S&P 500 Rebound Tempered by Hot ISM Services and JOLTS

S&P 500 Rebound Tempered by Hot ISM Services and JOLTS

Also five-year T-note, silver, natural gas and Japanese yen futures

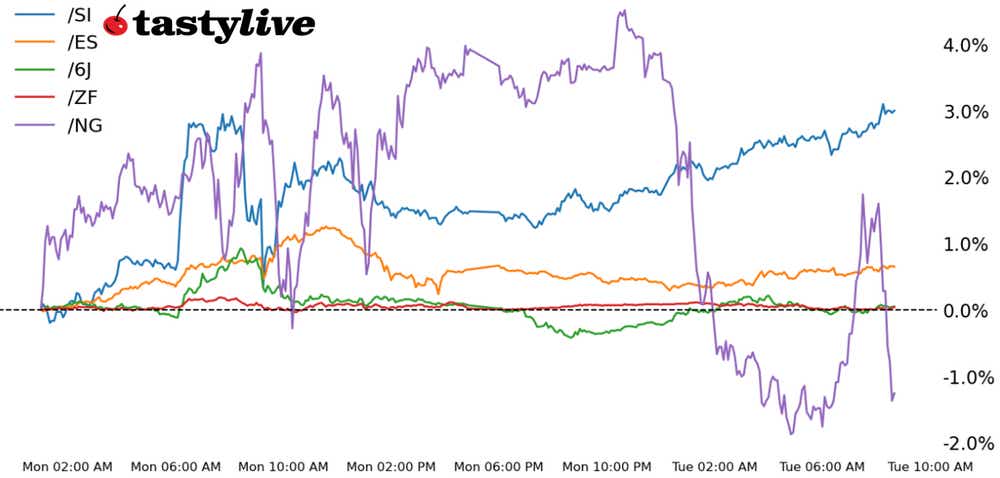

- S&P 500 E-mini futures (/ES): +0.26%

- 5-year T-note futures (/ZF): -0.01%

- Silver futures (/SI): +1.31%

- Natural gas futures (/NG): -3.4%

- Japanese yen futures (/6J): -0.11%

Financial markets were jolted today following the release of the December U.S. purchasing managers’ index (PMI) report from the Institute for Supply Management (ISM). While the topline figure came in better than expected, a positive development, a look beneath the surface revealed an alarming rise in inflation: The prices paid subcomponent jumped to 64.4 from 58.2. Similarly, the November U.S. job openings and labor turnover survey (JOLTS) showed a sharp uptick in job openings at 8.09 million vs. the 7.7 million expected, further evidence of the resilient U.S. labor market. Equity markets have been losing ground, bond yields are rising, and the U.S. dollar has flipped from red to green on the day.

Symbol: Equities | Daily Change |

/ESH5 | +0.26% |

/NQH5 | +0.1% |

/RTYH5 | +0.39% |

/YMH5 | +0.3% |

U.S. equity markets dipped this morning, pausing a rally from the past two trading days. Nvidia (NVDA) rose in pre-market trading after announcing a new set of chips but surrendered those gains after the opening bell. S&P 500 futures (/ESH5) fell about 0.2% in early morning trading, with the consumer discretionary and technology sectors dragging on sentiment. Rising bond yields pressured equities, with Treasury yields making a break to fresh multi-month highs.

Strategy: (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5920 p Short 5925 p Short 6070 c Long 6075 c | 15% | +200 | -50 |

Short Strangle | Short 5925 p Short 6070 c | 46% | +8900 | x |

Short Put Vertical | Long 5920 p Short 5925 p | 60% | +75 | -175 |

Symbol: Bonds | Daily Change |

/ZTH5 | 0% |

/ZFH5 | -0.01% |

/ZNH5 | -0.06% |

/ZBH5 | -0.25% |

/UBH5 | -0.42% |

Treasury yields moved higher across the curve this morning, following an overnight move in Europe that saw higher yields across the Euro Zone. According to Bloomberg, a record number of borrowers sold bonds in Europe, with 28 issuers raising about $32 billion after returning from the holidays. Today, the Treasury will auction off three-year notes. Bond traders will shift their focus to employment data later this week via the ADP report and non-farm payroll report.

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 105.25 p Short 105.5 p Short 106.5 c Long 106.75 | 30% | +164.06 | -85.94 |

Short Strangle | Short 105.5 p Short 106.5 c | 54% | +796.88 | x |

Short Put Vertical | Long 105.25 p Short 105.5 p | 77% | +85.94 | -164.06 |

Symbol: Metals | Daily Change |

/GCG5 | +1.12% |

/SIH5 | +1.31% |

/HGH5 | +1.14% |

Gold prices (/GCG5) rose today despite a move higher in Treasury yields. Traders see fewer rate cuts this year amid rising inflation pressures on the economy. Traders may see gold as an appetizing asset to hold going into a higher inflationary environment. This week’s jobs data could help traders focus their view on where the Fed will go with rates, which could influence the trajectory of precious metals.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2625 p Short 2630 p Short 2690 c Long 2695 | 18% | +390 | -110 |

Short Strangle | Long 2625 p Short 2630 p | 54% | +8340 | x |

Short Put Vertical | Long 2625 p Short 2630 p | 68% | +180 | -330 |

Symbol: Energy | Daily Change |

/CLG5 | +0.73% |

/HOG5 | +0.19% |

/NGG5 | -3.4% |

/RBG5 | -0.03% |

Natural gas futures (/NGG5) slipped by about 3% in morning trading, continuing a selloff from last week’s highs when gas surged to fresh multi-month highs. Forecasters still expect colder-than-average temperatures across much of the eastern United States through the first half of January but that isn’t offering enough to keep prices elevated. Meanwhile, U.S. gas production has dropped to the lowest levels since early November, likely because of the extreme cold that has caused some production shut-ins. However, production will likely rebound, at least modestly, over the short-term, which could explain the failure to hold prices near last week’s levels.

Strategy (29DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3.4 p Short 3.45 p Short 3.65 c Long 3.7 c | 12% | +460 | -50 |

Short Strangle | Short 3.45 p Short 3.65 c | +55% | +6120 | x |

Short Put Vertical | Long 3.4 p Short 3.45 p | 32% | +370 | -130 |

Symbol: FX | Daily Change |

/6AH5 | +0.53% |

/6BH5 | +0.19% |

/6CH5 | +0.12% |

/6EH5 | +0.02% |

/6JH5 | -0.11% |

Japanese yen futures (/6JH5) extended a selloff from early morning trading despite recent warnings by Japanese authorities over excessive currency moves. While the recent news about the incoming Trump administration narrowing the scope of tariffs hit the dollar, it isn’t enough to stop the yen’s decline. Traders likely want to see more clarity on how tariffs will be implemented in the coming administration, and the scope of the Federal Reserve’s rate cuts will also play a key role in the yen’s direction.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.006275 p Short 0.0063 p Short 0.00645 c Long 0.006475 c | 32% | +200 | -112.50 |

Short Strangle | Short 0.0063 p Short 0.00645 c | 55% | +1150 | x |

Short Put Vertical | Long 0.006275 p Short 0.0063 p | 68% | +112.50 | -200 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.