Nasdaq 100 Jumps and Crude Oil Plunges as Israel-Iran Chapter Closes

Nasdaq 100 Jumps and Crude Oil Plunges as Israel-Iran Chapter Closes

Also, 10-year T-note, gold, crude oil, and Japanese yen futures

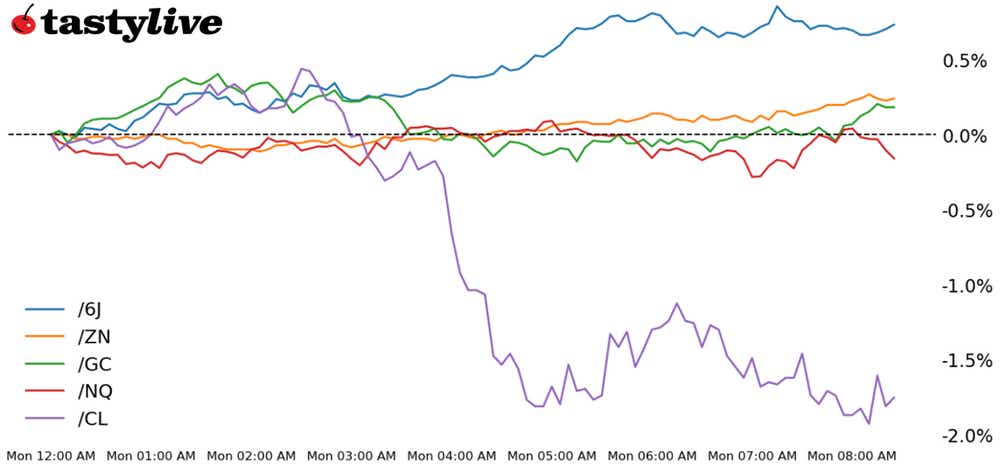

- Nasdaq 100 E-mini futures (/ES): +0.72%

- 10-year T-note futures (/ZN): 0%

- Gold futures (/GC): -0.2%

- Crude oil futures (/CL): -6.38%

- Japanese yen futures (/6J): -0.32%

Shortly after markets in New York closed for the week on Friday, Israel launched the long-awaited response to the Iranian missile strike of Oct. 1. As the dust settled in Iran on Saturday morning, it became clear no key civilian or energy infrastructure was damaged, and ensuing statements by the Ayatollah suggested no further escalation would transpire. That’s been good news for risk appetite, with U.S. equity markets pushing higher at the open and holding those gains. Bonds have seesawed between aggressive losses to trading back to breakeven, while the energy market is in disarray now that geopolitical risk premia is evaporating.

Symbol: Equities | Daily Change |

/ESZ4 | +0.57% |

/NQZ4 | +0.72% |

/RTYZ4 | +0.8% |

/YMZ4 | +0.54% |

Nasdaq contracts(/NQZ4) led U.S. equity futures higher to start the week, rising about 0.72% ahead of the opening bell. Traders are giddy for a big week of earnings that include several high-profile tech names. Advanced Micro Devices (AMD) and Alphabet (GOOGL) will report earnings after the close tomorrow. Then we get Microsoft (MSFT) and Meta (META) on Wednesday after the close. On Thursday afternoon, we’ll see results from Amazon (AMZN), Intel (INTC) and Apple (AAPL) cross the wires. However, with excitement comes the possibility of disappointment. It could be a decisive week for the market as we head deeper into the fourth quarter.

Strategy: (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 18750 p Short 19250 p Short 22250 c Long 22750 c | 61% | +2230 | -7770 |

Short Strangle | Short 19250 p Short 22250 c | 67% | +6535 | x |

Short Put Vertical | Long 18750 p Short 19250 p | 79% | +1480 | -8520 |

Symbol: Bonds | Daily Change |

/ZTZ4 | 0% |

/ZFZ4 | 0% |

/ZNZ4 | 0% |

/ZBZ4 | +0.05% |

/UBZ4 | +0.15% |

It’s a big week for Treasuries ahead of the Treasury Department’s quarterly refunding announcement due on Wednesday. Traders expect that the refunding auctions will cross the wires at $125 billion, which would mark the third straight quarter unchanged. However, if the market is surprised with an increase in bond auctions, it could inject a bit more volatility. Neither candidate former President Donald Trump nor Vice President Kamala Harris is expected to reduce deficit spending, and 10-year note auctions have already seen record sizes. The week is starting off with little change across the curve, as traders gear up for a big week of corporate earnings.

Strategy (25DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 110 p Short 110.25 p Short 111.5 c Long 111.75 c | 24% | +187.50 | -62.50 |

Short Strangle | Short 110.25 p Short 111.5 c | 56% | +1453.50 | x |

Short Put Vertical | Long 110 p Short 110.25 p | 66% | +93.75 | -156.25 |

Symbol: Metals | Daily Change |

/GCZ4 | -0.2% |

/SIZ4 | -0.06% |

/HGZ4 | -0.41% |

A pullback in the dollar offered little help to gold prices to start the week, with contracts (/GCZ4) nearly unchanged this morning. Geopolitical tensions eased slightly after Israel attacked military targets in Iran, foregoing an attack on the country’s oil infrastructure. Still, precious metals are primed for higher ground, especially as the U.S. election approaches.

Strategy (35DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2740 p Short 2745 p Short 2815 c Long 2820 c | 23% | +390 | -110 |

Short Strangle | Short 2745 p Short 2815 c | 60% | +7920 | x |

Short Put Vertical | Long 2740 p Short 2745 p | 63% | +210 | -290 |

Symbol: Energy | Daily Change |

/CLZ4 | -6.38% |

/HOZ4 | -4.5% |

/NGZ4 | -7.66% |

/RBZ4 | -5.15% |

Crude oil futures (/CLZ4) plummeted this morning, with prices down over 6% ahead of the New York open. The drop is already the biggest since July 2022. Traders sold the commodity after Israel launched attacks in Iran against military targets. Traders previously feared that Iran’s oil infrastructure would be targeted, potentially affecting over 3 million barrels per day of production.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 65.5 p Short 66 p Short 70 c Long 70.5 c | 16% | +380 | -120 |

Short Strangle | Short 66 p Short 70 c | 48% | +5350 | x |

Short Put Vertical | Long 65.5 p

| 54% | +210 | -290 |

Symbol: FX | Daily Change |

/6AZ4 | +0.01% |

/6BZ4 | +0.13% |

/6CZ4 | -0.06% |

/6EZ4 | +0.12% |

/6JZ4 | -0.32% |

Japanese yen futures (/6JZ4) fell to a fresh three-month low to start the week following a snap election in Japan. Traders are weighing how losses for the Liberal Democratic Party will impact the currency in the future. Later this week, the bank of Japan will announce an interest rate decision, with traders expecting the Bank of Japan to hold rates steady. The currency remains one of the worst performers this year, and the upcoming decision is unlikely to change its course over the short term.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00645 p Short 0.0065 p Short 0.00665 c Long 0.0067 c | 29% | +425 | -200 |

Short Strangle | Short 0.0065 p Short 0.00665 c | 57% | +1925 | x |

Short Put Vertical | Long 0.00645 p Short 0.0065 p | 68% | +225 | -400 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts #Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.