Markets are Struggling and Commodities are Mixed as the U.S. Dollar Climbs

Markets are Struggling and Commodities are Mixed as the U.S. Dollar Climbs

Also, 30-year T-bond, copper, natural gas and euro futures

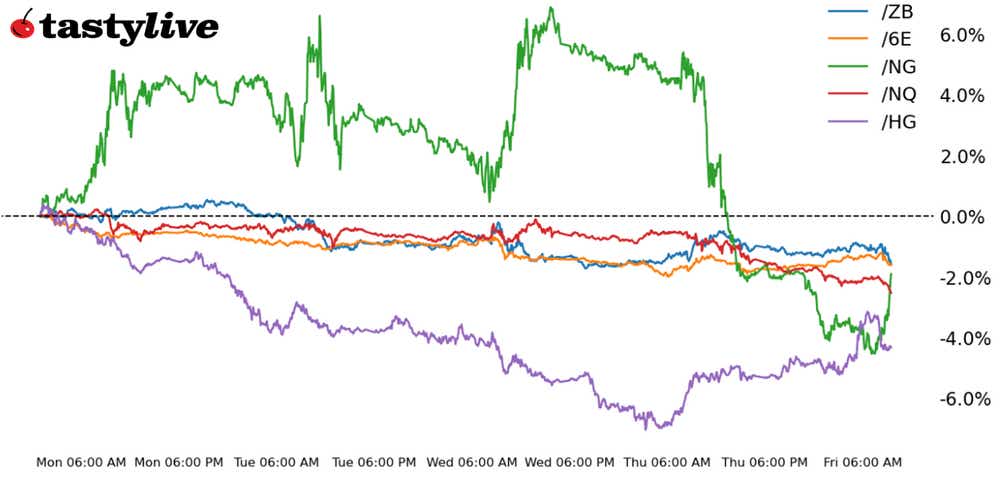

- Nasdaq 100 E-mini futures (/NQ):- -1.44%

- 30-year T-bond futures (/ZB): -1.02%

- Copper futures (/HG): +0.6%

- Natural gas futures (/NG): -1.11%

- Euro futures (/6E): -0.19%

After meandering price action for much of the week, a sourer tone has set in today. U.S. equity markets are struggling across the board, led lower by the Nasdaq 100. U.S. Treasuries, particularly at the long end of the curve, continue to struggle. Commodities are mixed as the U.S. dollar has resumed its climb. The odds of a Federal Reserve interest rate cut have fallen in the wake of Fed Chair Jerome Powell’s comments yesterday afternoon; the probability of a 25 basis-point (bps) rate cut in December has dropped from a high of 82% to 53% over the past 48 hours.

Symbol: Equities | Daily Change |

/ESZ4 | -0.75% |

/NQZ4 | -1.44% |

/RTYZ4 | -0.36% |

/YMZ4 | -0.36% |

Nasdaq futures (/NQZ4) fell 1% in this morning’s trading, extending the weekly loss to about 2%, as traders step back from the risk taking of last week’s post-election trade. Applied Materials (AMAT) fell 9% in pre-market trading after reporting mixed guidance that disappointed investors. That spoiled the sentiment in the chip sector, with the VanEck Semiconductor ETF (SMH) falling 1.5% ahead of the bell. Alibaba (BABA) was nearly unchanged after trimming earlier gains that the stock made on its earnings release.

Strategy: (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 19200 p Short 19400 p Short 22000 c Long 22200 c | 68% | +830 | -3170 |

Short Strangle | Short 19400 p Short 22000 c | 73% | +4150 | x |

Short Put Vertical | Long 19200 p Short 19400 p | 89% | +390 | -3610 |

Symbol: Bonds | Daily Change |

/ZTZ4 | -0.16% |

/ZFZ4 | -0.37% |

/ZNZ4 | -0.53% |

/ZBZ4 | -1.02% |

/UBZ4 | -1.17% |

Treasuries were lower today as interest rate cut bets eased, with traders expecting less chance of the Fed cutting in December than was priced in just a few days ago. Fed speakers as of late have pushed back against expectations that the December rate cut is “not a done deal,” as Boston Federal Reserve President Susan Collins put it. The downward move in the bond markets over the past two weeks have likely put some pressure on the Fed to reconsider its strategy over the short term.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 110 p Short 112 p Short 120 c Long 122 c | 64% | +562.50 | -1437.50 |

Short Strangle | Short 112 p Short 120 c | 69% | +1062.50 | x |

Short Put Vertical | Long 110 p Short 112 p | 83% | +296.88 | -1703.13 |

Symbol: Metals | Daily Change |

/GCZ4 | +0.02% |

/SIZ4 | +0.53% |

/HGZ4 | +0.6% |

Some good news from China helped copper futures (/HGZ4) in overnight trading, with prices up about 0.7% this morning. China’s retail sales for October rose 4.8% from a year ago. That was up from the previous month’s 3.2% year-over-year increase. Still, copper was on track to record a loss of over 4% for the week, which would mark the biggest drop since July. The data from China is encouraging, but likely provided a trigger for some profit taking on the short side of the trade, given that the macro and geopolitical situations remain a headwind for industrial metals.

Strategy (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3.7 p Short 3.8 p Short 4.4 c Long 4.5 c | 63% | +662.50 | -1837.50 |

Short Strangle | Short 3.8 p Short 4.4 c | 69% | +1862.50 | x |

Short Put Vertical | Long 3.7 p Short 3.8 p | 86% | +237.50 | -2262.50 |

Symbol: Energy | Daily Change |

/CLZ4 | -0.96% |

/HOZ4 | -0.69% |

/NGZ4 | -1.11% |

/RBZ4 | -0.4% |

Natural gas futures (/NGZ4) continued to fall today, extending a move from yesterday that saw the price drop over 6%. Still, prices remain on track to record a 2% gain for the week, if today’s price action holds. The Energy Information Administration (EIA) reported a 42 billion-cubic-feet (Bcf) storage build yesterday for the previous week. That nearly matched expectations but left inventory in the U.S. well above its one- and five-year averages. Meanwhile, warm weather is expected across the Eastern United States into December, tempering expected demand. Gains from earlier in the week came off of the contract lows, and prices may have trouble extending the rally amid the bloated supply situation.

Strategy (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.55 p Short 2.6 p Short 2.9 c Long 2.95 c | 22% | +380 | -120 |

Short Strangle | Short 2.6 p Short 2.9 c | 58% | +4120 | x |

Short Put Vertical | Long 2.55 p

| 72% | +130 | -370 |

Symbol: FX | Daily Change |

/6AZ4 | -0.37% |

/6BZ4 | -0.43% |

/6CZ4 | -0.31% |

/6EZ4 | -0.19% |

/6JZ4 | +0.17% |

Euro futures (/6EZ4) were nearly unchanged this morning as prices moderated going into the weekend. The currency is on track to put in a second week of losses, as traders in the U.S. price in a reduced pace of rate cuts from the Federal Reserve. The incoming Trump administration has bolstered bets that the European Central Bank (ECB) will move to cut rates at a faster pace. Markets expect a 25bps cut at next month’s ECB meeting, as the expectation of tariffs complicates the path for the European economy. The continuous contract is coming up against the 2023 October swing low 1.0482.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.045 p Short 1.05 p Short 1.07 c Long 1.075 c | 33% | +412.50 | -212.50 |

Short Strangle | Short 1.05 p Short 1.07 c | 57% | +1762.50 | x |

Short Put Vertical | Long 1.045 p Short 1.05 p | 74% | +187.50 | -437.50 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.