US Dollar May Rise as Stocks Fall After FOMC as Recession Risk Takes Center Stage

US Dollar May Rise as Stocks Fall After FOMC as Recession Risk Takes Center Stage

By:Ilya Spivak

- US stocks diverged from Dollar, gold after sluggish November CPI print

- In-line FOMC rates outlook may shift the spotlight to recession worries

- FX options flash “risk-off” setting, hinting USD may rise on haven flows

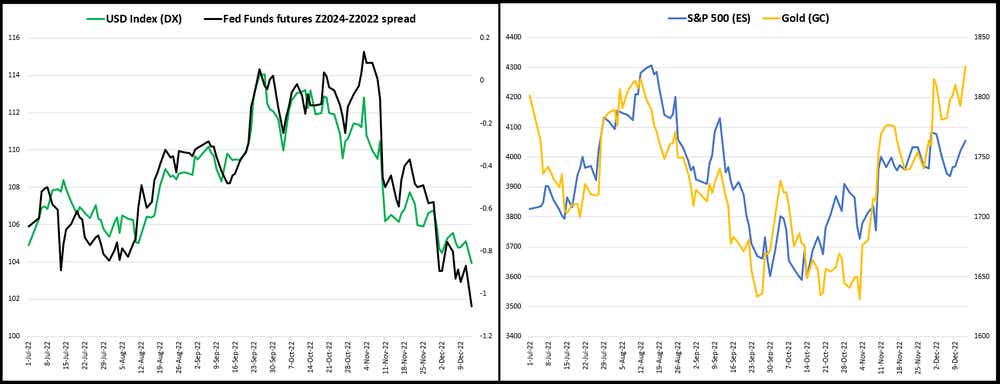

Price action across most major assets has been defined by the trajectory of the 2023-2024 Fed policy outlook since mid-year. The benchmark DXY index tracking the average value of the US Dollar has tellingly moved in near lockstep with the rate spread between December 2022 and 2024 Fed funds futures.

The Greenbank began to sink in November as market pricing turned from eyeing stasis to increasingly large rate cuts over the coming two years. Gold prices rose alongside the S&P 500 – a proxy for market-wide risk appetite – over the same period, speaking to relief in rate-sensitive assets as the peak of the tightening cycle came into view.

The response to November’s lower-than-expected CPI print seemed to echo these dynamics. The core inflation rate fell to 6.0 percent year-on-year, undershooting the median forecast of 6.1 percent and registering the lowest reading since July. Two-year rate cut expectations deepened by 19 basis points (bps) and DX futures fell to a six-month low.

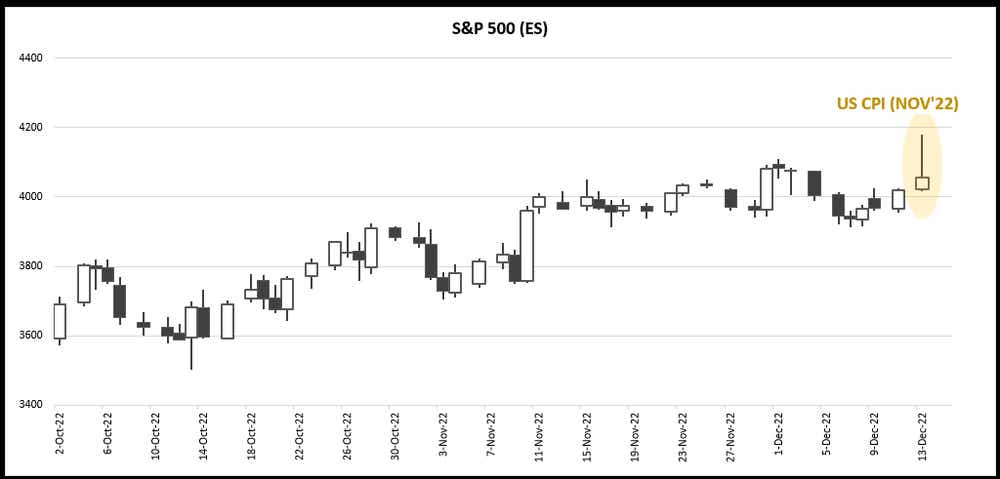

Gold responded as might have been expected, adding just over 1.7 percent. Equities broke the mold, however. The S&P 500 spiked sharply higher at first – operating as would be envisioned by looking at the recent past – then crumbled into the close to finish the session little-changed.

The spotlight now turns to the FOMC monetary policy announcement. Markets have been unwavering in their positioning for a 50bps rise for close to six weeks. That would mark a downshift after four consecutive 75bps increases. Recent commentary from Fed officials has helpfully underpinned bets on a dialing-back in the pace of tightening.

As it stands, the priced-in outlook envisions a mid-year peak of the rate-increase cycle somewhere just below the 5 percent line, corresponding to a 475-500bps official target range. The “central tendency” marked in September’s forecast update from central bank officials sat at 440-490bps for 2023, for a median “terminal” rate of 4.6 percent.

Fed Chair Powell has recently hinted at an upside revision in December’s rate projections, implying that median might rise. This need not disrupt the endgame however: nudging up the lower bound of the “tendency” range to the markets’ expected setting without bothering the sub-500bps peak would bring the median to 4.8 percent.

Meanwhile, a downgrade of the expected growth trajectory might be more substantive. Figures from Citigroup suggest that the positive trend in US economic data outcomes relative to baseline forecasts has stalled since the Fed last met on November 2. A Bloomberg survey of recession odds within one year rose above 60% for the first time since September 2020 over the same period.

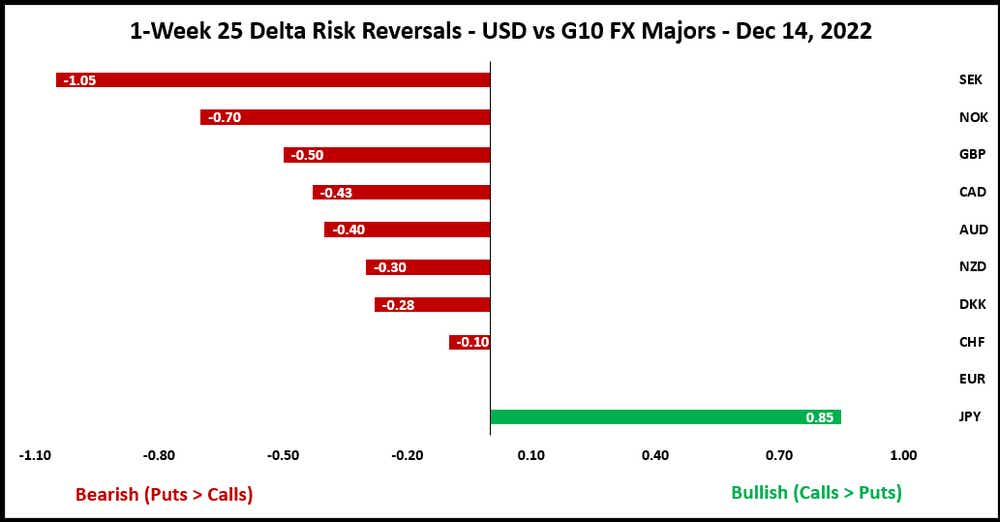

On balance, investors might walk away from December’s FOMC with the conclusion that the prime object of speculation has shifted from the length and amplitude of tightening to the depth of economic downturn coming in its wake. This would amount to a “risk off” scenario, with stocks falling alongside Treasury yields while bonds and the US Dollar are lifted by haven-seeking capital flows.

In fact, US stocks’ post-CPI performance may have foreshadowed as much already. Options markets seem to agree. One-week 25-delta risk reversals – the implied volatility spread between similar put and call options – flagged bearish cues for most G10 FX currencies against USD at the start of the week. The similarly anti-risk Japanese Yen is a telling exception. That breakdown has barely budged after the CPI print crossed the wires.

- Written by Ilya Spivak, Head of Global Macro

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.