Preview: The Most Important Earnings Cycle in Three Years?

Preview: The Most Important Earnings Cycle in Three Years?

Although, we did see this show play out during the pandemic

- Geopolitical tensions are high just as the third-quarter earnings season arrives.

- Labor and wage costs are beating inflation, but the job market and retail sales have been robust.

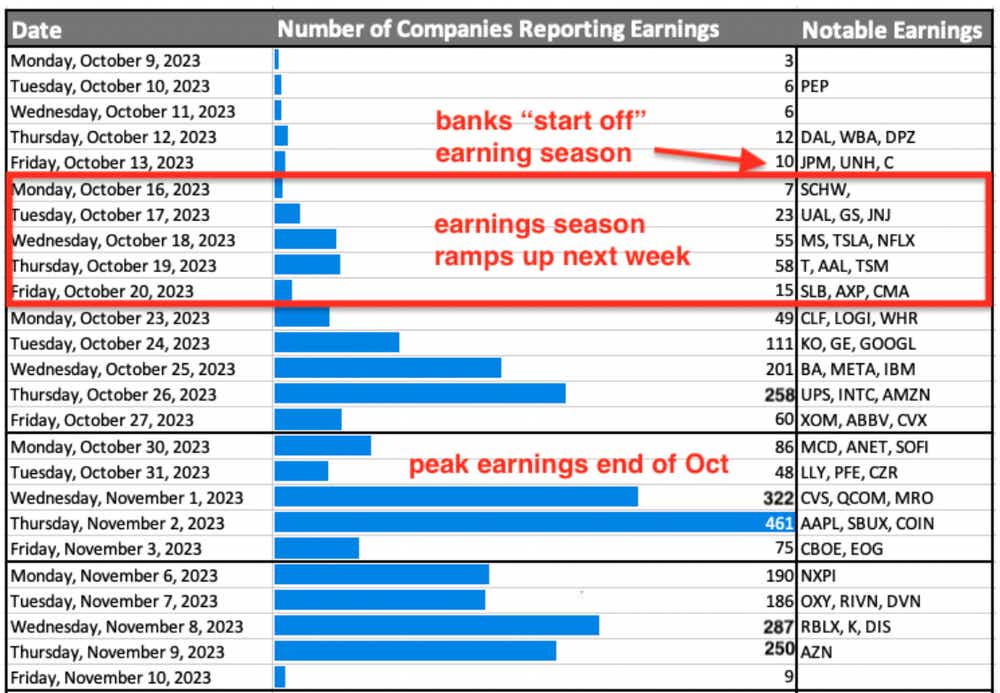

- The peak of earnings season will occur during the week of Oct. 30.

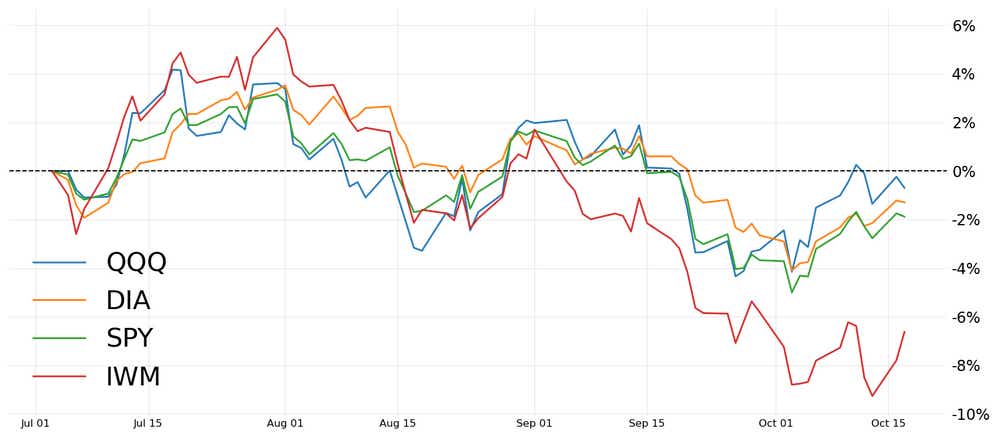

The S&P 500 is down 2% since July and has endured plenty of storylines that have threatened to derail gains in 2023. Geopolitical tensions are high with two conflicts in progress: one in eastern Europe and one in the Middle East. Additionally, U.S. economic data consistently seems to reinforce the fact that interest rates will be higher for longer. And nobody seems to know the exact nature and duration of longer.

Right on cue, third-quarter earnings are just getting underway and could be the most important we've seen since pandemic times. Remember 2020 when it was difficult to forecast the impact of the coronavirus on corporate earnings? No one could have predicted how nimble and innovative companies would become as a result of a worldwide pandemic. Yet, somehow many companies pulled it off. Adapt or die.

The rising cost of labor and interest

Corporations are arguably in the same position now except this time the proverbial boogeyman is labor costs. Labor is a major cost at most companies, and it has continued to rise. Wage growth has also been beating inflation, which, means many companies’ wage bills are rising more rapidly than the prices they are able to charge.

Making matters worse, the rise in interest rates, which is supposed to combat inflation, has led to rising financing costs that, ultimately, weighs on demand. And if that isn't enough, many overseas economies have been weak, while the strength of the dollar has cut into the value of profits U.S. multinationals earn abroad. It's a vicious cycle.

Sustained consumer spending

On the flip side, a strong job market is giving consumers the ability to keep spending. Americans are increasingly allocating more of their spending toward services and away from goods as the pandemic’s effects continue to lessen. This bodes well for public companies like Apple (AAPL) and Walmart (WMT). They make or sell goods overrepresented in the S&P 500 compared with the overall U.S. economy.

So how does it all end? We should have a pretty good idea where things are headed after the five days ending Nov. 3. Not only is it the busiest week of earnings season, but the Fed will have concluded its sixth meeting of 2023 that week. Lots of fireworks will be popping off and I cannot wait to see it.

Jermal Chandler, tastylive head of options strategy, has been in the market and trading for 20 years. He hosts Engineering the Trade, airing Monday, Tuesday, Thursday and Friday. @jermalchandler

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.