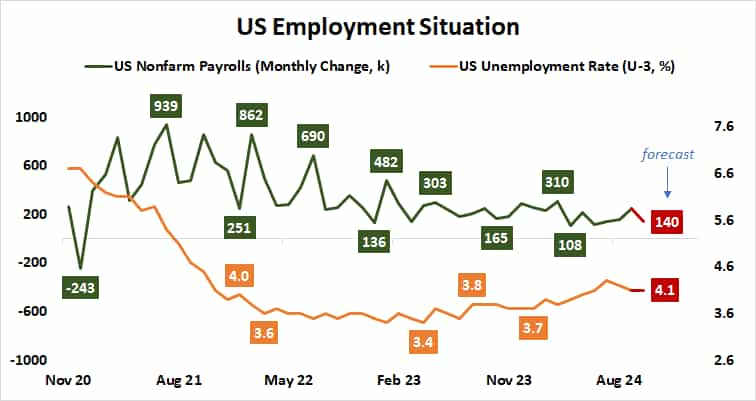

Finally, October’s official employment report is projected to bring a meager 140,000 rise in nonfarm payrolls, the smallest since June. The unemployment rate is penciled in at 4.1%, unchanged from the three-month low set in September. Wages are expected to sustain a growth rate of 4% year-on-year.

Australian dollar at risk from local inflation, Chinese PMI data

Soggy Australian consumer price index (CPI) and Chinese purchasing managers index (PMI) data might keep the Aussie dollar under pressure. The currency has slid to the lowest level since mid-August despite a stubbornly hawkish stance from the Reserve Bank of Australia (RBA) amid a broad-based rebound in its U.S. counterpart.

If rate cut speculation builds, that seems likely to strengthen the pull downward. That could be just what happens as CPI inflation cools to 2.9% year-on-year in third-quarter data, marking the lowest reading since the three months to March 2021. Chinese PMI figures highlighting ongoing standstill in Australia’s largest export market might help, too.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Euro on the brink as growth and inflation data drives ECB views

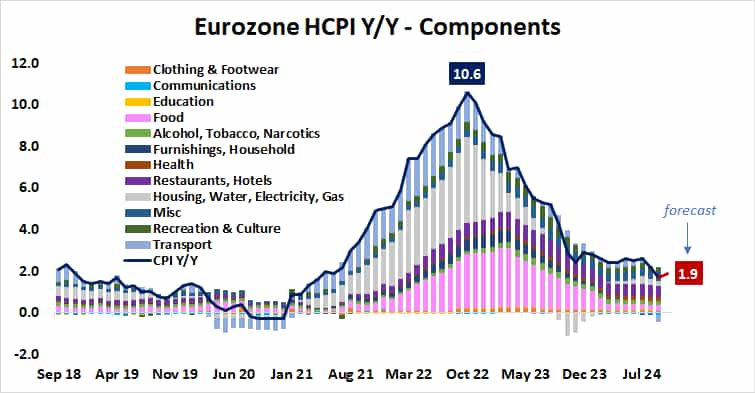

Pressure from a dovish shift in monetary policy expectations may also strike the euro. CPI inflation is expected to come down to 1.9% year-on-year in October, marking a slight uptick from 1.7% in September. Third-quarter GDP figures are seen showing growth of 0.8% year-on-year, a touch higher than 0.6% previously.

Analytics from Citigroup suggest Eurozone economic news continues to tend toward disappointment relative to baseline forecasts. That means markets anticipating a slightly improved euro yield profile after this week’s data releases may be forced into a dovish rethink, sending the single currency lower.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.