S&P 500 Grinds Higher After Fed Chair Powell Speech

S&P 500 Grinds Higher After Fed Chair Powell Speech

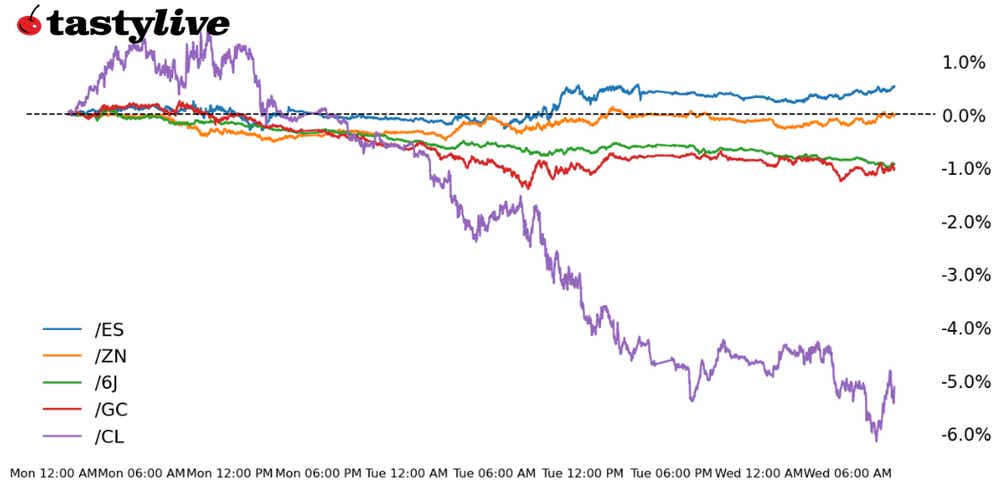

Also, 10-year T-note, gold, crude oil and Japanese yen futures

- S&P 500 e-mini futures (/ES): +0.14%

- 10-year T-note futures (/ZN): -0.01%

- Gold futures (/GC): -0.21%

- Crude oil futures (/CL): -0.93%

- Japanese yen futures (/6J): -0.32%

The much-hyped speech by Federal Reserve Chair Jerome Powell this morning yielded nothing by way of commentary on monetary policy.

While that may be a disappointment, it also seemed unlikely that traders should have expected a dramatic shift in tone given that Fed Chair Powell spoke just a week ago at the November Federal Open Market Committee (FOMC) press conference. He takes the podium again tomorrow at 2 p.m. Eastern Time/1 p.m. Central Time.

Symbol: Equities | Daily Change |

/ESZ3 | +0.14% |

/NQZ3 | +0.06% |

/RTYZ3 | -0.37% |

/YMZ3 | +0.15% |

A week of S&P 500 gains

Seven consecutive days of gains in the S&P 500 (/ESZ3)—the best streak in two years—are being greeted by a potential eighth-consecutive move higher as North American trading begins on Wednesday.

Three of the four major indexes were trading above water in the futures market ahead of the cash bell, though gains were relatively modest. The Russell 2000 (/RTYZ3) is struggling for a third day in a row even as long-end U.S. bonds rally.

Strategy: (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4390 p Short 4400 p Short 4500 c Long 4510 c | 17% | +387.50 | -105 |

Long Strangle | Long 4390 p Long 4510 c | 50% | x | -5900 |

Short Put Vertical | Long 4390 p Short 4400 p | 62% | +150 | -350 |

Symbol: Bonds | Daily Change |

/ZTZ3 | -0.03% |

/ZFZ3 | -0.06% |

/ZNZ3 | -0.01% |

/ZBZ3 | +0.16% |

/UBZ3 | +0.42% |

Bond yield curve twists

Powell’s lack of commentary on rate hikes or cuts may be a letdown for some, by bond traders are relatively unmoved in either direction.

There’s some slight twisting of the yield curve on Wednesday, with the bull flattener continuing to make its way through markets; the 2s10s spread (the difference between the 10-year yield and the 2-year yield) is back to -37 bps. Once more, 30s (/ZBZ3) and ultras (/UBZ3) are the biggest movers on the session.

Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107 p Short 107.25 p Short 109.25 c Long 109.50 c | 47% | +109.38 | -140.63 |

Long Strangle | Long 107 p Long 109.50 c | 34% | x | -468.75 |

Short Put Vertical | Long 107 p Short 107.25 p | 75% | +62.50 | -187.50 |

Symbol: Metals | Daily Change |

/GCZ3 | -0.21% |

/SIZ3 | +0.98% |

/HGZ3 | -0.15% |

Gold price remains down

Gold prices (/GCV3) remain down slightly after Powell offered no comments on monetary policy this morning when speaking. The week lacks any notable catalyst for precious metals, but tomorrow’s jobless claims data may nudge prices in a different direction. For now, a rising dollar and short-term Treasury yields are working against gold prices.

Strategy (48DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1950 p Short 1955 p Short 1980 c Long 1985 c | 14% | +420 | -80 |

Long Strangle | Long 1950 p Long 1985 c | 48% | x | -5,210 |

Short Put Vertical | Long 1950 p Short 1955 p | 70% | +180 | -320 |

Symbol: Energy | Daily Change |

/CLZ3 | -0.93% |

/HOZ3 | -1.92% |

/NGZ3 | -0.48% |

/RBZ3 | -0.17% |

Oil prices fall

Oil prices (/CLV3) fell about $0.46 per barrel, or 0.59%, Wednesday morning as traders digested the latest inventory data from the American Petroleum Institute (API), which showed an 11.9-million-barrel build for crude oil and a one-million-barrel build for distillates.

Gasoline stocks fell by 400,000 barrels, but signs elsewhere point to cooling demand and refiners are preparing to scale back run rates ahead of further expected demand weakness. The Energy Information Administration’s weekly inventory report won’t be released today due to system maintenance.

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 74.5 p Short 75 p Short 79 c Long 79.5 c | 19% | +390 | -110 |

Long Strangle | Long 74.5 p Long 79.5 c | 43% | x | -5,110 |

Short Put Vertical | Long 74.5 p Short75 p | 57% | +210 | -290 |

Symbol: FX | Daily Change |

/6AZ3 | -0.06% |

/6BZ3 | -0.27% |

/6CZ3 | -0.18% |

/6EZ3 | -0.24% |

/6JZ3 | -0.32% |

Despite a contraction in yield premium between Treasuries and Japanese government bonds Japanese yen futures continue to decline. That is likely a frustrating development for Japanese policy makers who have kept a close eye on the sliding currency at a time when they are carefully trying to find an exit from ultra-loose monetary policy.

The Bank of Japan's summary of opinions for its latest policy meeting is due out later today, which could influence the Japanese yen (/6JZ3).

Strategy (30DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0065 p Short 0.006525 p Short 0.006775 c Long 0.0068 c | 59% | +100 | -212.50 |

Long Strangle | Long 0.0065 p Long 0.0068 c | 27% | x | -350 |

Short Put Vertical | Long 0.0065 p Short 0.006525 p | 87% | +37.50 | -275 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.