Stocks and Bonds Dip and Then Rip After Strong U.S. Jobs Report

Stocks and Bonds Dip and Then Rip After Strong U.S. Jobs Report

Also 30-year T-bond, gold, natural gas and Japanese yen futures

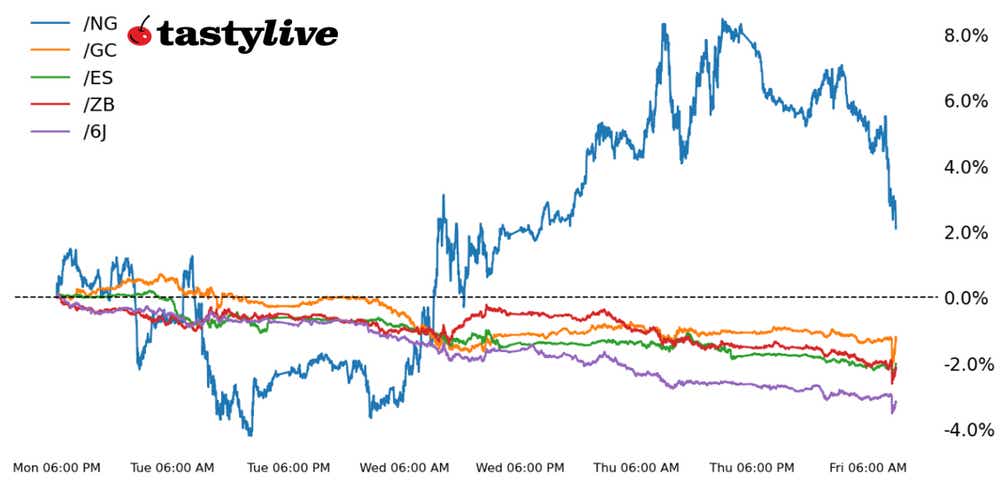

- S&P 500 E-mini futures (/ES): -0.39%

- 30-year T-bond futures (/ZB): -1.22%

- Gold futures (/GC): -0.64%

- Natural gas futures (/NG): -3.90%

- Japanese yen futures (/6J): -0.69%

The U.S. economy closed out 2023 on solid footing. The December U.S. nonfarm payrolls report (NFP) revealed a headline gain of 216,000 vs. the consensus forecast of 170,000. The household employment survey showed that the unemployment rate (U3) held at 3.7%, while wages increased by 4.1% year over year vs. the expected 3.9%.

But not all aspects of the jobs data were good. Workers reported 683,000 fewer jobs, and the labor force participation rate dropped to 62.5% from 62.8%. The composition of job holders also changed dramatically: full-time workers lost 1.5 million jobs, while part-time workers added 762,000.

Despite a less-than-pristine report, the U.S. labor market remains in fairly good shape. According to the Atlanta Federal Reserve Jobs Calculator, the US economy needs to add only 52,000 jobs per month through 2024 to keep the unemployment rate (U3) at 4.1% or lower, which is where the Federal Reserve believes the unemployment rate will be by the end of the year.

Overall, the December U.S. jobs report catalyzed a classic reaction in the markets, whereby stocks and bonds initially sold-off on the headline figures, only to rally back to and through their pre-release levels; this is why we often say “don’t trust the first move on jobs day.”

Symbol: Equities | Daily Change |

/ESH4 | -0.39% |

/NQH4 | -0.40% |

/RTYH4 | -0.83% |

/YMH4 | -0.35% |

Equity markets haven’t been kind to investors to start 2024 and the S&P 500 is no exception, with futures (/ESH4) down nearly 2% this week. However, prices are holding up rather well considering the move in bonds and the immediate reaction following the jobs report. It looks las though we may not get a cut in March from the Federal Reserve but considering this week’s move, traders may decide to hit the buy button going into next week in the hopes that markets will remain optimistic enough on the Fed’s path to support equity prices.

Strategy: (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4660 p Short 4670 p Short 4770 c Long 4780 c | 18% | +375 | -125 |

Long Strangle | Long 4660 p Long 4780 c | 49% | x | -5712.50 |

Short Put Vertical | Long 4660 p Short 4670 p | 63% | +162.50 | -337.50 |

Symbol: Bonds | Daily Change |

/ZTH4 | -0.14% |

/ZFH4 | -0.34% |

/ZNH4 | -0.46% |

/ZBH4 | -0.92% |

/UBH4 | -1.22% |

Treasuries are responding to the better-than-expected December jobs report. Yields are on the rise across the curve, especially on the long end. 30-year T-bond futures (/ZBH4) posting a loss of about 0.75% ahead of Wall Street’s opening bell, adding about 19 basis points (bps)to the underlying’s yield. While bonds remain well above lows posted back in October and November, the past week’s action has sent a chill across markets. Swap traders are only pricing in 12 bps of cuts at the March Federal Open Market Committee (FOMC) meeting.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 118 p Short 119 p Short 125 c Long 126 c | 41% | +531.25 | -468.75 |

Long Strangle | Long 118 p Long 126 c | 37% | x | -1875 |

Short Put Vertical | Long 118 p Short 119 p | 72% | +281.25 | -718.75 |

Symbol: Metals | Daily Change |

/GCG4 | -0.64% |

/SIH4 | +0.08% |

/HGH4 | -0.23% |

Gold prices (/GCG4) are holding up surprisingly well after this morning’s hot NFP report, which pushed bond yields higher—something that typically weighs on gold. The metal remains in a bullish technical stance, although prices are off recent highs. Ongoing tensions across the Middle East may help to support precious metals even if bond yields continue to rise.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2030 p Short 2040 p Short 2090 c Long 2100 c | 24% | +730 | -270 |

Long Strangle | Long 2030 p Long 2100 c | 44% | x | -4650 |

Short Put Vertical | Long 2030 p Short 2040 p | 66% | +400 | -600 |

Symbol: Energy | Daily Change |

/CLG4 | +1.16% |

/HOG4 | +0.27% |

/NGG4 | -3.90% |

/RBG4 | +0.38% |

U.S. natural gas futures (/NGG4) are trimming weekly gains despite European prices rising overnight as weather forecasts remain on the colder side, increasing the demand outlook. Yesterday saw the U.S. Energy Information Administration (EIA) report a 14 billion cubic feet (bcf) withdraw for the week ending Dec. 29, missing analysts’ expectations for –40 bcf and lighter than the prior week’s 87 bcf draw. With stockpiles 399 bcf above the five-year average—according to the EIA—there was only limited upside for the rally to continue.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.15 p Short 2.2 p Short 2.7 c Long 2.75 c | 34% | +320 | -180 |

Long Strangle | Long 2.15 p Long 2.75 c | 39% | x | -2570 |

Short Put Vertical | Long 2.15 p Short 2.2 p | 64% | +180 | -320 |

Symbol: FX | Daily Change |

/6AH4 | -0.47% |

/6BH4 | -0.24% |

/6CH4 | -0.11% |

/6EH4 | -0.30% |

/6JH4 | -0.69% |

2024 was supposed to be a great year for the yen, but this week is set to be one of the worst for the Japanese currency since 2016. Japanese yen futures (/6JH4) are down about 0.5% this morning to put the weekly loss north of 3%. The recent earthquake in Japan has complicated the Bank of Japan’s path to tightening policy and this morning’s jobs report has done the same to the Fed’s dovish shift.

Strategy (63DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0067 p Short 0.00675 p Short 0.00715 c Long 0.0072 c | 52% | +237.50 | -387.50 |

Long Strangle | Long 0.0067 p Long 0.0072 c | 31% | x | -825 |

Short Put Vertical | Long 0.0067 p Short 0.00675 p | 82% | +137.50 | -487.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.