S&P 500 at All-Time Highs after CPI; FOMC Later Today

S&P 500 at All-Time Highs after CPI; FOMC Later Today

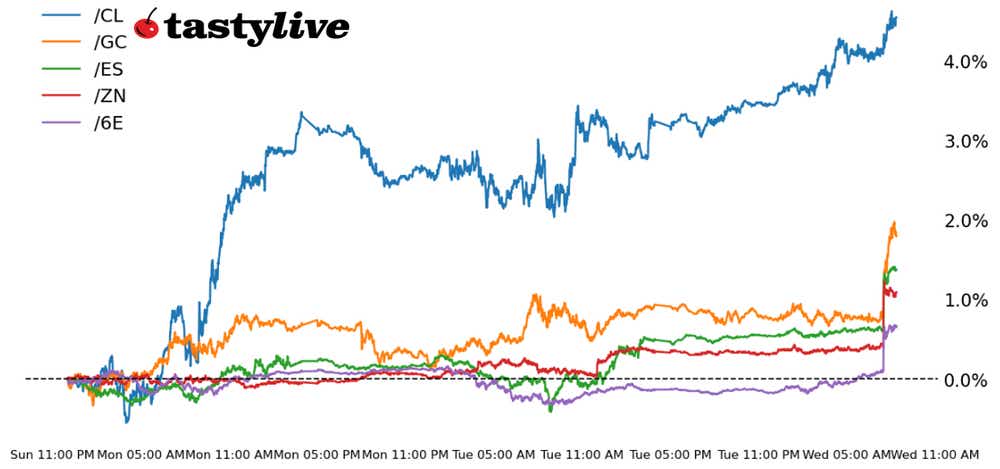

Also, 10-year T-note, gold, crude oil and Euro futures

S&P 500 E-mini futures (/ES): +0.85%

10-year T-note futures (/ZN): +0.81%

Gold futures (/GC): +1.29%

Crude oil futures (/CL): +1.69%

Euro futures (/6E): +0.86%

Relief is the mood on Wall Street this morning following the release of the May U.S. inflation report. The May U.S. consumer price index came in cooler than expected at 0% month-over-month (m/m) and 3.3% year-over-year (y/y) on the headline, and 0.2% m/m and 3.4% y/y on the core; both the headline and core readings missed forecasts (0.1% m/m and 3.4% y/y expected for the headline; and 0.2% m/m and 3.5% y/y on the core).

While goods inflation has been the primary story in recent months, disinflationary pressures are appearing elsewhere. To wit: core consumer price index (CP) ex shelter is now 1.9% y/y. Such a reading will likely give Federal Open Market Committee (FOMC) officials confidence to look past the lag in shelter (owner's equivalent rent, or OER) and transportation (auto insurance).

The initial reaction boosted stock futures and bond yields dropped. For equities, markets have rallied to fresh all-time highs. For bonds, they've erased nearly all of the losses after the jobs report last Friday. With these new data in hand, market participants seem to have no concern about the Federal Reserve's June policy meeting later today.

Symbol: Equities | Daily Change |

/ESM4 | +0.85% |

/NQM4 | +0.84% |

/RTYM4 | +2.73% |

/YMM4 | +0.93% |

This morning’s CPI report gave a green light to bulls who rushed into equity markets following the data, which suggests the Fed will cut sooner rather than later. The market has gyrated between seeing one and two rate cuts this year, with equities sensitive to those changes.

Oracle (ORCL) rose nearly 9% in pre-market trading after reporting better-than-expected earnings. GameStop (GME) is down 4% before the bell, following yesterday’s 22.8% gain. Citron Research tweeted this morning that it abandoned its short position on the stock, saying that the large cash position from dilution will likely keep the stock price afloat for now while also snubbing Keith Gill’s livestream as an insult to capital markets.

Strategy: (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5250 p Short 5275 p Short 5725 c Long 5750 c | 65% | +252.50 | -997.50 |

Short Strangle | Short 5275 p Short 5725 c | 70% | +1600 | x |

Short Put Vertical | Long 5250 p Short 5275 p | 85% | +137.50 | -1112.50 |

Symbol: Bonds | Daily Change |

/ZTU4 | +0.29% |

/ZFU4 | +0.62% |

/ZNU4 | +0.81% |

/ZBU4 | +1.22% |

/UBU4 | +1.30% |

Bonds yields across the curve dropped sharply after this morning’s inflation data, which supports a trend lower in prices for the U.S. economy. The 10-year yield dropped 2.7%—the largest single day percentage decline since January. Yields on the short end of the curve saw an even sharper drop, reflecting the dovish bets for Fed rate cuts. 10-year T-note futures (/ZNU4) were up 0.81% at the New York open, challenging an intraday high from June 7. The technical structure of higher highs and lower lows from the April swing low supports a continued uptrend for the bond future. Today’s Fed announcement may help to cement that view.

Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 108 p Short 108.5 p Short 112.5 c Long 113 c | 62% | +140.63 | -359.38 |

Short Strangle | Short 108.5 p Short 112.5 c | 69% | +484.38 | x |

Short Put Vertical | Long 108 p Short 108.5 p | 88% | +78.13 | -421.88 |

Symbol: Metals | Daily Change |

/GCQ4 | +1.29% |

/SIN4 | +3.33% |

/HGN4 | +1.71% |

Gold contracts (/GCQ4) were modestly higher before this morning's inflation report and accelerated following the soft CPI numbers, with a softer dollar and lower yields clearing upside for precious metals. While Fed rate cut bets have moved higher, there are still plenty of risks from today’s FOMC announcement although the path of least resistance now appears to be higher because it gives the Fed ammo to move further into the rate cutting headspace. After today’s Fed announcement, gold traders will turn their focus to tomorrow’s producer price index (PPI), which will inform markets further on the inflation story.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2225 p Short 2250 p Short 2450 c Long 2475 c | 62% | +750 | -1750 |

Short Strangle | Short 2250 p Short 2450 c | 69% | +2610 | x |

Short Put Vertical | Long 2225 p Short 2250 p | 84% | +370 | -2130 |

Symbol: Energy | Daily Change |

/CLN4 | +1.69% |

/HON4 | +2.01% |

/NGN4 | -1.89% |

/RBN4 | +1.62% |

Crude oil prices joined the broader rally, with a softer rate environment likely supporting the demand for oil later this year. Yesterday’s report from the American Petroleum Institute (API) showed a crude oil drawdown of 2.5 million barrels for the week ending June 7. That was deeper than the cut of 1.75 million barrels that markets expected. Today’s Energy Information Administration (EIA) report is in focus for energy traders.

Strategy (35DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 73 p Short 73.5 p Short 84.5 c Long 85 c | 62% | +140 | -360 |

Short Strangle | Short 73.5 p Short 84.5 c | 70% | +1100 | x |

Short Put Vertical | Long 73 p Short 73.5 p | 82% | +70 | -430 |

Symbol: FX | Daily Change |

/6AM4 | +1.28% |

/6BM4 | +0.86% |

/6CM4 | +0.52% |

/6EM4 | +0.86% |

/6JM4 | +0.77% |

The U.S. Dollar has been thrashed in the wake of the May inflation report. The DXY Index has retraced nearly all of its gains from Friday. The largest constituent of the DXY Index, the Euro (/6EM4), is having its best day since December 2023. Sharp reversals on higher than normal volumes (> one-month average) across the FX market indicate a meaningful technical turn is afoot.

Strategy (58DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.055 p Short 1.06 p Short 1.11 c Long 1.115 c | 66% | +187.50 | -437.50 |

Short Strangle | Short 1.06 p Short 1.11 c | 72% | +662.50 | x |

Short Put Vertical | Long 1.055 p Short 1.06 p | 94% | +75 | -550 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.