S&P 500 Recovers and Then Slumps After 2Q ’24 U.S. GDP Beats Expectations

S&P 500 Recovers and Then Slumps After 2Q ’24 U.S. GDP Beats Expectations

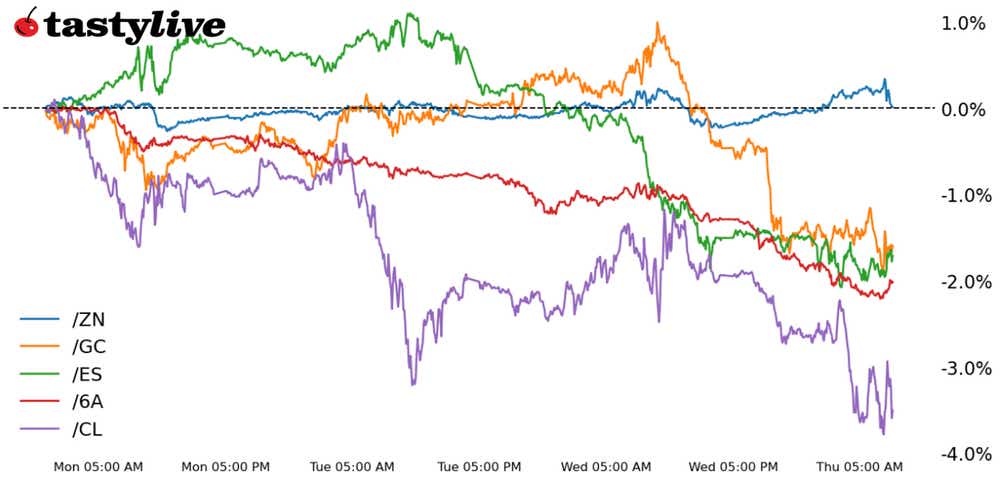

Also, 10-year T-note, gold, crude oil and Australian dollar futures

S&P 500 E-mini futures (/ES): +0.03%

10-year T-note futures (/ZN): -0.38%

Gold futures (/GC): +0.40%

Crude oil futures (/CL): +0.28%

Australian dollar futures (/6A): -0.99%

Better-than-expected U.S. gross domestic product (GDP) data for the second quarter, alongside a modest improvement in weekly jobless claims, are allowing traders to breath a sigh of modest relief today. U.S. equity markets are off their weekly lows, while bonds have backed off their daily highs. Lacking evidence that a recession is imminent, interest rate cut odds have pulled back, allowing the U.S. dollar to rebound. USD-denominated assets are struggling as a result, with energy and metals sitting near weekly lows.

Symbol: Equities | Daily Change |

/ESU4 | +0.02% |

/NQU4 | +0.18% |

/RTYU4 | +0.48% |

/YMU4 | -0.03% |

U.S. equity markets are trying to stop the bleeding following the batch of data releases this morning. Fears of an imminent recession—and thus a July Federal Reserve interest rate cut—are backing off.

Overall, earnings have come across as disappointing for investors: through 9:30 a.m. EDT today, 580 companies had reported, with only 43% of stocks moving higher; the average return around earnings has been -0.2% thus far. This would be the worst quarter for earnings (with respect to how the market has responded) since 3Q ’23 (45% positive returns with an average return of -0.7%). It remains to be seen whether the positive reaction today is a dead cat bounce, insofar as the optimism began fading shortly after the U.S. cash open.

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5200 p Short 5225 p Short 5725 c Long 5750 c | 64% | +375 | -875 |

Short Strangle | Short 5225 p Short 5725 c | 73% | +3025 | x |

Short Put Vertical | Long 5200 p Short 5225 p | 84% | +187.50 | -1062.50 |

Symbol: Bonds | Daily Change |

/ZTU4 | 0% |

/ZFU4 | +0.04% |

/ZNU4 | +0.11% |

/ZBU4 | +0.37% |

/UBU4 | +0.5% |

Better than expected growth data are pushing back Fed rate cut odds for July, reducing the potential of a 25-basis-point (bps) rate cut and for September, reducing the potential of a 50-bps rate cut, which may be weighing on Treasuries today. Treasury auctions this week have been mixed (good twos, mediocre fives), and there is a seven-year note auction later today.

Strategy (57DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 108 p Short 108.5 p Short 113.5 c Long 114 c | 61% | +140.63 | -343.75 |

Short Strangle | Short 108.5 p Short 113.5 c | 69% | +609.38 | x |

Short Put Vertical | Long 108 p Short 108.5 p | 91% | +62.50 | -437.50 |

Symbol: Metals | Daily Change |

/GCQ4 | -1.83% |

/SIU4 | -5.19% |

/HGU4 | -0.16% |

The U.S. economy may not be sliding into imminent recession, but the rest of the world is still struggling. The diminished prospect of an emergency Fed rate cut next week is hitting precious metals hard, in particular silver prices (/SIU4), which are down over 5% today. If /SIU4 is any guide, then gold prices (/GCQ4), which just broke below 2400, may be on track to return to multi-month range lows near 2300.

Strategy (62DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2225 p Short 2250 p Short 2500 c Long 2525 c | 62% | +740 | -1760 |

Short Strangle | Short 2250 p Short 2500 c | 70% | +3140 | x |

Short Put Vertical | Long 2225 p Short 2250 p | 87% | +300 | -2200 |

Symbol: Energy | Daily Change |

/CLU4 | -0.44% |

/HOU4 | -1.01% |

/NGU4 | -1.56% |

/RBU4 | -0.85% |

Energy markets remain under pressure despite the stronger-than-expected 2Q ’24 U.S. GDP report. Why? Markets are forward looking, and the growth reading doesn’t tell us anything about the future. What did tell us something about the future this week? The surprise rate cuts from China. Further easing from the People’s Bank of China (PBOC) suggests underlying demand continues to weaken, which in turn translates into expectations that global growth will remain pressured in the second half of 2024.

Strategy (54DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 68 p Short 69 p Short 84 c Long 85 c | 66% | +230 | -770 |

Short Strangle | Short 69 p Short 84 c | 72% | +1290 | x |

Short Put Vertical | Long 68 p Short 69 p | 82% | +140 | -860 |

Symbol: FX | Daily Change |

/6AU4 | -0.49% |

/6BU4 | -0.23% |

/6CU4 | -0.11% |

/6EU4 | +0.06% |

/6JU4 | -0.1% |

Growth concerns are front and center today for most assets outside of the U.S. Part and parcel to this point is the continued shift in flows in foreign exchange (FX) markets, which have increasingly abandoned the carry trade in all its forms in favor of relative safe havens like the Japanese yen (/6JU4) and the U.S. dollar ($DXY). That the Australian dollar (/6AU4), crude oil (/CLQ4) and copper prices (/HGU4) are pressing their weekly lows underscores the aforementioned points about China becoming a greater source of concern for traders in recent sessions.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.635 p Short 0.64 p Short 0.67 c Long 0.675 c | 59% | +190 | -310 |

Short Strangle | Short 0.64 p Short 0.67 c | 69% | +570 | x |

Short Put Vertical | Long 0.635 p Short 0.64 p | 83% | +100 | -400 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.