U.S. presidential election, Fed rate decision, RBA and BOE meetings: Macro Week Ahead

U.S. presidential election, Fed rate decision, RBA and BOE meetings: Macro Week Ahead

By:Ilya Spivak

Stocks, bonds and gold may fall together if U.S. election uncertainty persists

- Stocks and bonds may fall together on uncertainty about the U.S. election outcome.

- The Fed will cut rates again, but markets are likely to focus on guidance.

- Dovish RBA and BOE commentary might provide a lift to the U.S. dollar.

A now-familiar dynamic weighed on Wall Street last week as interest rates continued to march higher. Two- and 10-year Treasury rates rose in tandem, with a bit more action at the long end driving a slight steepening of the yield curve. The benchmark S&P 500 shed 1.5% while the tech-tilted Nasdaq 100 lost 1.7%.

Gold prices and the U.S. dollar were little changed against this backdrop. The yellow metal took a minor step lower from record highs, down 0.2%. The greenback diverged vs. its major counterparts, falling against the euro but gaining ground against the British pound and the commodity currencies, the Australian and Canadian dollars.

Against this backdrop, these macro waypoints are likely to shape what comes next.

U.S. election uncertainty may see stocks and bonds fall together

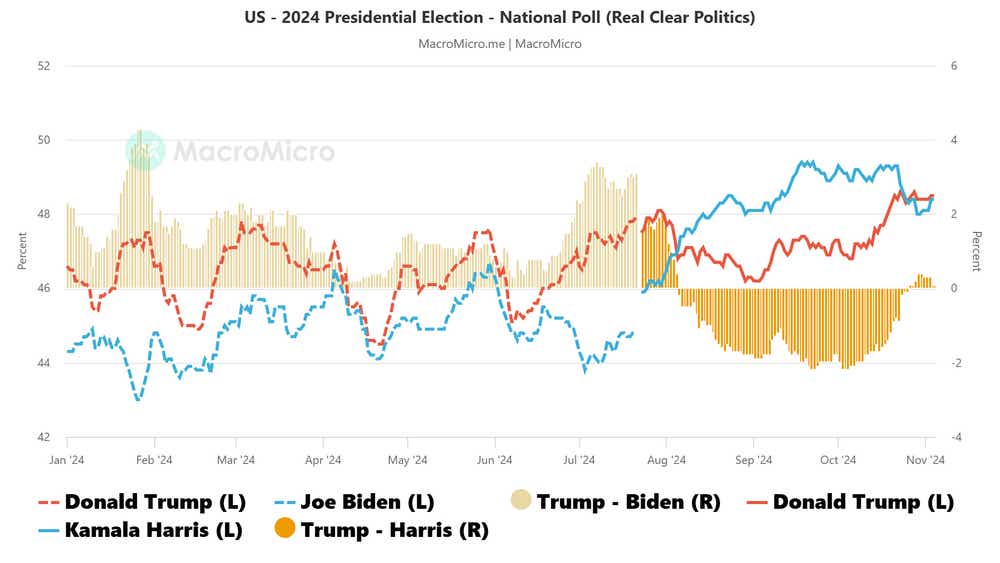

The U.S. presidential election makes for an obvious focal point on this week’s calendar. National opinion polls aggregate to a tie, according to data from Real Clear Politics. Betting markets have swung toward a similar conclusion in the past week, having previously favored Republican Donald Trump over Democrat Kamala Harris.

For traders, zooming in on the outcome as binary event risk rather than through the prism of eventual governing style and policy prospects seems most practical. On balance, the degree of post-election uncertainty is likely to define price action. Stocks may be hurt as yields rise if the result is unclear or contested within 24-48 hours of the polls closing.

Will the Federal Reserve embrace strong U.S. economic data?

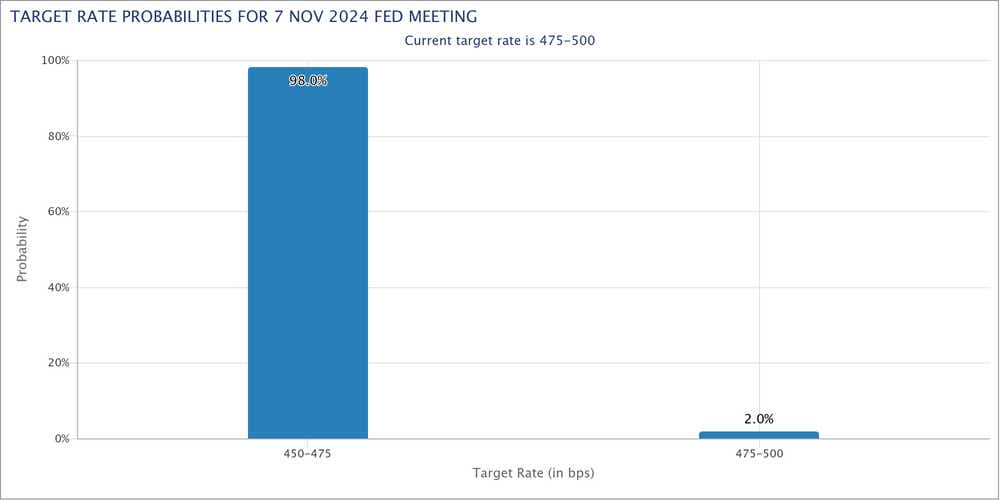

The markets are overwhelmingly tilted in favor of a 25-basis-point (bps) interest rate cut from the Federal Reserve. The probability of another such move in December stands at a commanding 81.7%, implying that traders expect the U.S. central bank to deliver on the forecast unveiled in September.

This probably means that the markets perceive a degree of “autopilot” at play until the calendar turns to 2025. Nevertheless, traders will be keen to weigh up how the central bank frames the run of hotter-than-expected U.S. economic data on offer since the rate-setting Federal Open Market Committee (FOMC) gathered six weeks ago.

For their part, the markets have reckoned that these upbeat results speak to upward pressure on inflation, guiding Treasury bond yields and the U.S. dollar higher in anticipation of a hawkish adjustment that limits next year’s rate cut path. 73bps are now priced in—a full cut less than Fed officials have projected.

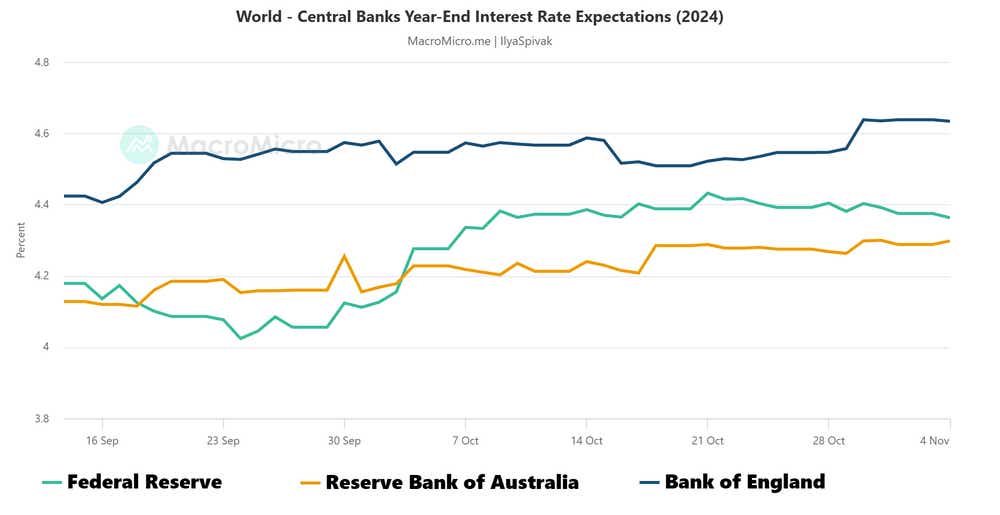

Dovish RBA, BOE guidance may offer a lift to the U.S. dollar

The U.S. dollar may find its way higher as central banks in Australia and the U.K. tilt toward the dovish end of the spectrum with their policy updates this week. The Reserve Bank of Australia (RBA) is expected to keep its target interest rate at 4.35%, while the Bank of England (BOE) is seen cutting by 25bps to 4.75%.

Both of those outcomes are heavily priced in and so may not have much to offer by way of directional inspiration for the markets. Downbeat growth dynamics for both economies since mid-year may inspire policymakers to adopt a more accommodative posture in official commentary, however. That may hurt the Australian dollar and British pound.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.