Poking Holes in a Robotics Rally

Poking Holes in a Robotics Rally

AI and robotic-themed stocks are not keeping pace with the broader tech sector

- The Nasdaq 100 is up by more than +38% year-to-date as of August 9, 2023.

- But tech companies with AI exposure are suffering: the Global X Robotics & Artificial Intelligence ETF (BOTZ), is down nearly 9% this month.

- A meaningful technical breakdown in BOTZ could be a bad omen for stocks, particularly the Nasdaq 100, in the near term.

The technological revolution that has gripped markets—sorry, not you superconductors—may have reached a turning point.

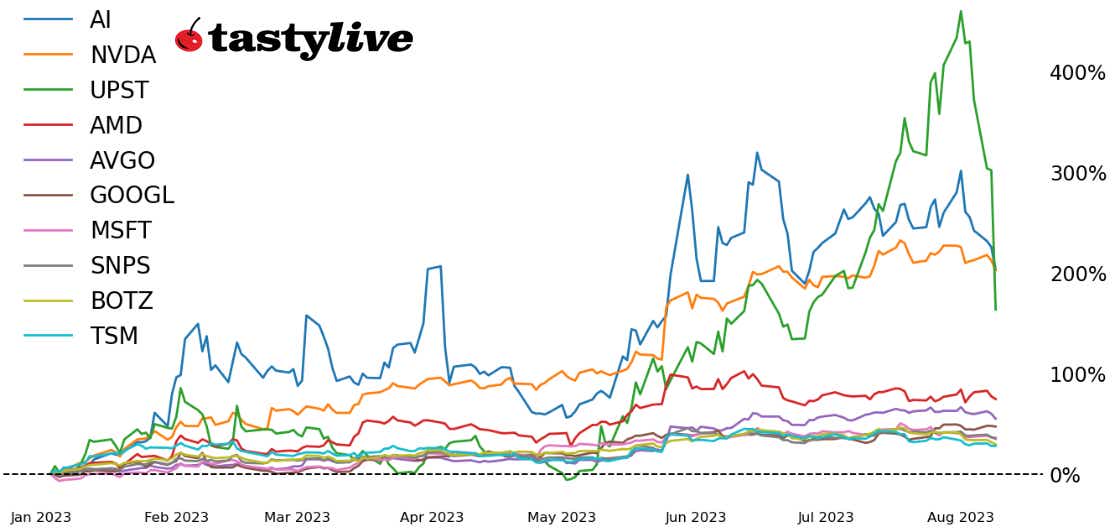

For much of 2023, artificial general intelligence (AGI, or AI in layman’s terms) has offered the promise of improving productivity and innovation for companies that hop on the bandwagon. It hasn’t just been names like NVDA or MSFT that have benefited—several AI-related companies have had outstanding years thus far.

Alas, the punch bowl may be getting low. The party may end soon. The Global X Funds Robotics & Artificial Intelligence ETF saw a meaningful sell-off in August, down 8.61%, while the tech-heavy Nasdaq 100 lost just 3.62%.

If the outperformance by robotic and AI-related stocks was a reason to cheer on stocks during the first half of the year, then it’s equally concerning that they have underperformed so dramatically in recent weeks. And the technical alarm bells are ringing in BOTZ, plain and simple.

BOTZ Price Technical Analysis: Daily Chart (August 2022 to August 2023)

The uptrend from October 2022, December 2022, March 2023, and May 2023 swing lows—four points of contact, indicating a very reliable move higher—has been broken.

In turn, the lows from June and July have been breached as well, bringing into focus a potential double top pattern which could produce a return back towards 25.00. Momentum has rolled over, with moving average convergence/divergence (MACD) fully trending below its signal line for the first time since October 2022, and Stochastics have found themselves holding in oversold territory.

The ‘buy the dip’ mindset has been materially harmed, at least for now. But in the short-term, air coming out of the AI bubble may be a bad omen for the broader stock market, particularly the tech-heavy Nasdaq 100 (QQQ or /NQ).

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.