The Power of Extended Expiration Options in Earnings Trading

The Power of Extended Expiration Options in Earnings Trading

By:Kai Zeng

Research suggests that slightly extending trading durations during expirations won't compromise profits, but will reduce volatility

- Now is a good time to explore the potential of extended earnings expiration in Shopify (SHOP).

- We've investigated the performance of weekly options during earnings season since 2015, using data from five companies: Advanced Micro Devices (AMD), Intel (INTC), JP Morgan (JPM), IBM (IBM) and Amazon (AMZN).

- Earnings are a 50-50 shot and trading them is a random game.

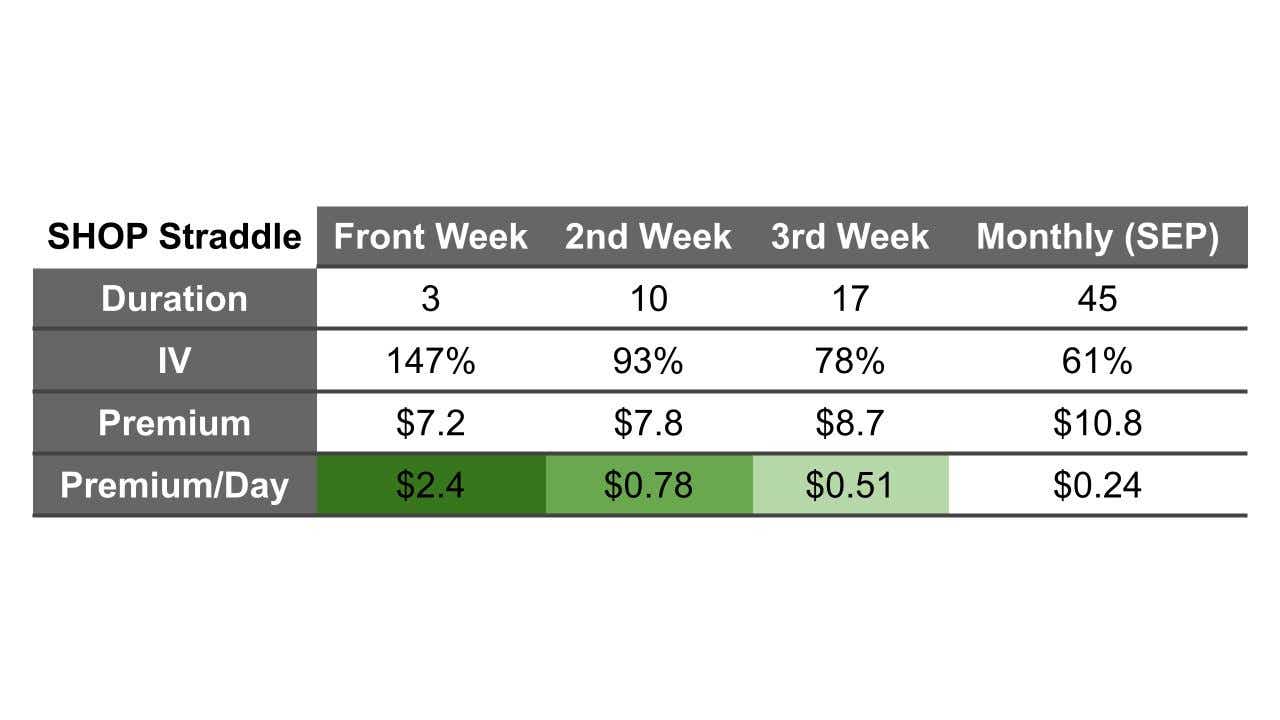

As we navigate through earnings season, it's an opportune time to explore the potential of extended earnings expiration. Traders frequently prefer the nearest expiration cycle due to its notably higher implied volatility, which leads to inflated option prices. This trend is evident across nearly all stocks, as exemplified by Shopify (SHOP) in the following chart.

In this case, the earnings volatility for Shopify can fluctuate from 144% in the initial week to mid-70s in subsequent weeks. As we approach the earnings date, volatility tends to increase. However, this increase isn't always reflected as significantly in option pricing as one might anticipate. A 100% higher implied volatility doesn't necessarily translate into option prices that are twice as expensive.

While the front week options present the highest daily potential profit and loss (P&L), subsequent weeks also yield substantial figures, often two or three times more than regular monthly options.

We've analyzed the implied volatility across various timeframes, from three to 45 days, using a SHOP straddle as an illustrative example. From the table, we can see that the potential daily max return can vary from 2.40 for the shortest weekly options to 0.24 for a 45-day option. This demonstrates how earnings expectations can inflate the options premium, particularly for weekly options from a daily change perspective.

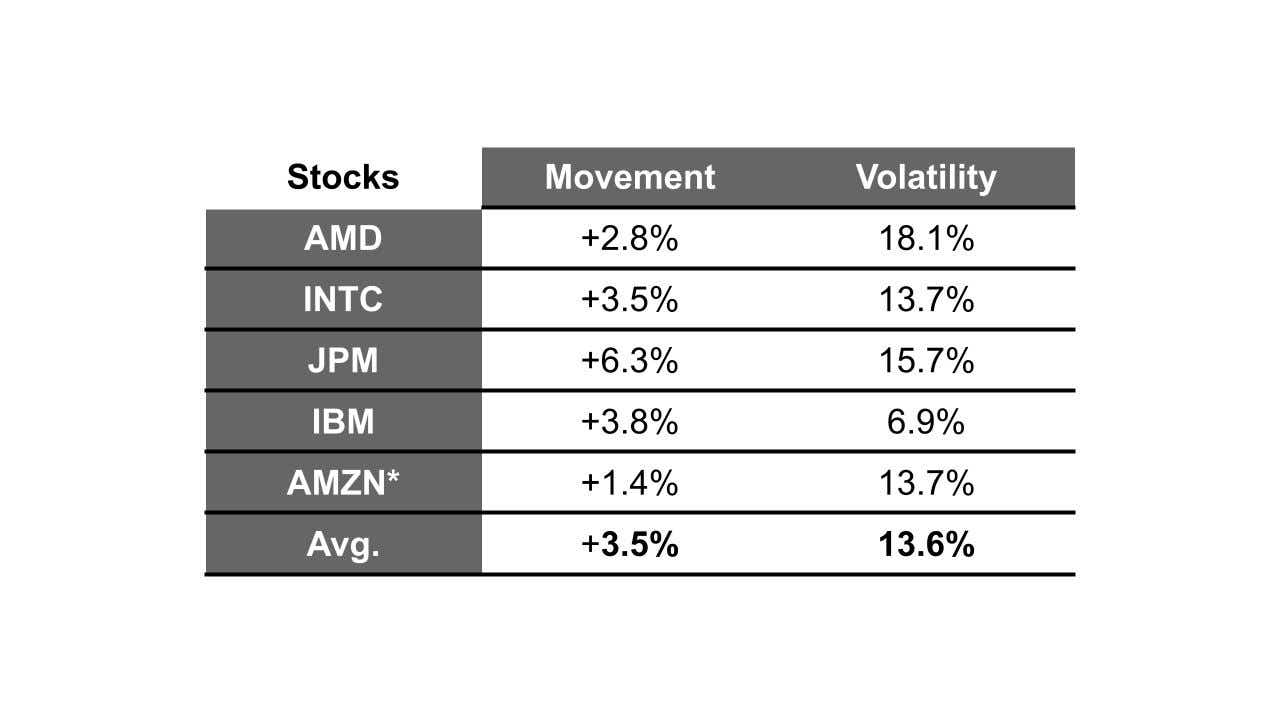

It's intriguing to consider the performance of slightly longer weekly options during earnings season in comparison to front-week options. Could they serve as viable alternatives? We've investigated the performance of weekly options during earnings season, using data from five companies since 2015: Advanced Micro Devices (AMD), Intel (INTC), JP Morgan (JPM), IBM (IBM) and Amazon (AMZN). The trades were entered the day before earnings and covered the day after.

Reviewing the stocks' performances, all demonstrated average positive returns post-earnings, accompanied by a significant amount of volatility. This is to be expected given the nature of earnings movement. So, examining longer expiration options becomes meaningful because traders can have more time to adjust their position if a black swan event happens.

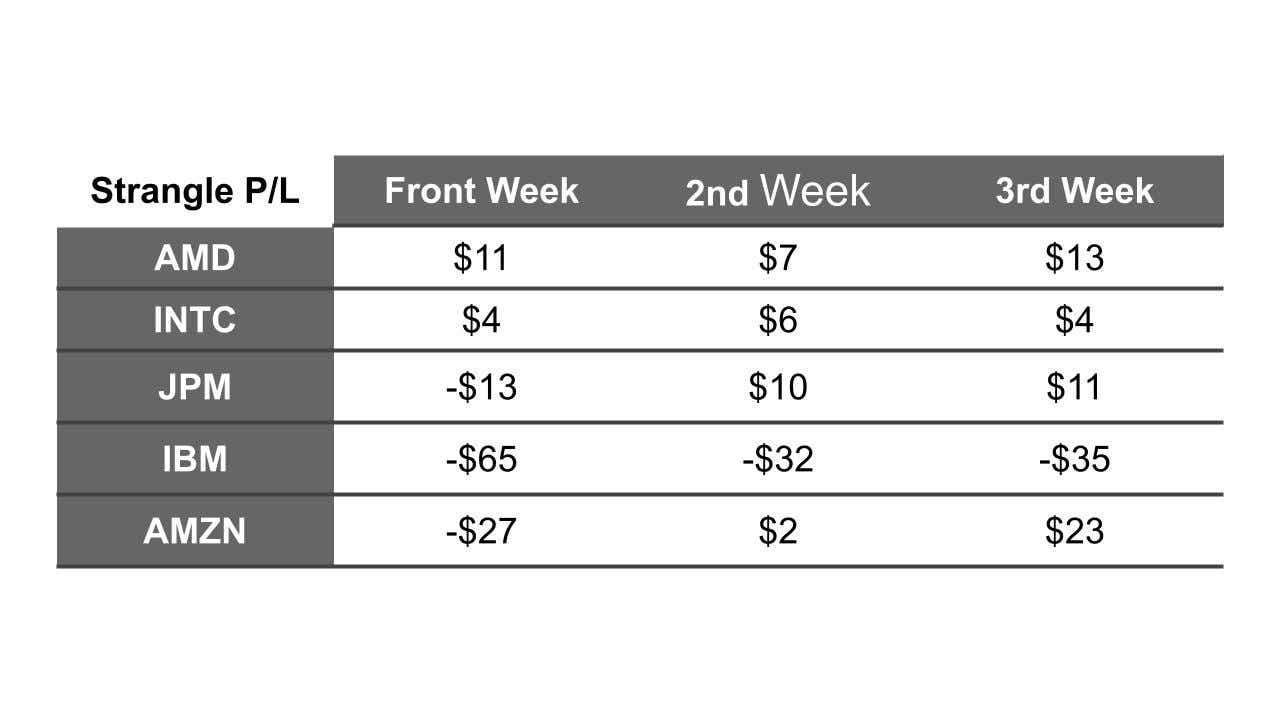

Our analysis revealed that not all stocks showed positive returns post-earnings, but the longer expiration cycles didn't underperform the front week on average. This is a promising indication for potentially utilizing slightly longer expiration cycles. We then questioned the impact of volatility.

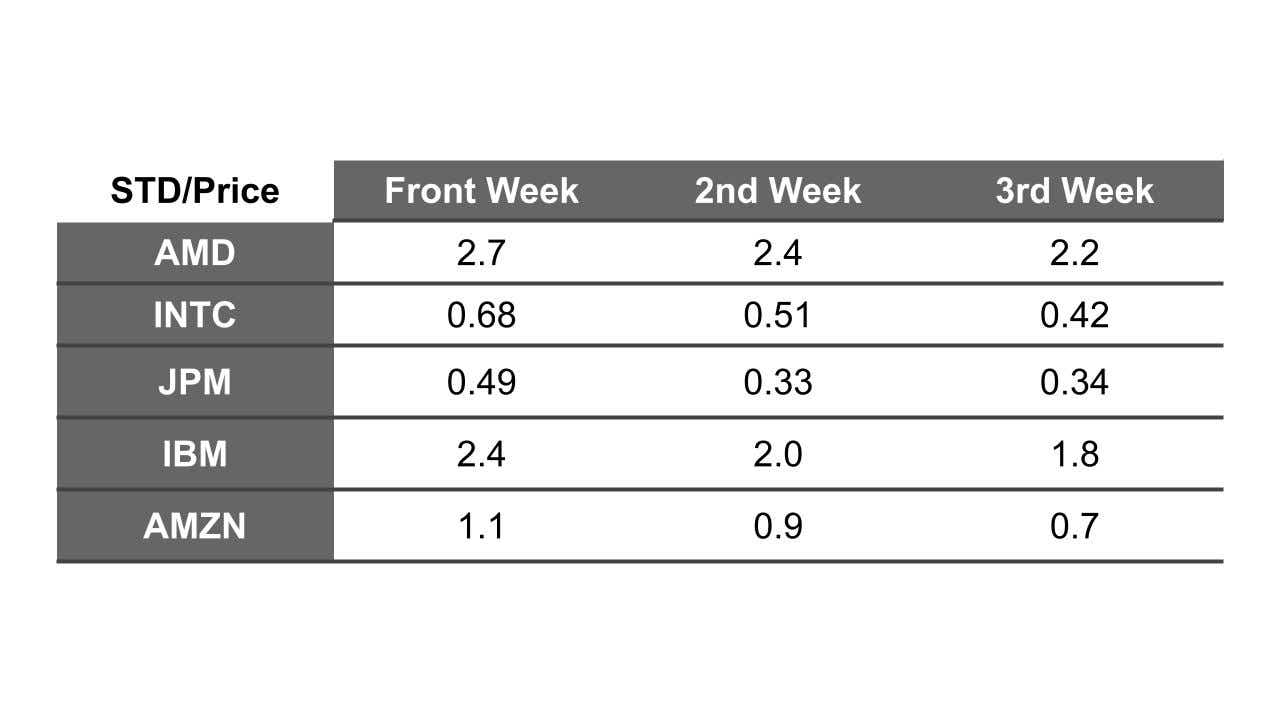

Volatility tends to decrease with longer-duration options, which is logical. This confirms that slightly extending trading duration won't necessarily compromise profits while reducing volatility.

While options with shorter duration may offer a higher potential daily return for an earnings play – on paper, slightly longer duration options, such as two or three weeks, don't necessarily result in reduced performance. They may even help to decrease volatility and stabilize returns. As our studies indicate, extending our timeframe doesn't necessarily lead to poorer outcomes. In fact, in many instances, we might fare better.

Remember, earnings are a 50-50 shot and trading them is a very random game. However, by going out a bit longer, you might just improve your odds.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.