S&P 500, Bonds Gap Higher after Bessent Tapped to Run Treasury

S&P 500, Bonds Gap Higher after Bessent Tapped to Run Treasury

Also, 10-year T-note, gold, crude oil and Japanese yen futures

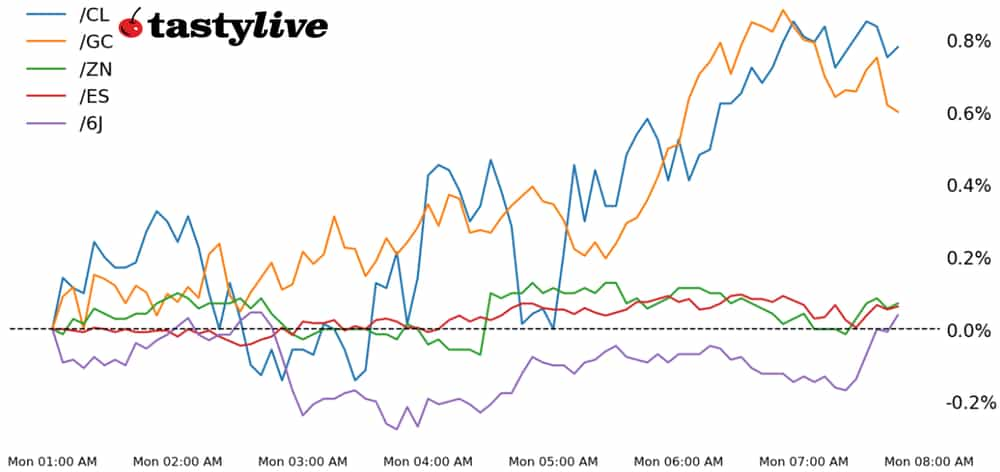

- S&P 500 E-mini futures (/ES): +0.49%

- 10-year T-note futures (/ZN): +0.43%

- Gold futures (/GC): -1.03%

- Crude oil futures (/CL): -0.27%

- Japanese yen futures (/6J): +0.54%

The holiday-shortened week is starting off with a swell in positive sentiment after Scott Bessent was tapped as the next Secretary of the Treasury. Bessent’s multi-decade career as a successful macro hedge fund manager who worked alongside trading legends like George Soros and Stanley Druckenmiller speaks for itself. And markets are listening, with a wave of relief settling in today. U.S. equities are higher across the board, as are Treasuries, while the U.S. dollar is lower versus all other major currencies. Elsewhere, deflating geopolitical risk might be in the cards, as Israel, Hezbollah and Lebanon are moving closer toward a ceasefire.

Symbol: Equities | Daily Change |

/ESZ4 | +0.49% |

/NQZ4 | +0.48% |

/RTYZ4 | +1.01% |

/YMZ4 | +0.71% |

The S&P 500 (/ESZ4) may not be the leader today, but it’s quickly approaching its all-time closing high established earlier in the month. Volatility continues to slump (IVR: 16.9), with the spot VIX back below 15. Technical momentum continues to build for each of the four U.S. equity index futures. This may prove to be a frustrating environment for bears: low volume, low volatility and positive momentum are hallmark signs of a melt-up environment.

Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5700 p Short 5750 p Short 6350 c Long 6400 c | 63% | +440 | -2060 |

Short Strangle | Short 5750 p Short 6350 c | 68% | +2175 | x |

Short Put Vertical | Long 5700 p Short 5750 p | 86% | +212.50 | -2287.50 |

Symbol: Bonds | Daily Change |

/ZTH5 | +0.08% |

/ZFH5 | +0.23% |

/ZNH5 | +0.43% |

/ZBH5 | +0.89% |

/UBH5 | +1.3% |

The bond bounce back around Bessent being bestowed the keys to Treasury seems to be nothing more than relief that former Federal Reserve Governor Kevin Warsh would not. During the Global Financial Crisis, Warsh famously argued against stimulus out of fear of inflation. In hindsight, worry about inflation in the summer of 2008 was entirely misplaced. The read-through is that Warsh has a hawkish bias that would ultimately lead to higher terminal interest rates were he to become a policy official with his hands on the levers of the American economy. There are three important Treasury auctions this week: 2-year notes later today, 5-year notes tomorrow, and 7-year notes on Wednesday.

Strategy (60DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107 p Short 108 p Short 113 c Long 114 c | 61% | +265.63 | -734.38 |

Short Strangle | Short 108 p Short 113 c | 68% | +640.63 | x |

Short Put Vertical | Long 107 p Short 108 p | 86% | +140.63 | -859.38 |

Symbol: Metals | Daily Change |

/GCG5 | -1.03% |

/SIH5 | -1.66% |

/HGH5 | +0.64% |

Deflating geopolitical risk may be a reason why precious metals are suffering at the start of the week. Lower U.S. Treasury yields and a weaker U.S. dollar would otherwise seem to be a supportive environment for gold (/GCG5) and silver prices (/SIH5). A ceasefire among Israel, Hezbollah and Lebanon would take down the risk of regional war leading to an energy supply crisis, cutting down the right-tail risk posed of higher oil prices sparking another jump in inflation pressures.

Strategy (64DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2525 p Short 2550 p Short 2875 c Long 2900 c | 63% | +720 | -1770 |

Short Strangle | Short 2550 p Short 2875 c | 71% | +3610 | x |

Short Put Vertical | Long 2525 p Short 2550 p | 84% | +360 | -2140 |

Symbol: Energy | Daily Change |

/CLF5 | -0.27% |

/HOH5 | +0.14% |

/NGF5 | +6.08% |

/RBH5 | -0.49% |

Crude oil prices (/CLF5) are trading lower today, but notably, volatility has continued to trend lower (IVR: 43.5) over the past three weeks. The 66-72 trading range that’s been carved out since the middle of October hasn’t yielded, leaving a rather undesirable set of technical circumstances. Elsewhere, natural gas prices (/NGF5) are surging again as the latest NOAA 8-14 day temperature outlook is forecasting below-average temperatures for states spanning from Maine to Florida, and Texas to Minnesota.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 61 p Short 63 p Short 80 c Long 82 c | 65% | +440 | -1560 |

Short Strangle | Short 63 p Short 80 c | 71% | +1670 | x |

Short Put Vertical | Long 61 p Short 63 p | 80% | +260 | -1740 |

Symbol: FX | Daily Change |

/6AZ4 | +0.25% |

/6BZ4 | +0.4% |

/6CZ4 | +0.17% |

/6EZ4 | +0.8% |

/6JZ4 | +0.54% |

The arrival of Bessent as Secretary of the Treasury has produced a weaker U.S. dollar immediately on the other side of the weekend. Traders may see the opportunity to fade strength in the British pound (/6BZ4), the euro (/6EZ4) and the Japanese yen (/6JZ4) as a result, given the trends in the majors have yet to turn. The macro calendar is saturated this week despite the holiday: the November FOMC meeting minutes due tomorrow are the highlight.

Strategy (74DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0061 p Short 0.0062 p Short 0.0069 c Long 0.007 c | 69% | +250 | -1000 |

Short Strangle | Short 0.0062 p Short 0.0069 c | 73% | +725 | x |

Short Put Vertical | Long 0.0061 p Short 0.0062 p | 91% | +87.50 | -1162.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.