Russell 2000 Struggles as Trump Tariff Talk Lifts Dollar, Yields

Russell 2000 Struggles as Trump Tariff Talk Lifts Dollar, Yields

Also, 10-year T-note, gold, crude oil and British pound futures

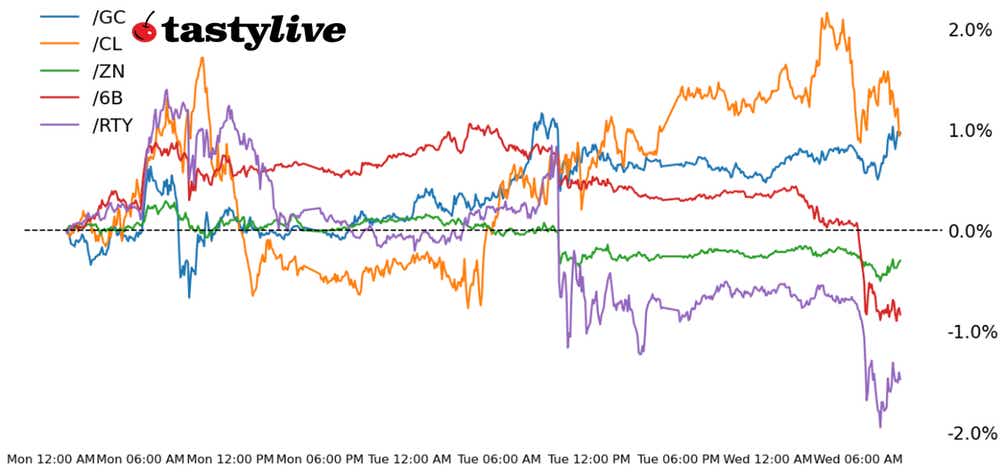

- Russell 2000 E-mini futures (/RTY): -0.61%

- 10-year T-note futures (/ZN): -0.03%

- Gold futures (/GC): +0.5%

- Crude oil futures (/CL): +0.2%

- British pound futures (/6B): -1.12%

Today’s price action has produced mixed markets. The December U.S. ADP employment change reading was softer than expected (+122,000 vs. +140,000), while weekly U.S. jobless claims indicated sustained strength (+201,000 vs. +218,000). Nevertheless, a report from CNN regarding President-elect Donald Trump declaring a national emergency to justify across-the-board tariffs is helping keep U.S. Treasury yields elevated, which in turn is helping the U.S. dollar test its highs for 2025.

Symbol: Equities | Daily Change |

/ESH5 | 0% |

/NQH5 | -0.02% |

/RTYH5 | -0.61% |

/YMH5 | +0.04% |

The sustained push higher at the long-end of the yield curve continues to hobble the Russell 2000 (/RTYH5) more than the other major indexes. Notably, regional banks are down over 1% year-to-date, while /RTYH5 is down just -0.25% this year. The spot VIX is up a stick, trading over 18. Elsewhere, Nvidia (NVDA) CEO Jensen Huang poured cold water on the quantum computing bubble, saying that truly impactful quantum computers were “decades” away. Several recent highflyers in the space are down more than 20% at the start of the session.

Strategy: (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2025 p Short 2100 p Short 2400 c Long 2475 c | 65% | +920 | -2830 |

Short Strangle | Short 2100 p Short 2400 c | 70% | +1910 | x |

Short Put Vertical | Long 2025 p Short 2100 p | 82% | +485 | -3265 |

Symbol: Bonds | Daily Change |

/ZTH5 | +0.04% |

/ZFH5 | +0.04% |

/ZNH5 | -0.03% |

/ZBH5 | -0.28% |

/UBH5 | -0.51% |

Trump’s tough tariff talk continues to be a catalyst for rates and FX, and today's price action underscores that reality. The report from CNN helped spark a move higher in yields, which are getting no help from expectations around the Fed’s rate cut cycle nor from participants in recent auctions—yesterday’s 10-year note auction was middling at best. Today’s 30-year bond auction (/ZBH5) will be in focus, as will the December Federal Open Market Committee (FOMC) meeting minutes.

Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 104.5 p Short 106 p Short 110.5 c Long 112 c | 65% | +296.88 | -1203.13 |

Short Strangle | Short 106 p Short 110.5 c | 69% | +531.25 | x |

Short Put Vertical | Long 104.5 p Short 106 p | 86% | +171.88 | -1328.13 |

Symbol: Metals | Daily Change |

/GCG5 | +0.5% |

/SIH5 | +0.83% |

/HGH5 | +0.62% |

Tariff talk and aspirations of U.S. territorial expansion across North America don’t seem to be bothering metals or energy, unlike the other asset classes. Gold prices (/GCG5) remain rangebound, trapped within the confines of a symmetrical triangle that has been forming over the past six months. Silver prices (/SIH5) are trying to retake their uptrend off their summer and fall 2023 swing lows. Alongside the break of the multi-month downtrend in copper prices (/HGH5), metals are showcasing a high degree of resiliency in the face of considerable cross-asset headwinds.

Strategy (48DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2530 p Short 2545 p Short 2815 c Long 2830 c | 64% | +430 | -1070 |

Short Strangle | Short 2545 p Short 2815 c | 72% | +2900 | x |

Short Put Vertical | Long 2530 p Short 2545 p | 88% | +160 | -1340 |

Symbol: Energy | Daily Change |

/CLG5 | +0.2% |

/HOG5 | -0.33% |

/NGG5 | +3.97% |

/RBG5 | +0.22% |

Energy markets remain rather quiet, all things considered, as measures of volatility have not budged significantly for either crude oil (/CLG5) or natural gas (/NGG5) prices. Trump’s talk of “drill baby, drill” amid a reversal of President Joe Biden’s offshore drilling ban impacting 625 million acres can’t be done by executive order but instead requires Congressional action. The short-term trajectory for global oil supply remains tight, even if the demand side leaves much to be desired amid China’s ongoing deflation and Europe’s sluggish growth.

Strategy (68DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 64 p Short 65.5 p Short 84.5 c Long 86 c | 66% | +340 | -1160 |

Short Strangle | Short 65.5 p Short 84.5 c | 73% | +1750 | x |

Short Put Vertical | Long 64 p Short 65.5 p | 80% | +230 | -1270 |

Symbol: FX | Daily Change |

/6AH5 | -0.56% |

/6BH5 | -1.12% |

/6CH5 | -0.38% |

/6EH5 | -0.56% |

/6JH5 | -0.31% |

As Trump’s tariff talk rankles rates, the U.S. dollar is pushing to some of its highest levels of 2025. But attention today is not on the usual suspects like the euro (/6EH5) or the Japanese yen (/6JH5), but instead on the British Pound (/6BH5). U.K. Prime Minister Keir Starmer may be having his Liz Truss lettuce moment, with U.K. Gilt yields surging to their highest levels since 1998 while Sterling crumbles. Fiscal crisis may be emerging across the pond.

Strategy (58DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.175 p Short 1.19 p Short 1.275 c Long 1.29 c | 66% | +250 | -687.50 |

Short Strangle | Short 1.19 p Short 1.275 c | 71% | +581.25 | x |

Short Put Vertical | Long 1.175 p Short 1.19 p | 88% | +125 | -812.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.