Stocks Will Not Find Recession Risk Relief in China Trade

Stocks Will Not Find Recession Risk Relief in China Trade

By:Ilya Spivak

Observers expect only modest growth in exports and imports from the world’s second-largest economy

China is expected to show narrow improvements in July’s trade and inflation data.

On-trend results will point to an anemic state for the world’s No. 2 economy.

Stock markets yearning for relief from global recession fears are unlikely to get it.

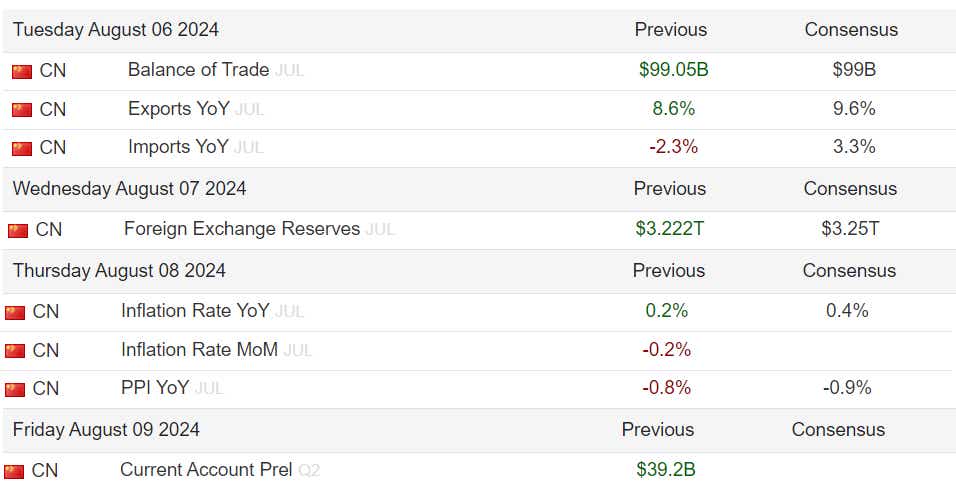

China is due to report July’s trade balance as well as producer and consumer price statistics (PPI and CPI, respectively). Modest improvements are expected on both fronts. Export and import growth is seen accelerating from the prior month while the headline inflation gauge ticks higher to 0.4% year-on-year from 0.2% in the prior month.

Readings broadly in line with expectations would remain within established trends over recent months. That’s hardly encouraging. China has struggled to revive economic activity after emerging from the COVID-19 pandemic. In fact, the second quarter marked a year of real gross domestic product (GDP) growth outpacing nominal expansion.

China trade and inflation data to underline an anemic status quo

That is a woeful state. When inflation-adjusted (i.e. “real”) growth tracks higher than the broader measure, this implies a negative reading on the price growth coefficient. This speaks to anemic demand. Put simply, the economy as a whole is being “discounted” because there is insufficient uptake to clear supply.

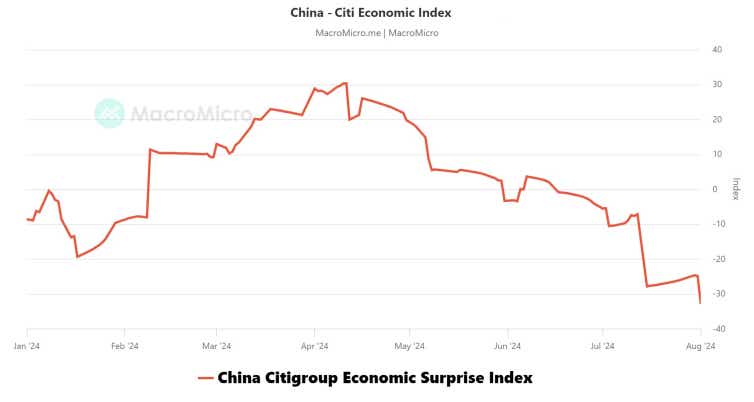

Citigroup data suggests Chinese economic figures have increasingly deteriorated relative to baseline forecasts over recent weeks. That may set the stage for downside surprises that make for a still sadder story than the status quo in the world’s second-largest economy.

Such outcomes would come at a most inconvenient time, just as the markets begin to worry in earnest about the onset of a recession. Ongoing weakness in China coupled with near-standstill in the Eurozone and increasingly acute signs of slowdown in the U.S. suggest all three major engines of global demand might be misfiring in tandem.

A weak economy in China adds to downward pressure on stock markets

The latest purchasing managers index (PMI) data from S&P Global showed worldwide economic activity growth slowed for a second consecutive month in July, sliding to the weakest setting since April. Meanwhile, Citigroup reports global economic data outcomes—not just those out of China—have increasingly disappointed for four months.

On balance, this seems to bode ill for risk appetite, hinting that the brutal bloodletting sweeping stock markets at the start of August reflects a gathering trend instead of a singular episode. Indeed, equities have traded lower—albeit at a calmer pace—since early July. A respite may yet come near-term, but the path of least resistance seems to lead downward.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.