Top 10 Stocks to Watch: September 2023

Top 10 Stocks to Watch: September 2023

From Adobe to Zscaler, ten essential tickers for your watch list

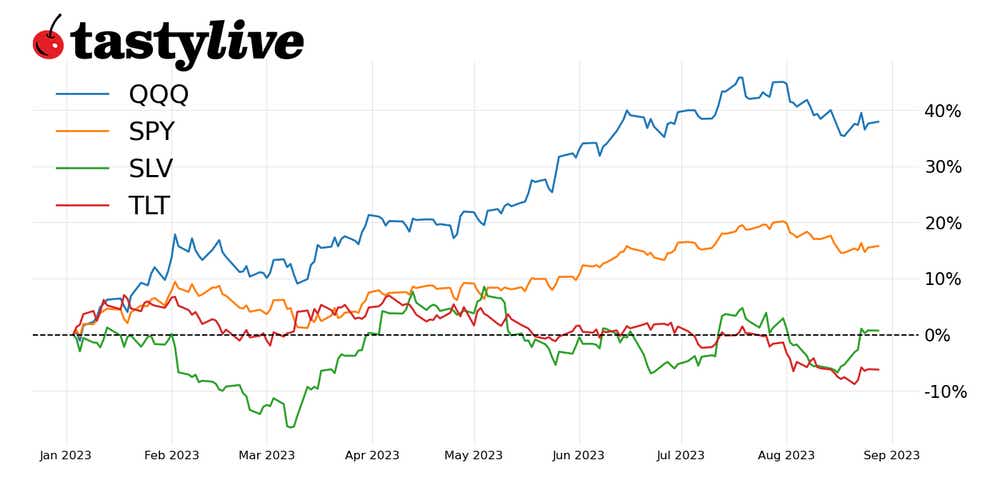

- The S&P 500 has found support at $4,350-$4,400, indicating potential sideways movement between $4,300 and $4,500 in September, unless there is a significant breakthrough.

- Recent choppiness in the S&P 500 suggests increased buyer-seller disagreement, potentially leading to a retest of 2023 highs ($4,600) or a push down to above $4,200 by the end of September.

- Increased uncertainty warrants close market monitoring for signs of momentum on either side, potentially leading to a retest and follow-through of critical levels.

Since our last update, the market has pulled back from 2023 highs and has found buyers at the $4,350 to $4,400 level. $4,300 appears to be the next significant support level below the current price action for S&P 500. It is possible we will test the $4,300 support level in September.

It’s possible the S&P 500 will move sideways through September, bouncing between $4,300 and $4,500. If price action moves through either of these levels with velocity, look for a retest and then follow-through.

Price action over the last two weeks in the S&P 500 seems to have become choppier. It's as though buyers and sellers are starting to disagree more than now than they did four weeks ago. If either buyers or sellers start to take control in the next couple of weeks, it’s possible they will gather enough momentum to push the market to retest 2023 highs around $4,600 toward the end of September or push down to test support above $4,200 in the same period.

Top 10 stocks to watch in August 2023

- ZS - 9/5 - After the close

- AI - 9/6 - After the close

- DOCU - 9/7 - After the close

- KR - 9/8 - Before the open

- ORCL - 9/11 - After the close

- ADBE - 9/14 - After the close

- FDX - 9/20 - After the close

- COST - 9/26 - After the close

- ACN - 9/28 - Before the open

- KMX –10/5 - Before the open

1) Zscaler

Zscaler (ZS), a global cloud-based information security company with headquarters in San Jose, California, provides a platform for securing connections between users and applications. It offers services such as secure access service edge (SASE), zero-trust network access and threat prevention. More than 500 companies around the globe use Zscaler’s services to protect employees and data in today's cloud-first world.

ZS is currently trading at $142.31, up 24.05% from its opening price of 2023 at $114.72. The current IVR on the tastytrade platform is 41.2. The IV in September's contract is 76.4 and October's contract is 58.9. ZS has reported positive net income in zero of the last five quarterly reports.

ZS markets are 10 cents wide in September. ZS has a decent amount of liquidity. A 20-delta strangle sets up well in September, as well as a $5 wide iron condor at the same strike price. If you make an earnings trade in September and need to protect your position after earnings are released, you can roll it out to October to give the position more time.

2) C3.ai, Inc.

C3.ai (AI) is an enterprise artificial intelligence (AI) applications software company that helps organizations optimize business processes by deploying digital transformation applications. Headquartered in Redwood City, California, C3.ai's platform and applications enable businesses to harness the power of AI, big data, and cloud computing to drive new efficiencies, reduce costs, and improve operational performance. The company serves multiple industries, including manufacturing, energy, utilities, and healthcare.

AI is currently trading at $29.54, up 158.44% from its opening price of 2023 at $11.43. The current IVR on the tastytrade platform is 14.1. IV in September's contract is 115.6 and October's contract is 94.6. AI has reported positive net income in zero of the last five quarterly reports.

A 20-delta strange sets up well here in September. An iron condor can also work well here. Remember, Iron Condors are much more difficult to adjust or roll than a strangle. This is true for most defined risk positions compared to undefined risk positions. However, that doesn’t mean that it is not possible. A September earnings position can be rolled out to October if more time is needed to defend the positions.

3) DocuSign Inc.

DocuSign (DOCU) is a San Francisco-based company that provides electronic signature technology and digital transaction management services for facilitating electronic exchanges of signed documents. It allows individuals and businesses to sign, send, and manage documents anytime, anywhere, and on any device, thereby eliminating the need for physical paperwork. DocuSign’s platform is used by millions of people and hundreds of thousands of organizations around the world to transform and automate their business-critical processes.

DOCU is currently trading at $47.94, down 15.05% from its opening price of 2023 at $56.44. The current IVR on the tastytrade platform is 27.8. The IV in September's contract is 76 and October's contract is 56.2. DOCU has reported positive net income in two of the last five quarterly reports.

A 20-delta strange sets up well here in September. The credit to buying power used is good in September and October contracts. Markets are a few cents wide in September. Liquidity is good for DOCU. Iron condors and directional spreads can also be set up with good risk to reward probability. Again, an earnings position in September can be rolled out to October to give the position more time to become profitable if the earnings trade goes against you.

4) The Kroger Co.

The Kroger Co. (KR) is one of the largest supermarket chains in the United States, headquartered in Cincinnati, Ohio. It operates multiple retail formats, including supermarkets, multi-department stores, and marketplace stores, under various banner names across the country. Kroger also manufactures and processes some of the food for sale in its supermarkets and has a strong online presence with services like online ordering, curbside pickup, and home delivery.

KR is currently trading at $46.80, up 5.2% from its opening price of 2023 at $44.48. The current IVR on the tastytrade platform is 35.9. The IV in September's contract is 31.8 and October's contract is 26.2. KR has reported positive net income in all the last five quarterly reports.

Kroger can be a difficult stock to trade options on. A 20-delta short strangle in September does not give you the credit buying power required ratio that you are looking for. The credit collected is too low for an undefined position. However, at the money directional spreads or even an aggressive iron condor will set up okay here. It may be best to use a position in KR for earnings as a purely binary play. If it wins after earnings, take it off. If it loses after earnings, take it off.

5) Oracle Corp.

Oracle (ORCL) is a multinational computer technology corporation headquartered in Austin, Texas. Oracle offers a broad range of software, hardware, and services, including its focus areas of database software, cloud systems, enterprise software, and hardware systems. Oracle serves a wide array of customers across various industries, including financial services, public sector, healthcare, and manufacturing, helping them optimize their IT infrastructure and transition to the cloud.

ORCL is currently trading at $117.56, up 42.55% from its opening price of 2023 at $82.47. The current IVR on the tastytrade platform is 52.1. IV in September's contract is 40.8 and October's contract is 34.8. ORCL has reported positive net income in all the last five quarterly reports.

A five-dollar wide, 23-delta iron condor sets up well in September contracts. Short Five-dollar wide, 35-delta directional spreads also set up well in September. Liquidity in ORCL is good. Markets are about 5-cents wide in September. An earnings position in September can be rolled out to October to give the position more time if needed.

6) Adobe Inc.

Adobe (ADBE) is a multinational software company headquartered in San Jose, California, known for its creative, marketing, and document management solutions. Its flagship products include Adobe Photoshop, Adobe Illustrator, and Adobe Acrobat, which are widely used by creative professionals around the world. Adobe also provides digital marketing tools and services, enabling businesses to create, manage, and optimize their digital content across web, mobile, and social channels.

ADBE is currently trading at $532.53, up 56.55% from its opening price of 2023 at $340.16. The current IVR on the tastytrade platform is 39.4. The IV in September's contract is 44.1 and October's contract is 38.1. ADBE has reported positive net income in the last five quarterly reports.

ADBE is an expensive product to trade, and I would not recommend undefined risk positions in this product, unless you have an exceptionally large account to work with. Defined risk positions are going to work well in ADBE right now. Five-dollar wide, 23-delta iron condors set up well in September contracts. Five and Ten-dollar wide short spreads also set up well in September. Again, these earnings positions can be rolled out to October if the earnings report turns the position against you.

7) FedEx Corp.

FedEx (FDX) is a multinational delivery services company headquartered in Memphis, Tennessee. It provides a broad portfolio of transportation, e-commerce, and business services, including overnight courier services, freight services, and logistics solutions. FedEx operates one of the largest cargo airlines in the world and has a global network that reaches nearly every country and territory.

FDX is currently trading at $258.72, up 47.87% from its opening price of 2023 at $174.97. The current IVR on the tastytrade platform is 27.8. The IV in September's contract is 24.4 and October's contract is 30.7. FDX has reported positive net income in the last five quarterly reports.

FDX is also an expensive product to trade. I would only recommend undefined risk positions in this product if you were working with a very large account. If you want to put on an earnings play, you’ll be using October contracts. 25-delta short spreads currently set up well in October. It may be helpful to wait until we get further into September before putting this trade of because additional strike prices will likely become available.

8) Costco Wholesale Corp.

Costco (COST) is a multinational warehouse club retailer headquartered in Issaquah, Washington. It operates membership-only warehouse clubs that offer a wide variety of products at discounted prices, including groceries, electronics, appliances, and more. Costco also provides additional services such as optical, pharmacy, and travel services, and has a strong online presence with e-commerce operations in several countries.

COST is currently trading at $534.90, up 16.79% from its opening price of 2023 at $458. The current IVR on the tastytrade platform is 23.3. The IV in September's contract is 17.6 and October's contract is 21.9. COST has reported positive net income in the last five quarterly reports.

COST is an expensive product to trade, and I would only recommend undefined risk positions in this product if you had a large account to work with. Earnings trades will use October's contracts. A five-dollar wide, 20-delta iron condor sets up well in October contracts. Short spreads are also going to set up well with your preference of risk and directionality. It may be beneficial to wait until we get further into September before putting this earnings trade on.

9) Accenture plc

Accenture (ACN) is a multinational professional services company headquartered in Dublin, Ireland. It provides a broad range of services and solutions in strategy, consulting, digital, technology, and operations. Accenture works with clients across various industries, including financial services, healthcare, and public services, helping them transform their businesses and achieve high performance.

ACN is currently trading at $321.28, up 19.35% from its opening price of 2023 at $269.20. The current IVR on the tastytrade platform is 26.3. The IIV in September's contract is 21.3 and October's contract is 26.7. ACN has reported positive net income in the last five quarterly reports.

ACN is an expensive product to trade, like ACN and COST on this list, and I would only recommend undefined risk positions in this product if you had an exceptionally large account to work with. Earnings trades will use October's contracts. A five-dollar wide, 20-delta iron condor sets up well in October contracts. Short spreads are also going to set up well with your preference of risk and directionality. It may be beneficial to wait until we get further into September before putting this earnings trade on.

10) CarMax Inc.

CarMax (KMX) is the largest used-car retailer in the United States, headquartered in Richmond, Virginia. It operates a chain of retail stores that offer a wide variety of used vehicles, as well as a range of related products and services, including vehicle financing, extended warranties, and insurance. CarMax also has an online presence, allowing customers to search for vehicles, get appraisals, and complete the car-buying process online.

KMX is currently trading at $79.66, up 29.11% from its opening price of 2023 at $61.70. The current IVR on the tastytrade platform is 28.6. The IV in September's contract is 32.8 and October's contract is 47.2. KMX has reported positive net income in the last five quarterly reports.

Earnings trades for KMX will use October's contracts. An 18-delta short strangle currently sets up well in October. A five-dollar wide, 20-delta iron condor also sets up well in October contracts. However, we are a bit far out from this earnings event. It may be beneficial to wait until we get further into September before putting this earnings trade on.

Ryan Sullivan works on the tastylive master control team as an operator and producer for live shows and pre-produced content. He is an active options and forex trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.