S&P 500 Choppy after DOJ’s NVDA Inquiry, Softer JOLTs Data

S&P 500 Choppy after DOJ’s NVDA Inquiry, Softer JOLTs Data

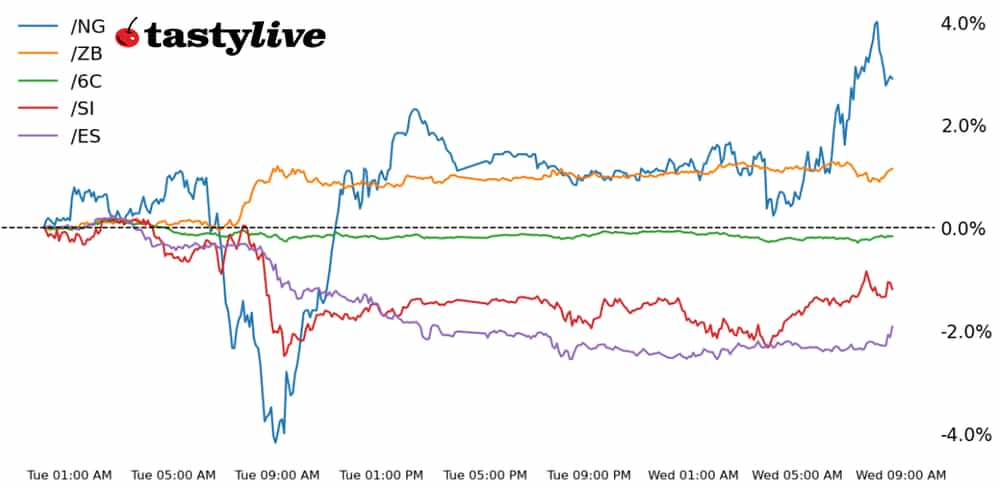

Also 30-year T-Bond, Silver, Natural Gas, and Canadian Dollar Futures

S&P 500 E-mini futures (/ES): -0.08%

30-year T-bond futures (/ZB): +0.23%

Silver futures (/SI): +0.37%

Natural gas futures (/NG): +1.32%

Canadian dollar futures (/6C): +0.05%

Yesterday’s rout to start September trading is finding little follow-through today, with U.S. equity markets shuffling between gains and losses early in the session. The morning’s slate of U.S. economic data continued to point to a slowing growth situation, with the August U.S. job openings and labor turnover survey (JOLTs) showing a sharp drop-off in job openings (7.67 million vs 8.1 million expected). Treasury yields are moving lower as rate markets pull forward expectations of a 50-basis-point (bps) Federal Reserve interest rate cut in two weeks.

Elsewhere, energy prices continue to struggle, with crude oil below 70 per barrel for the first time since December 2023.

Symbol: Equities | Daily Change |

/ESU4 | -0.08% |

/NQU4 | -0.27% |

/RTYU4 | -0.45% |

/YMU4 | +0.09% |

The S&P 500 futures continued to fall this morning after traders learned the U.S. Justice Department issued a subpoena for Nvidia (NVDA), signaling further interest into an antitrust investigation of the company’s practices. The bellwether technology stock commands a lot of influence over market sentiment, given its high-flyer status. The rest of the market will have to pick up the slack for equity indexes to move higher today.

Strategy: (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5125 p Short 5150 p Short 5925 c Long 5950 c | 62% | +220 | -1030 |

Short Strangle | Short 5150 p Short 5925 c | 67% | +2500 | x |

Short Put Vertical | Long 5125 p Short 5150 p | 87% | +110 | -1140 |

Symbol: Bonds | Daily Change |

/ZTZ4 | +0.09% |

/ZFZ4 | +0.16% |

/ZNZ4 | +0.21% |

/ZBZ4 | +0.23% |

/UBZ4 | +0.35% |

The 30-year T-bond futures contract (/ZBZ4) is slightly higher but the upside seen yesterday has moderated, with prices up only about 0.08% ahead of the New York open. The Fed’s Beige Book and U.S. data on job openings may sway yields today before the focus shifts to Friday’s jobs report. There are no notable auctions scheduled for today from the Treasury.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 118 p Short 120 p Short 130 c Long 132 c | 64% | +546.88 | -1453.13 |

Short Strangle | Short 120 p Short 130 c | 70% | +1265.63 | x |

Short Put Vertical | Long 118 p Short 120 p | 84% | +296.88 | -1703.13 |

Symbol: Metals | Daily Change |

/GCZ4 | -0.22% |

/SIZ4 | +0.37% |

/HGZ4 | -0.28% |

Silver prices (/SIZ4) trimmed losses from overnight, with prices holding above yesterday’s intraday lows. The metal has been heavily sold over the past two days, bringing prices to the lowest levels since mid-August. A stall in the dollar’s upside appears to be helping to support the metal today, but prices could remain at risk if China’s industrial activity continues to slow.

Strategy (54DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 25 p Short 25.5 p Short 31.5 c Long 32 c | 64% | +660 | -1840 |

Short Strangle | Short 25.5 p Short 31.5 c | 72% | +3295 | x |

Short Put Vertical | Long 25 p Short 25.5 p | 83% | +310 | -2190 |

Symbol: Energy | Daily Change |

/CLQ4 | -1.07% |

/HON4 | -1.45% |

/NGV4 | +1.32% |

/RBN4 | -0.92% |

Natural gas futures (/NGV4) rose today, extending gains from the day prior as traders start to focus on the winter season, when stockpiles typically draw down. The United States is seeing cooler weather, which should allow stockpiles to build further before colder temps sweep in. European demand has eased recently, reducing the premium Dutch futures hold over Henry Hub U.S. prices. Earlier this week, the Biden administration approved exports for U.S. sourced natural gas from Mexico, potentially increasing demand via that route. Focus shifts to tomorrow’s numbers from the Energy Information Administration.

Strategy (54DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.5 p Short 1.75 p Short 2.75 c Long 3 c | 64% | +720 | -1780 |

Short Strangle | Short 1.75 p Short 2.75 c | 71% | +1610 | x |

Short Put Vertical | Long 1.5 p Short 1.75 p | 95% | +80 | -2420 |

Symbol: FX | Daily Change |

/6AU4 | +0.27% |

/6BU4 | +0.21% |

/6CU4 | +0.05% |

/6EU4 | +0.14% |

/6JU4 | +0.67% |

The Canadian dollar (/6C) is rallying back this morning in the wake of the September Bank of Canada (BOC) rate decision. BOC policymakers cut the main rate by 25-bps for the third consecutive meeting, bucking limited but meaningful 22% odds of a 50-bps cut. Policymakers continued to guide toward more cuts, which presents a potential read-through on the U.S. economy: about 80% of Canada’s exports head to the U.S., so if the Canadian economy is slowing, it stands to reason demand in the U.S. may be weakening.

Strategy (65DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.715 p Short 0.72 p Short 0.76 c Long 0.765 c | 67% | +100 | -400 |

Short Strangle | Short 0.72 p Short 0.76 c | 71% | +280 | x |

Short Put Vertical | Long 0.715 p Short 0.72 p | 94% | +40 | -460 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.