S&P 500, Two-Year T-Note, Gold, Crude Oil, and British Pound Futures

S&P 500, Two-Year T-Note, Gold, Crude Oil, and British Pound Futures

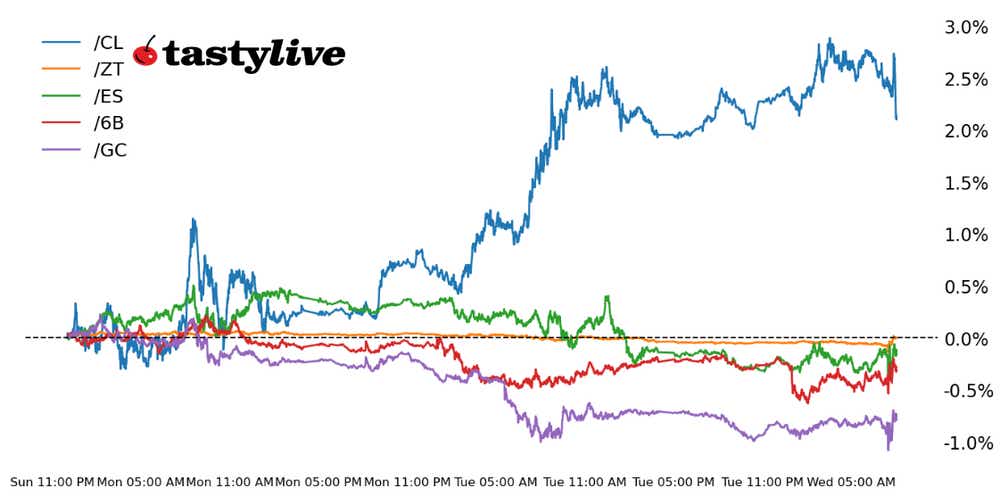

This morning’s Five Futures in Focus

- S&P 500 e-mini futures (/ES): +0.06%

- Two-year T-note futures (/ZT): -0.01%

- Gold futures (/GC): -0.10%

- Crude oil futures (/CL): 0.00%

- British pound futures (/6B): -0.03%

The release of the August U.S. inflation report this morning provoked some volatility, but most markets are relatively unchanged ahead of the U.S. cash equity open on Wednesday.

Hotter-than-expected headline inflation may have initially spooked traders, who sold down both stocks and bonds. But with core measures still trending in the right direction, and the Fed’s "supercore" measure not showing a jump, the losses were quickly reversed. If there is a theme thus far to Wednesday, it’s “unchanged.”

Symbol: Equities | Daily Change |

/ESZ3 | +0.06% |

/NQZ3 | +0.05% |

/RTYZ3 | +0.30% |

/YMZ3 | +0.02% |

All U.S. equity index futures are pointing modestly higher, led by the Russell 2000 (/RTYZ3). Yet, none of the four majors are showing any sort of significant gains, as /RTYZ3 was only up by +0.30% at the time this note was written. Technical studies continue to suggest a meaningful lack of momentum, either bullish or bearish, as trading ranges that were carved out starting in June remain in place.

Strategy: (48DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4470 p Short 4480 p Short 4560 c Long 4570 c | 16% | +400 | -100 |

Long Strangle | Long 4470 p Long 4570 c | 51% | x | -5525 |

Short Put Vertical | Long 4470 p Short 4480 p | 61% | +162.50 | -342.50 |

Symbol: Bonds | Daily Change |

/ZTZ3 | -0.01% |

/ZFZ3 | -0.15% |

/ZNZ3 | -0.06% |

/ZBZ3 | -0.47% |

/UBZ3 | -0.30% |

Bond yields continue to press higher, although the August U.S. inflation report did very little by way of changing their standing on the session. two-year notes (/ZTZ3) dropped then recovered, with the two-year yield trading lower than it was ahead of the CPI report. The main concern for the bond market, across the curve, remains energy; crude oil prices hit another fresh yearly high today.

Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 101 p Short 101.25 p Short 101.75 c Long 102 c | 26% | +296.88 | -203.13 |

Long Strangle | Long 101 p Long 102 c | 54% | x | -437.50 |

Short Put Vertical | Long 101 p Short 101.25 p | 91% | +140.63 | -359.38 |

Symbol: Metals | Daily Change |

/GCZ3 | -0.10% |

/SIZ3 | -0.92% |

/HGZ3 | -0.16% |

Gold (/GCZ3) is trading down about $0.50 per ounce, which is a rather modest move given that U.S. inflation increased for the first time in six months. However, if inflation pressures are further supported by tomorrow’s factory-gate price data, traders may increase their selling of the metal. For now, limited upside in the dollar and subdued bond prices are supporting what should otherwise be a bearish day.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1925 p Short 1930 p Short 1940 c Long 1945 c | 11% | +460 | -40 |

Long Strangle | Long 1930 p Long 1940 c | 47% | x | -4,730 |

Short Put Vertical | Short 1930 p Long 1925 p | 59% | 250 | -250 |

Symbol: Energy | Daily Change |

/CLV3 | 0.00% |

/NGV3 | -0.89% |

Oil traders are awaiting U.S. inventory data from the Energy Information Administration (EIA) to support yesterday’s crude build of 1.7 million barrels reported by the American Petroleum Institute. WTI futures (/CLV3) are up about $0.06 per barrel this morning, hitting the highest of the year, despite yesterday’s inventory build. Typically, inventory data near the U.S. Labor Day weekend can be skewed by lower exports due to terminals and cargo ships running at reduced capacities amid lower head counts.

Meanwhile, the CBOE Crude Oil Volatility Index is trading at its lowest since December 2019, suggesting traders aren’t hedging downside exposure, at least not through options on the USO instrument. Outside of inventory data, U.S. and Japanese manufacturing data due this week my drive oil sentiment. Surging heating oil futures (/HO) continue to support strong outlooks on refinery profits, and diesel prices are expected to remain high going into the winter as OPEC cuts remove heavy-grade oils from an already tight market.

Strategy (34DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 88 p Short 88.5 p Short 89.5 c Long 90 c | 10% | +460 | -50 |

Long Strangle | Long 88.5 p Long 89.5 c | 47% | x | -5,120 |

Short Put Vertical | Short 88.5 p Long 88 p | 50% | 250 | -240 |

Symbol: FX | Daily Change |

/6AZ3 | -0.25% |

/6BZ3 | -0.03% |

/6CZ3 | -0.04% |

/6EZ3 | +0.08% |

/6JZ3 | -0.30% |

Stagflation, stagflation, stagflation. That’s the name of the game in Europe right now, for both the Eurozone and the U.K. Mixed performances in recent days may be attributed to a continued deterioration in data across the pond, and the ongoing rise in energy prices has proved to be an albatross around both the British pound’s (/6BZ3) and the euro’s (/6EZ3) proverbial necks. With the September European Central Bank rate decision tomorrow, it’s likely that the stagflation narrative will gain more attention in the coming sessions.

Strategy (23DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.235 p Short 1.24 p Short 1.26 c Long 1.265 c | 38% | +193.75 | -118.75 |

Long Strangle | Long 1.235 p Long 1.265 c | 37% | x | -531.25 |

Short Put Vertical | Long 1.235 p Short 1.24 p | 70% | +106.25 | -206.25 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.