Big Names to Report Earnings This Week

Big Names to Report Earnings This Week

Plus, Tesla and SPX trade ideas, backtesting on tastytrade and more

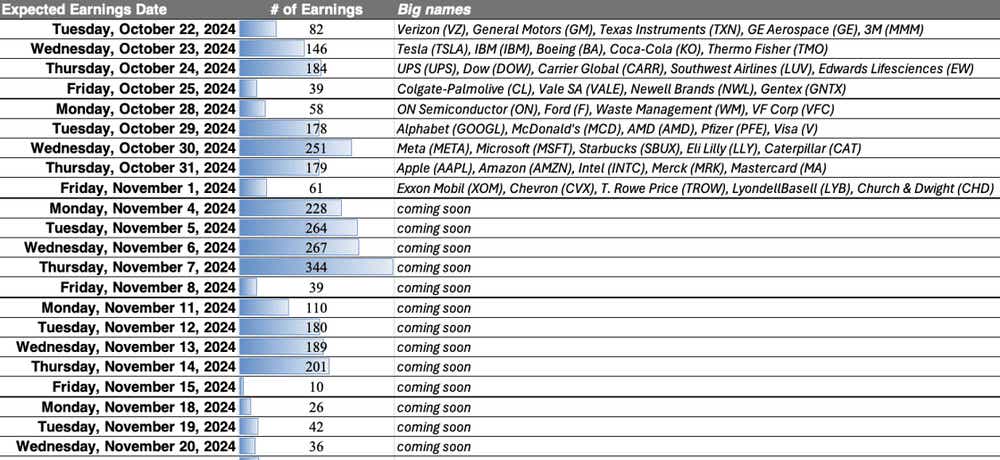

There are so many big-name companies reporting their earnings this week. Some of the bigger players are listed below.

We have 360 names on the spreadsheet with earnings—click to download here or click the picture below.

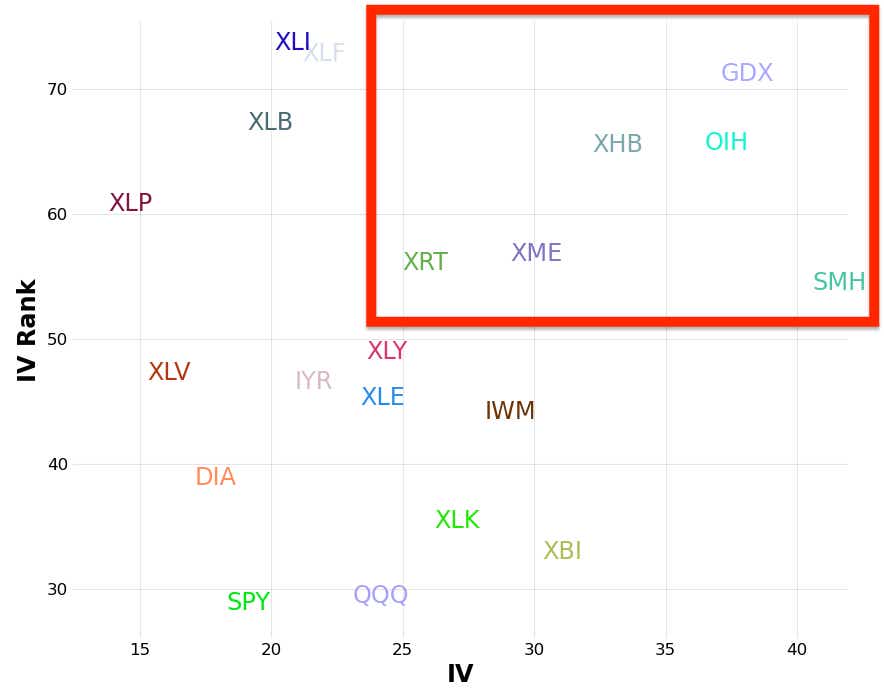

Big names with high IV and IV rank

The following exchange-traded funds (ETFs) have the "ideal" combination of high forward-looking implied volatility and high IV Rank. Many option traders look for this combination to sell options (and gain theta decay):

· GDX: VanEck Gold Miners ETF

· OIH: VanEck Oil Services ETF

· XHB: SPDR S&P Homebuilders ETF

· XME: SPDR S&P Metals & Mining ETF

· SMH: VanEck Semiconductor ETF

· XRT: SPDR S&P Retail ETF

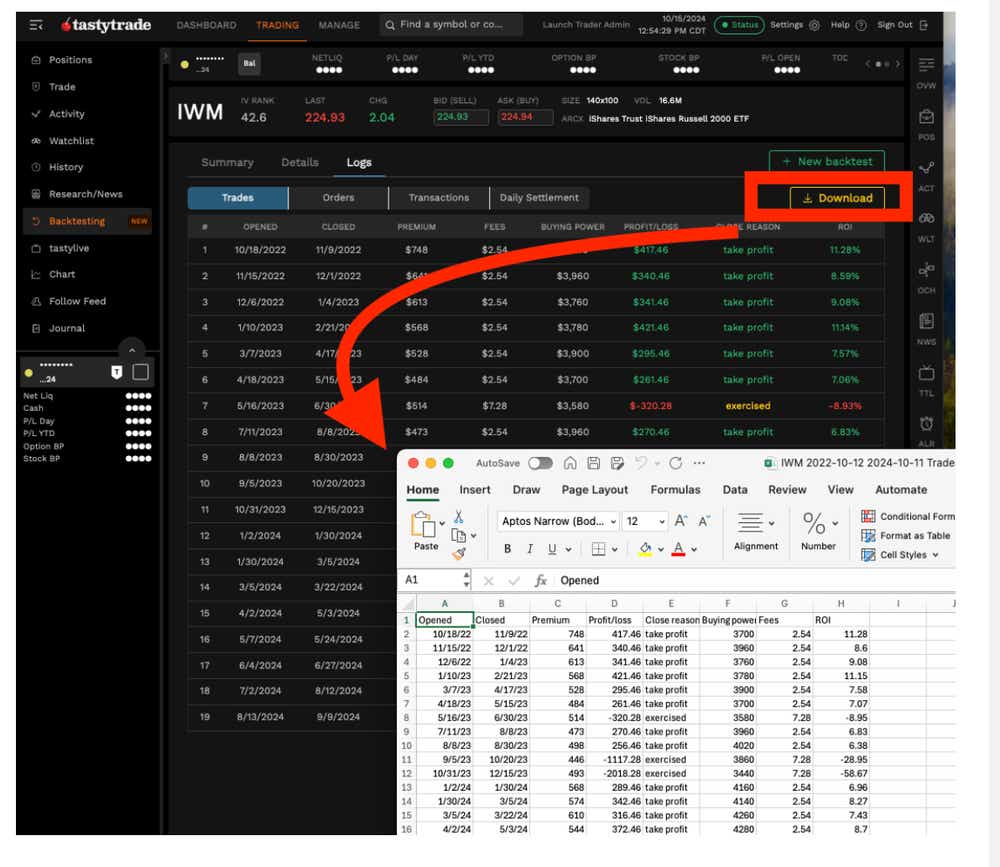

Backtesting on tastytrade

We wrote about this last week, but we decided to discuss it again because it has been requested. Click here for more information.

For now, it is only on the web version of tastytrade.

All nerds will love the ability to download logs, orders, transactions and daily settlements—all in CSV (spreadsheet) format.

Luckbox newsletter

Need a little more luck in your life? Join other active traders, investors, entrepreneurs, risk-takers and alpha-types. Subscribe for free to tastylive's Luckbox newsletter for your weekly look at life, money and probability.

Subscribe to Cherry Picks!

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

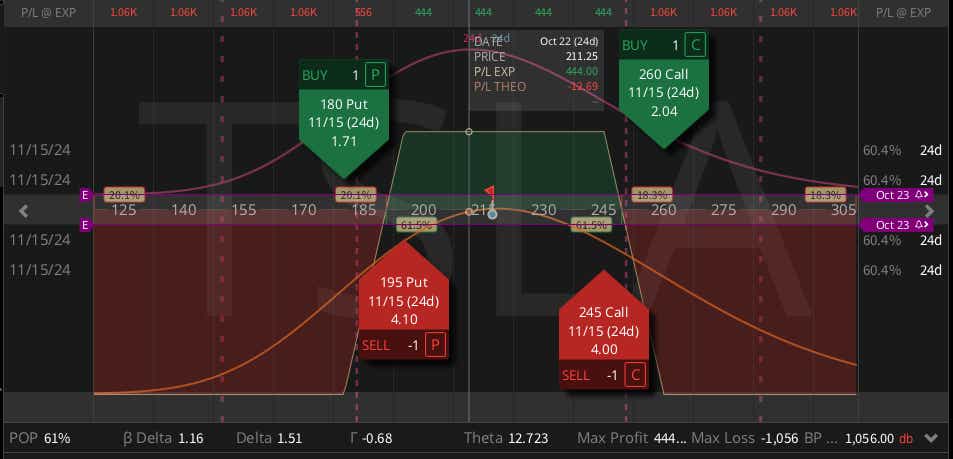

Two trade ideas

TSLA ($216) iron condor (Nov.) $4.44 Credit

Tesla (TSLA) will be one of the first big names in tech stocks to report earnings on Oct. 23 after the market close. The stock has been volatile, with a 52-week, low-high of $138-$271, and it has recently come off the highs down to $220. If you think it might stay rangebound after earnings, try a November iron condor: short the 195/185 put spread and the 245/260 call spread trades at $4.44 with enough duration to roll out if the stock moves greater than the $14 expected move through the end of the week.

SPX ($5836) iron condor (Nov. 1) $2.90 Credit

The most active stretch of earnings comes into play this week and next: elections, new from the Federal Reserve, volatility staying bid, bonds going wild. Yet, we've chopped around $5,800-$5,900 for the past week. If you think it might continue, consider a short duration SPX iron condor (Nov. 1). Short the 5690/5680 put spread and the 5950/5960 call spread trades at roughly 1/3rd the width of the strikes at around one standard deviation out of the money.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.