Nasdaq 100 at Monthly Lows After GOOGL and TSLA Earnings Reports

Nasdaq 100 at Monthly Lows After GOOGL and TSLA Earnings Reports

Also, 10-year T-note, silver, crude oil and Japanese yen futures

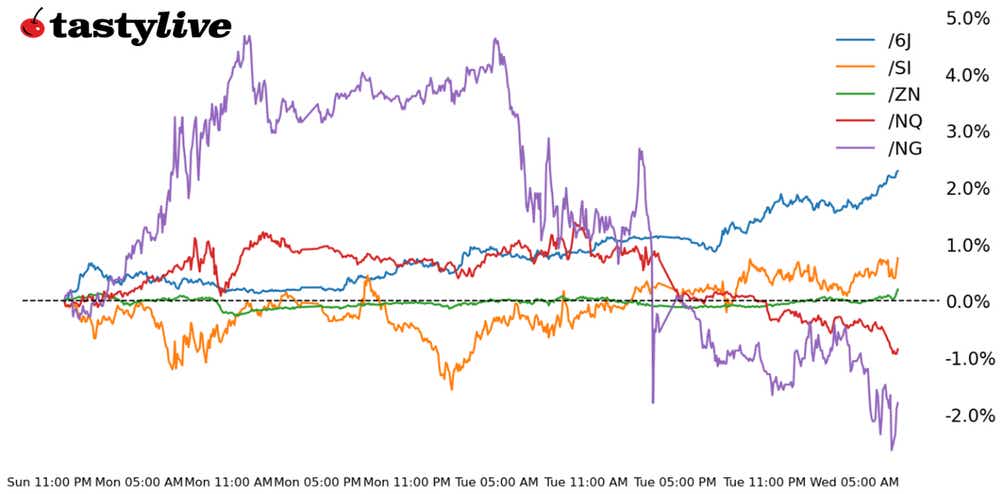

Nasdaq 100 E-mini futures (/NQ): +0.03%

10-year T-note futures (/ZN): -0.38%

Silver futures (/SI): +0.40%

Natural gas futures (/NG): +0.28%

Japanese yen futures (/6J): -0.99%

The rotation trade is taking a break today in favor of outright selling across the board in U.S. equities. Bonds are trading higher in the wake of this morning’s U.S. economic data, although the lower yields are dragging down the U.S. dollar (particularly in favor of the Japanese yen, again). The major energy products remain weaker, although the softer dollar may be helping to prop up gold and silver mid-week.

Symbol: Equities | Daily Change |

/ESU4 | -0.92% |

/NQU4 | -1.44% |

/RTYU4 | -0.69% |

/YMU4 | -0.49% |

Stocks are low in the wake of earnings from Alphabet (GOOGL) and Tesla (TSLA), with the latter down over 12% this morning. The disappointing earnings have been contextualized by former New York Federal Reserve President Bill Dudley’s essay in Bloomberg Opinion about the urgent need for the Fed to cut interest rates next week; historically, stocks don’t like “recession rate cuts.” Technical damage is accumulating, increasing the odds of a bigger setback in the Nasdaq 100 (/NQU4).

Strategy: (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 18000 p Short 18250 p Short 20750 c Long 21000 c | 67% | +1245 | -3755 |

Short Strangle | Short 18250 p Short 20750 c | 72% | +4300 | x |

Short Put Vertical | Long 18000 p Short 18250 p | 87% | +555 | -4445 |

Symbol: Bonds | Daily Change |

/ZTU4 | +0.08% |

/ZFU4 | +0.16% |

/ZNU4 | +0.17% |

/ZBU4 | +0.16% |

/UBU4 | +0.07% |

The unwind of the yen carry trade, coupled with a deterioration in risk appetite, may be helping to prop up bonds as safe havens through the turn of the week. A two-year note auction yesterday did little to upset the apple cart, while five- and seven-year note auctions are due today and tomorrow, respectively. Fed rate cut odds are solidified around the first rate cut coming in September (100% chance per Fed funds futures), but the Dudley essay may provoke some speculation that next week’s Federal Open Market Committee (FOMC) meeting is live.

Strategy (58DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 108 p Short 108.5 p Short 113.5 c Long 114 c | 59% | +140.63 | -359.38 |

Short Strangle | Short 108.5 p Short 113.5 c | 66% | +578.13 | x |

Short Put Vertical | Long 108 p Short 108.5 p | 92% | +46.88 | -453.13 |

Symbol: Metals | Daily Change |

/GCQ4 | +0.6% |

/SIU4 | +0.58% |

/HGU4 | -0.05% |

Lower yields and a weaker U.S. dollar are the ideal mix for precious metals, which are taking advantage of the tailwinds today. Both gold (/GCQ4) and silver prices (/SIU4) are rebounding from meaningful technical levels, the former near 2400 and the latter near 29. Bullish opportunities are becoming “cheaper” to express, insofar as both precious metals’ implied volatility ranks (IVRs) have pulled back in recent days.

Strategy (63DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 27 p Short 27.25 p Short 32.75 c Long 33 c | 57% | +435 | -815 |

Short Strangle | Short 27.25 p Short 32.75 c | 69% | +4140 | x |

Short Put Vertical | Long 27 p Short 27.25 p | 80% | +225 | -1025 |

Symbol: Energy | Daily Change |

/CLU4 | -0.44% |

/HOU4 | +1.12% |

/NGU4 | -1.69% |

/RBU4 | +1.04% |

Concerns around global growth continue to percolate following China’s surprise rate cuts at the start of the week. Demand for crude oil and global gross domestic product (GDP) have an impressive +0.92 correlation over the past 30 years, so signs that the world’s second largest economy—and perhaps its first largest as well—are slowing down. The return of even a modest amount of volatility is making positions in crude oil (/CLU4) more viable. After their rebound last week, natural gas prices (/NGU4) have failed to hold above the swing lows carved out in February.

Strategy (34DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.7 p Short 1.75 p Short 2.55 c Long 2.57 c | 64% | +110 | -390 |

Short Strangle | Short 1.75 p Short 2.55 c | 72% | +820 | x |

Short Put Vertical | Long 1.7 p Short 1.75 p | 82% | +70 | -430 |

Symbol: FX | Daily Change |

/6AU4 | -0.1% |

/6BU4 | +0.19% |

/6CU4 | -0.06% |

/6EU4 | +0.06% |

/6JU4 | +1.17% |

The Japanese yen (/6JU4) wrecking ball continues, having risen to its highest level since May. The remarkable turnaround began with the release of the June U.S. inflation report, and has since produced a break of the downtrend that has defined the market all of 2024. Talk of a Fed rate cut next week may be stoking fears leading to an unwind of the carry trade (across all JPY-pairs) as traders seek safe havens.

Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00625 p Short 0.0063 p Short 0.0068 c Long 0.00685 c | 69% | +125 | -500 |

Short Strangle | Short 0.0063 p Short 0.0068 c | 73% | +487.50 | x |

Short Put Vertical | Long 0.00625 p Short 0.0063 p | 89% | +43.75 | -581.25 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.