S&P 500 Stages Rally as October Jobs Report Misses Meaningfully

S&P 500 Stages Rally as October Jobs Report Misses Meaningfully

Also 10-year T-Note, Gold, Crude Oil, and British Pound Futures

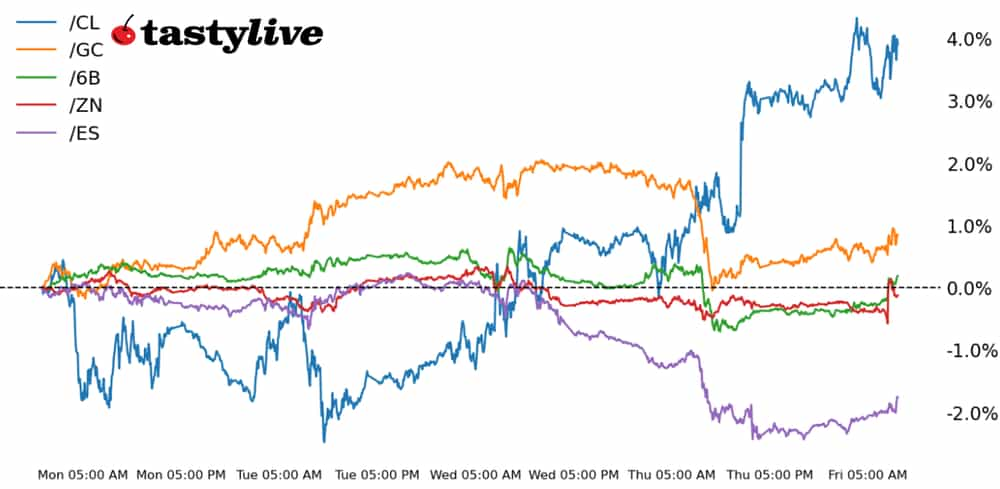

- S&P 500 E-mini futures (/ES): +0.44%

- 10-year T-note futures (/ZN): +0.28%

- Gold futures (/GC): +0.79%

- Crude oil futures (/CL): +2.6%

- British pound futures (/6B): +0.57%

The U.S. labor market is either humming along or rapidly decelerating, depending upon where you look. The October U.S. jobs report was mixed if not disappointing, with the focus on the headline figure of only 12,000 jobs added last month, well below the 113,000 anticipated. But with labor strikes and hurricanes amounting to significant headwinds—perhaps culling some 100,000 jobs from payrolls—the headline figure is being overlooked.

Instead, attention is on the unemployment rate (U3), and the lack of significant movement therein. U3 unemployment held steady at 4.1%, while wages surprised and came in up 0.4% month over month (m/m) and 4% year ver year (y/y) vs. the expected 0.3% up m/m and 3.9% y/y. Notably, the Sahm Rule indicator, which suggests a recession has started once the unemployment rate rises by more than 0.5% relative to the minimum of the three-month averages from the previous 12 months, has fallen to 0.43% from 0.5% last report; this means that recession condition has been untriggered.

The data at the end of October offers a still-optimistic view of the U.S. economy: After a summer slowdown, reacceleration has transpired into the fall. The economy is in a solid position at the macro level, neither booming nor busting. To this end, rates markets are likewise discounting a near 100% chance of a 25-basis-point (bps) rate cut when the Federal Reserve meets next week.

Symbol: Equities | Daily Change |

/ESZ4 | +0.44% |

/NQZ4 | +0.4% |

/RTYZ4 | +0.79% |

/YMZ4 | +0.44% |

The S&P 500 futures climbed this morning, adding about 0.5% ahead of the New York open, after a downbeat jobs report bolstered bets that the Federal Reserve would continue to cut interest rates. Amazon (AMZN) gained about 5% in pre-market trading after posting a better-than-expected quarterly profit. Intel (INTC) saw a similar gain ahead of the bell following its own earnings beat.

Strategy: (48DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5325 p Short 5375 p Short 6250 c Long 6300 c | 65% | +360 | -2140 |

Short Strangle | Short 5375 p Short 6250 c | 70% | +2525 | x |

Short Put Vertical | Long 5325 p Short 5375 p | 83% | +262.50 | -2237.50 |

Symbol: Bonds | Daily Change |

/ZTZ4 | +0.13% |

/ZFZ4 | +0.24% |

/ZNZ4 | +0.28% |

/ZBZ4 | +0.42% |

/UBZ4 | +0.4% |

The 10-year T-note futures (/ZNZ4) started the month on a positive footing following the biggest monthly decline for the contract since September 2022. Treasury yields fell across the curve as the jobs report added to Fed rate cut bets. The upcoming election and next week’s Federal Open Market Committee (FOMC) meeting now pose the two largest risks to markets. Treasury market volatility increased as the market approaches the November election, reflected by a more than 3% increase in the BofA MOVE index.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106 p Short 107 p Short 114 c Long 115 c | 68% | +234.38 | -765.63 |

Short Strangle | Short 107 p Short 114 c | 72% | +593.75 | x |

Short Put Vertical | Long 106 p Short 107 p | 90% | +109.38 | -890.63 |

Symbol: Metals | Daily Change |

/GCZ4 | +0.79% |

/SIZ4 | +1.25% |

/HGZ4 | +1.35% |

Gold prices (/GCZ4) rose as weaker Treasury yields opened a window for bulls to push prices higher. The metal remains in an uptrend despite earlier profit-taking this week. The fundamental backdrop for the precious metal was strengthened after the jobs report, which should help to support gold exchange-traded fund (ETF) flows, which have seen several back-to-back months of inflows.

Strategy (55DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2575 p Short 2600 p Short 2950 c Long 2975 c | 65% | +670 | -1830 |

Short Strangle | Short 2600 p Short 2950 c | 72% | +3380 | x |

Short Put Vertical | Long 2575 p Short 2600 p | 87% | +290 | -2210 |

Symbol: Energy | Daily Change |

/CLZ4 | +2.6% |

/HOZ4 | +1.54% |

/NGZ4 | -0.81% |

/RBZ4 | +2.16% |

Crude oil futures (/CLZ4) rose farther above the 70 handle after reports crossed the wires suggesting Iran is readying a retaliatory strike against Israel. However, sources cited by Axios say the retaliation will be limited, reducing the chance of a broadening conflict. Meanwhile, traders expect OPEC+ to push back production cut rollbacks, with a decision possibly coming as soon as next week.

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 61 p Short 62 p Short 81 c Long 82 c | 64% | +240 | -760 |

Short Strangle | Short 62 p Short 81 c | 72% | +1830 | x |

Short Put Vertical | Long 61 p Short 62 p | 79% | +140 | -860 |

Symbol: FX | Daily Change |

/6AZ4 | +0.11% |

/6BZ4 | +0.57% |

/6CZ4 | -0.04% |

/6EZ4 | +0.06% |

/6JZ4 | -0.02% |

A drop in U.S. yields on the other side of the October U.S. jobs report is helping other major currencies scape back some of their losses vs. the greenback, but not all that significantly. The Japanese Yen (/6JZ4) has been a significant mover since the release of the U.S. jobs figures, quickly losing its gains on the day. But the best performer is the British pound (/6BZ4), which on a technical basis is rallying from the uptrend off the October 2023 and April 2024 lows; alongside a high IVR, /6BZ4 may present the most actionable setup in FX futures heading into next week.

Strategy (63DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.25 p Short 1.26 p Short 1.34 c Long 1.35 c | 63% | +168.75 | -456.25 |

Short Strangle | Short 1.26 p Short 1.34 c | 69% | +556.25 | x |

Short Put Vertical | Long 1.25 p Short 1.26 p | 85% | +100 | -525 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.