Stock and Bond Markets Exhibit a Whole Lotta Love for the June U.S. Inflation Report

Stock and Bond Markets Exhibit a Whole Lotta Love for the June U.S. Inflation Report

Soft inflation numbers propel stocks to resume their climb up the stairway to heaven (metaphor exhausted)

- The June U.S. consumer price index came in softer than anticipated at +3% year over year on the headline and at +4.8% year over year.

- Decelerating price pressures are reducing speculation that the Federal Reserve will raise rates multiple times in 2023.

- Equity futures rallied across the board, while yields continued their drop in the wake of the June U.S. inflation data.

Market update: S&P 500 up +0.31% month-to-date

U.S. inflation continues to decelerate at a rapid pace. The June consumer price index posted +0.2% month over month and +3% year over year on the headline, and +0.2% month over month and +4.8% year over year on the core. The headline reading is the lowest since the March 2021 report (+2.6% year over year), while the core reading is the lowest since October 2021(+4.8% year over year).

Driven by declining prices for gasoline, health insurance, and used cars and trucks, this report marks 12 consecutive months with lower headline inflation in the U.S. than in the previous month, the longest streak since 1921.

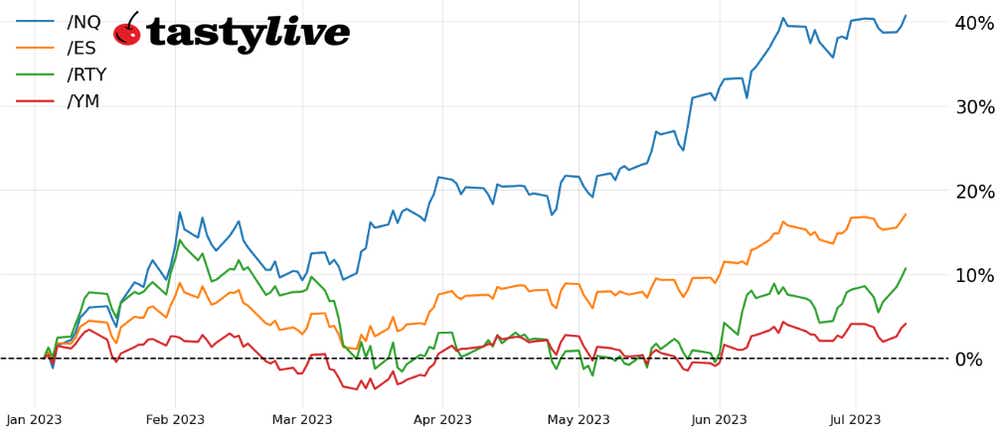

Traders have taken the news kindly, bidding up both stocks and bonds across the curve. At the time of writing, the S&P 500 (/ES) had rallied 0.68% on the session, touching a fresh yearly high of 4510.75. The Nasdaq 100 (/NQ) was up by 0.92%, while the leader in recent sessions, the Russell 2000 (/RTY), had added 1.21% on the day.

U.S. Treasuries (/ZT, /ZF, /ZN, /ZB, and /UB) are rallying across the curve. The two-year yield, after hitting 5.118% last Thursday, its highest level since 2007, has dropped down to 4.774%. The U.S. 10-year yield was last seen at 3.924%, down from its yearly high set last Friday at 4.094%.

Decelerating price pressures are reducing speculation that the Federal Reserve will raise rates multiple times in 2023, a shift in expectations that began late last week and has continued after the release of the June U.S. inflation report today.

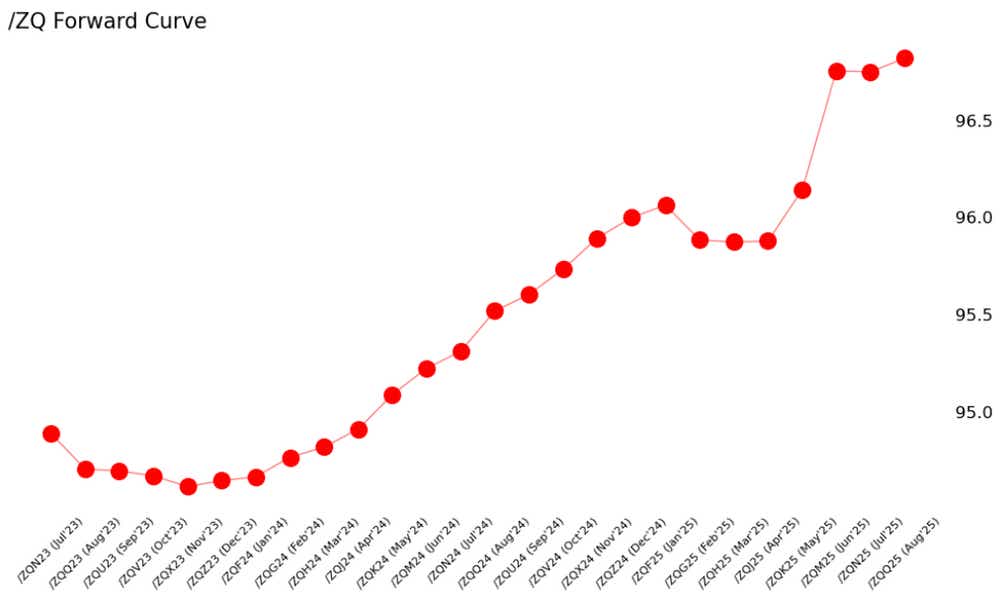

/ZQ Fed funds futures forward curve (August 2023 to December 2025)

The /ZQ (Fed funds) term structure shows an expectation the Fed will raise rates just once more in 2023, even though multiple Federal Reserve officials in recent days (Federal Reserve Bank Presidents Loretta Mester of Cleveland, James Bullard of St. Louis, Neel Kashkari of Minneapolis, Mary Daly of San Francisco and Vice Chairman Michael Barr) have all suggested inflation remains too high. The odds of a 25-bps rate hike in July remain robust at 92%, but odds of a second 25-bps rate hike before the year ends have dropped from 38% yesterday to 25% today, according to Fed funds futures.

Even at +3% year over year, headline inflation is still above the Fed’s medium-term target of 2%, and with the U.S. labor market still showing signs of resilience, Fed policymakers remain of the mindset that they still have a window with which to focus solely on taming price pressures.

It stands to reason that, barring a discernible shift in Fedspeak before the Fed’s communication blackout window leading into the July FOMC meeting, traders may find their growing expectations of a less hawkish Fed will prove disappointed in the coming weeks. For now, however, the trend is your friend, and the trend is pointing to additional strength in stocks and a further retrenchment in U.S. yields.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multi-national firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.